Answered step by step

Verified Expert Solution

Question

1 Approved Answer

King Soopers will self-develop the property; construct all on-site and off-site improvements at a cost of $4M; sell Outlots 4 -7; Lot 3 (fuel

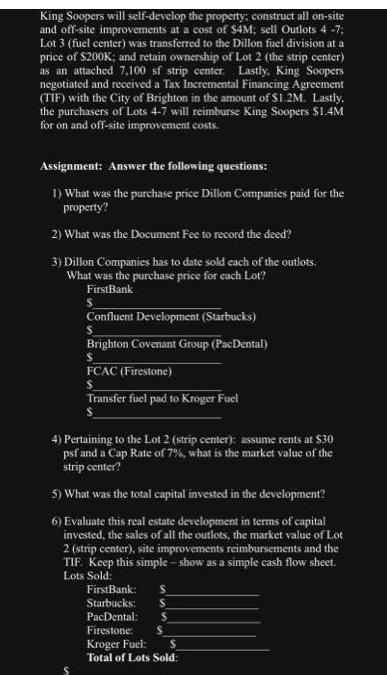

King Soopers will self-develop the property; construct all on-site and off-site improvements at a cost of $4M; sell Outlots 4 -7; Lot 3 (fuel center) was transferred to the Dillon fuel division at a price of $200K; and retain ownership of Lot 2 (the strip center) as an attached 7,100 sf strip center. Lastly, King Soopers negotiated and received a Tax Incremental Financing Agreement (TIF) with the City of Brighton in the amount of $1.2M. Lastly, the purchasers of Lots 4-7 will reimburse King Soopers $1.4M for on and off-site improvement costs. Assignment: Answer the following questions: 1) What was the purchase price Dillon Companies paid for the property? 2) What was the Document Fee to record the deed? 3) Dillon Companies has to date sold each of the outlots. What was the purchase price for each Lot? FirstBank Confluent Development (Starbucks) Brighton Covenant Group (PacDental) S FCAC (Firestone) S Transfer fuel pad to Kroger Fuel 4) Pertaining to the Lot 2 (strip center): assume rents at $30 psf and a Cap Rate of 7%, what is the market value of the strip center? 5) What was the total capital invested in the development? 6) Evaluate this real estate development in terms of capital invested, the sales of all the outlots, the market value of Lot 2 (strip center), site improvements reimbursements and the TIF. Keep this simple - show as a simple cash flow sheet. Lots Sold: FirstBank: S Starbucks: PacDental: Firestone: Kroger Fuel: Total of Lots Sold: 3) Dillon Companies has to date sold each of the outlots. What was the purchase price for each Lot? FirstBank Confluent Development (Starbucks) Brighton Covenant Group (PacDental) $ FCAC (Firestone) $ Transfer fuel pad to Kroger Fuel 4) Pertaining to the Lot 2 (strip center): assume rents at $30 psf and a Cap Rate of 7%, what is the market value of the strip center? 5) What was the total capital invested in the development? 6) Evaluate this real estate development in terms of capital invested, the sales of all the outlots, the market value of Lot 2 (strip center), site improvements reimbursements and the TIF. Keep this simple - show as a simple cash flow sheet. Lots Sold: FirstBank: Starbucks: PacDental: Firestone: Kroger Fuel: Total of Lots Sold: Market Value of Strip Center: On and Off-Site reimbursements: S TIF: Total Gross Value (in Dollars): Capital Invested: Land Purchase: On and Off-site Improvements: Total Capital Invested: Real Estate Value Realized:

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 The purchase price Dillon Companies paid for the property was5000000 2 The Document Fee to record ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started