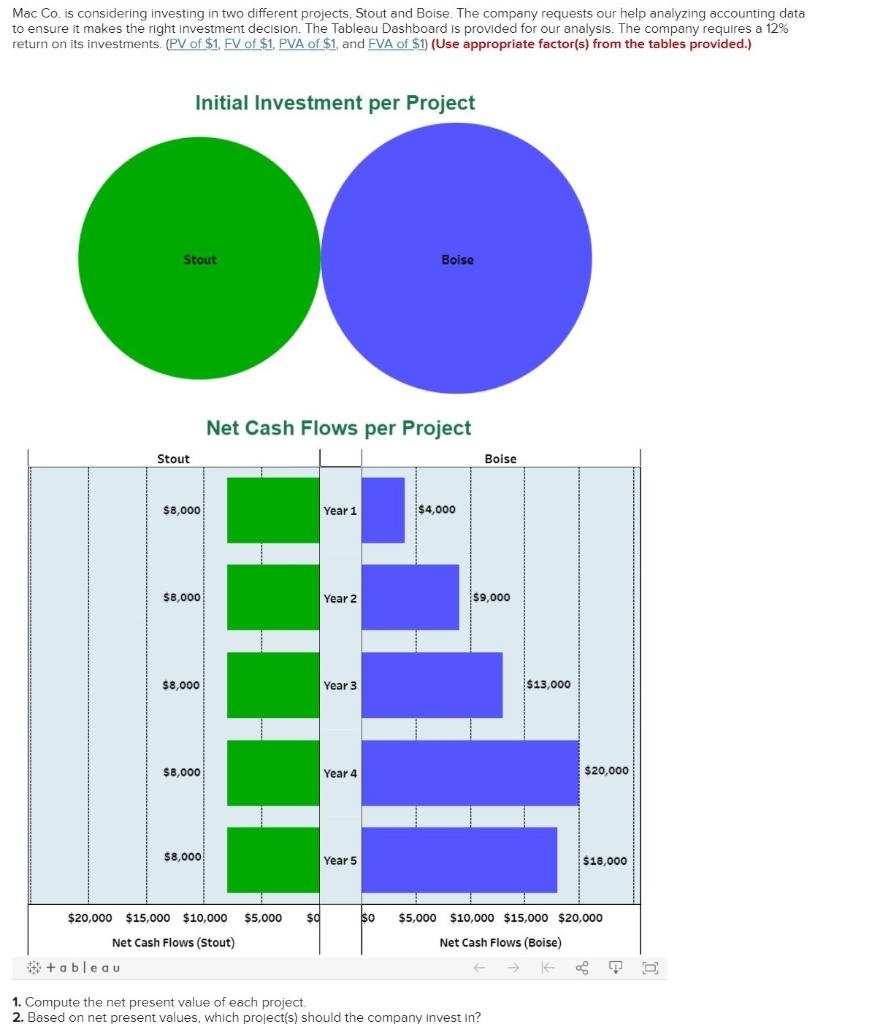

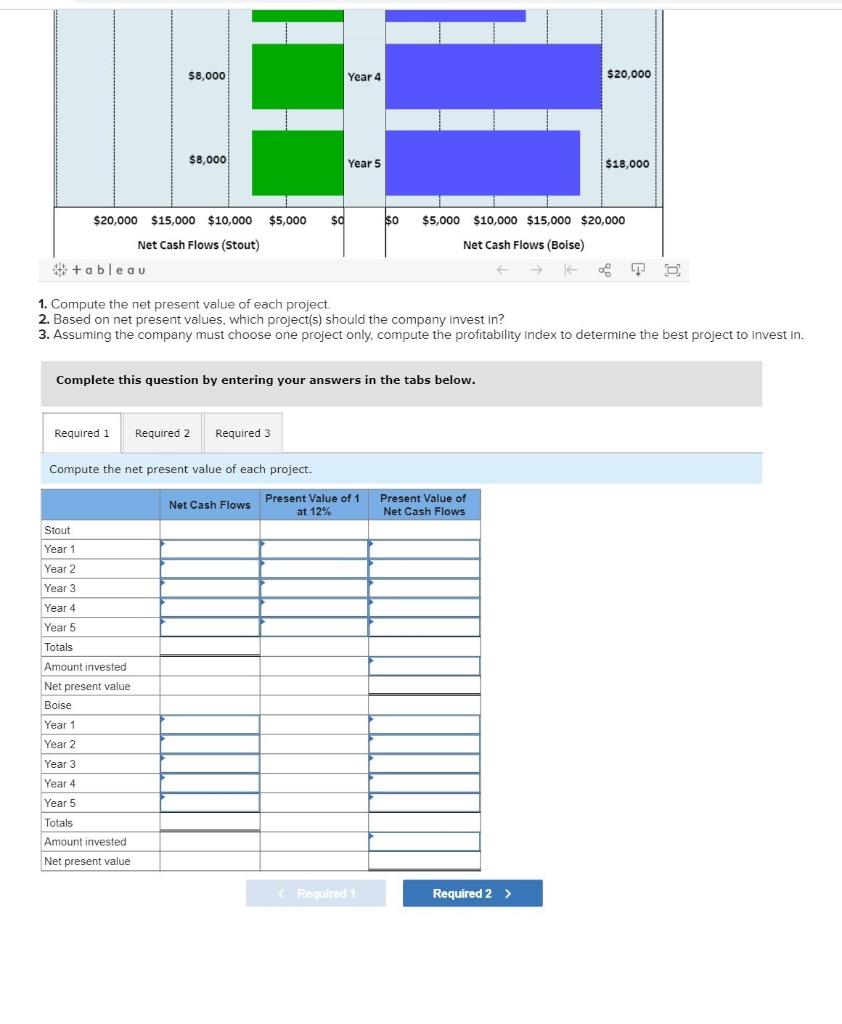

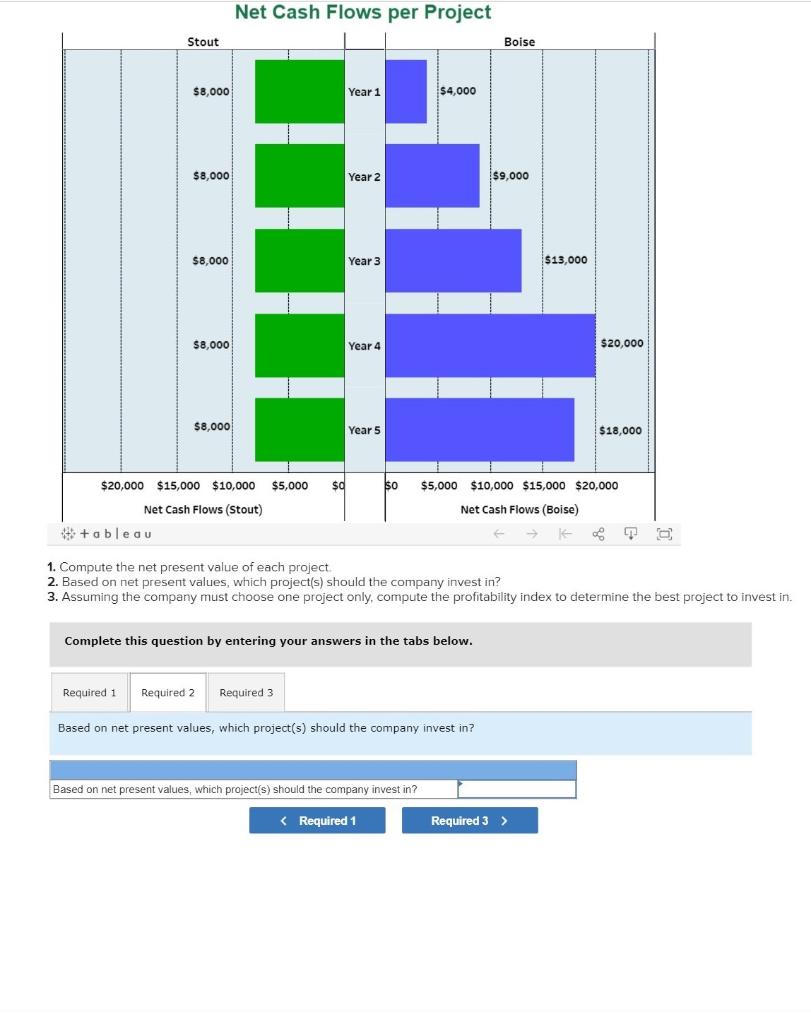

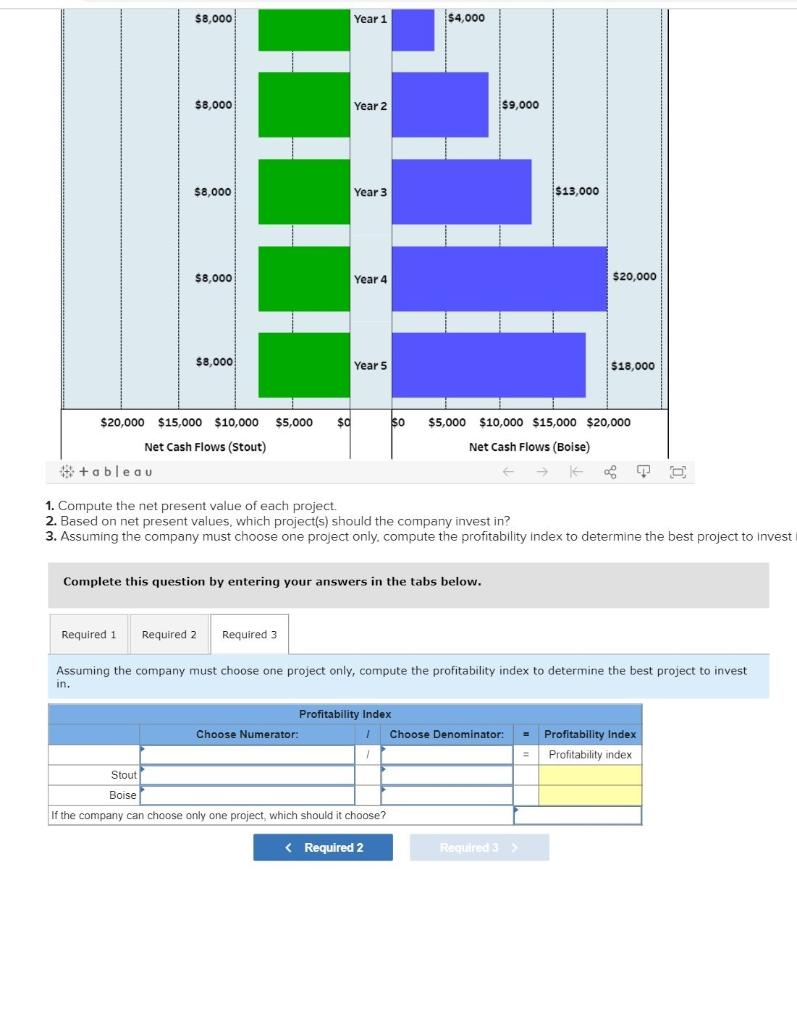

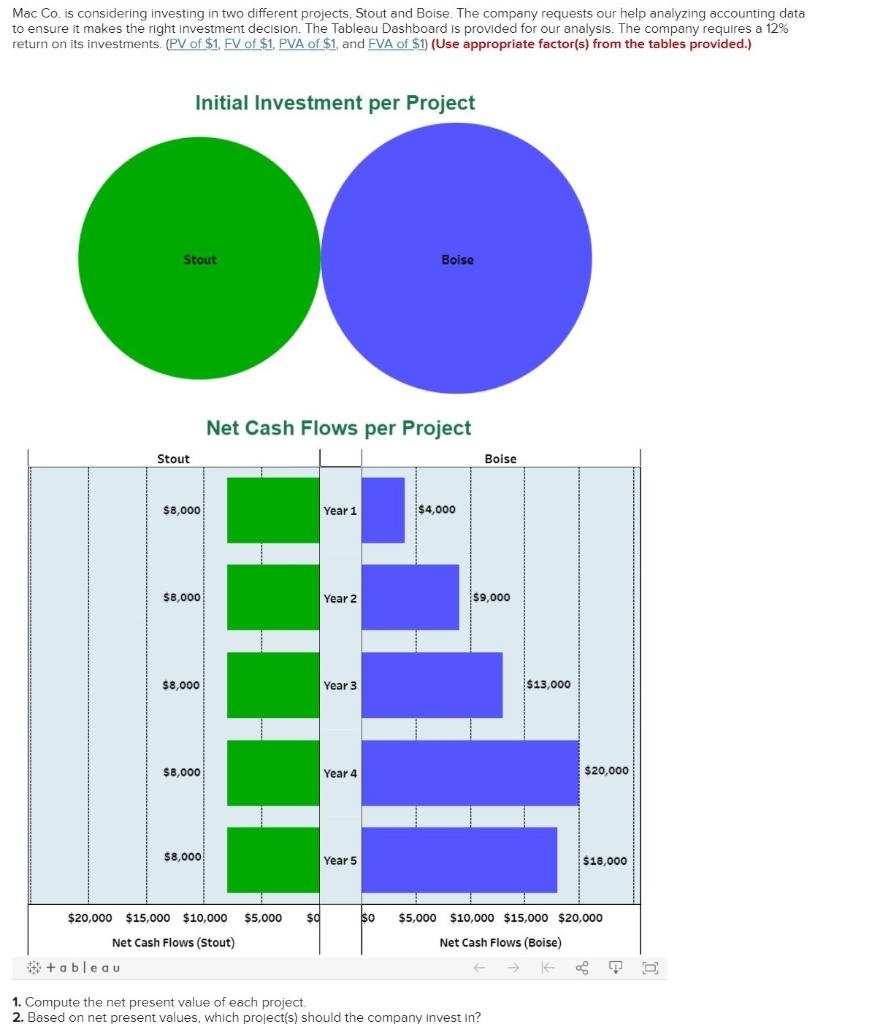

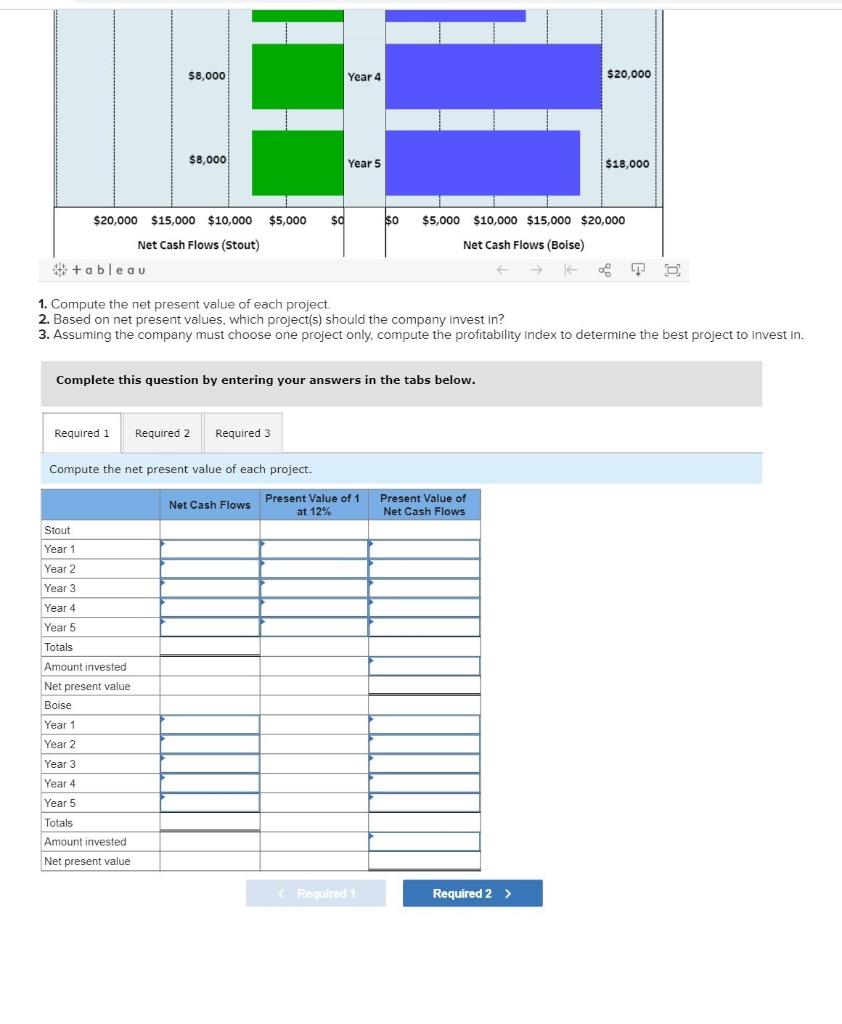

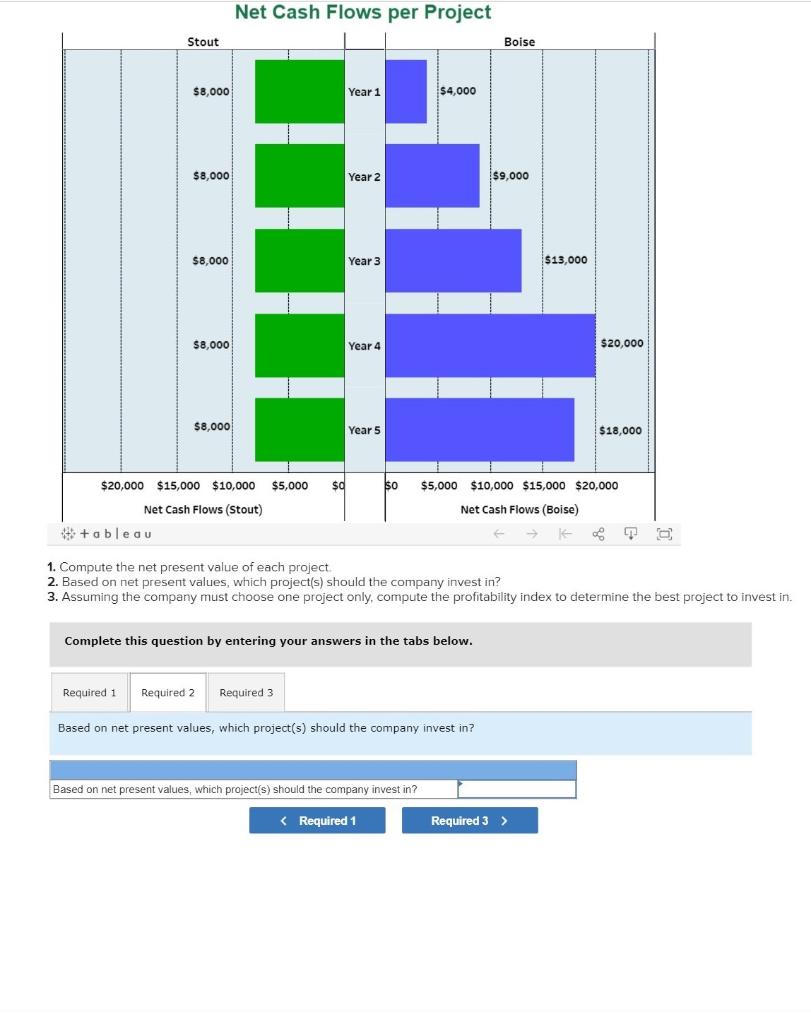

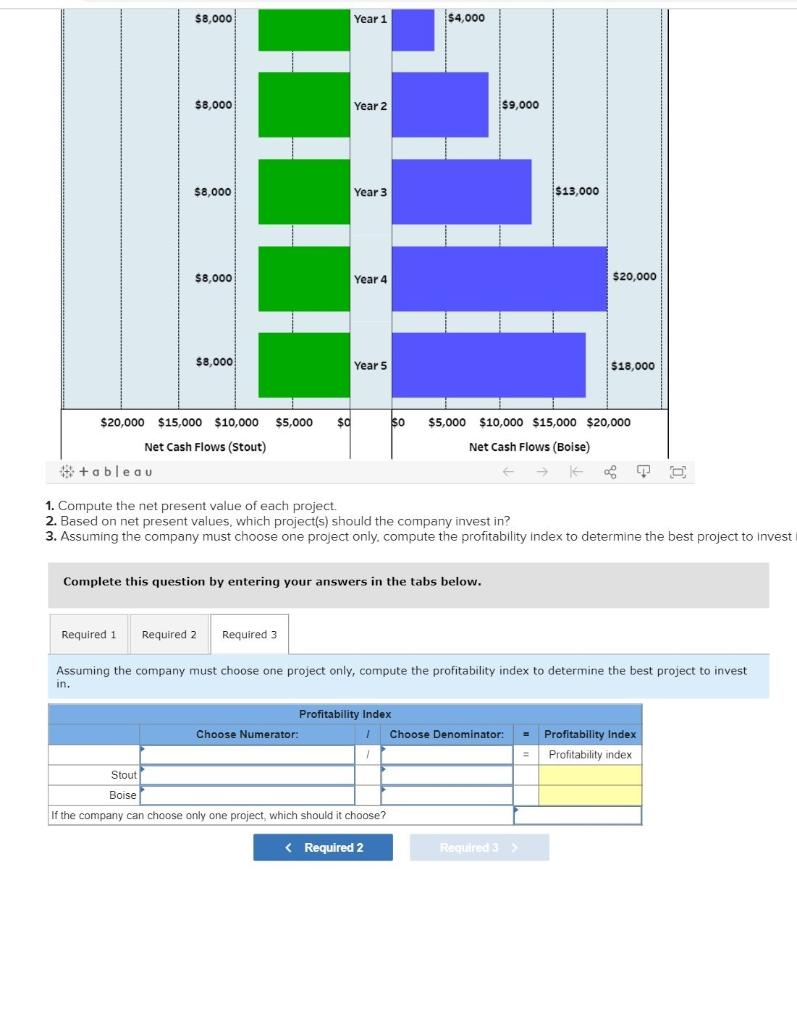

Mac Co. is considering investing in two different projects, Stout and Boise. The company requests our help analyzing accounting data to ensure it makes the right investment decision. The Tableau Dashboard is provided for our analysis. The company requires a 12% return on its investments. (PV of $1, FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Initial Investment per Project Stout Boise Net Cash Flows per Project Stout Boise $8,000 Year 1 $4,000 $8,000 Year 2 $9,000 $8,000 Year 3 $13,000 $8,000 Year 4 $20,000 $8,000 Year 5 $18,000 $20,000 $15,000 $10,000 $5,000 so SO $5,000 $10,000 $15,000 $20,000 Net Cash Flows (Boise) Net Cash Flows (Stout) ** tableau 1. Compute the net present value of each project. 2. Based on net present values, which project(s) should the company Invest in? $8,000 Year 4 $20,000 $8,000 Year 5 $18,000 $d so $5,000 $10,000 $15,000 $20,000 $20,000 $15,000 $10,000 $5,000 Net Cash Flows (Stout) *+ableau Net Cash Flows (Boise) 1. Compute the net present value of each project 2. Based on net present values, which project(s) should the company invest in? 3. Assuming the company must choose one project only, compute the profitability index to determine the best project to invest in. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the net present value of each project. Net Cash Flows Present Value of 1 at 12% % Present Value of Net Cash Flows Stout Year 1 Year 2 Year 3 Year 4 Year 5 Totals Amount invested Net present value Boise Year 1 Year 2 Year 3 Year 4 Year 5 Totals Amount invested Net present value Required: Required 2 > Net Cash Flows per Project Stout Boise $8,000 Year 1 $4,000 $8,000 Year 2 $9,000 $8,000 Year 3 $13,000 $8,000 Year 4 $20,000 $8,000 Year 5 $18,000 $20,000 $15,000 $10,000 $5,000 $d $0 $5,000 $10,000 $15,000 $20,000 Net Cash Flows (Boise) Net Cash Flows (Stout) tableau To 1. Compute the net present value of each project 2. Based on net present values, which project(s) should the company invest in? 3. Assuming the company must choose one project only, compute the profitability index to determine the best project to invest in. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Based on net present values, which project(s) should the company invest in? Based on net present values, which project(s) should the company invest in? $8,000 Year 1 1 $4,000 $8,000 Year 2 $9,000 $8,000 Year 3 3 $13,000 $8,000 Year 4 4 $20,000 $8,000 Year 5 $18,000 $0 SO $20,000 $15,000 $10,000 $5,000 Net Cash Flows (Stout) tableau $5,000 $10,000 $15,000 $20,000 Net Cash Flows (Boise) To 1. Compute the net present value of each project 2. Based on net present values, which project(s) should the company invest in? 3. Assuming the company must choose one project only. compute the profitability index to determine the best project to invest Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assuming the company must choose one project only, compute the profitability index to determine the best project to invest in. Profitability Index Choose Numerator: Choose Denominator: Profitability Index Profitability index Stout Boise If the company can choose only one project, which should it choose? ?