Answered step by step

Verified Expert Solution

Question

1 Approved Answer

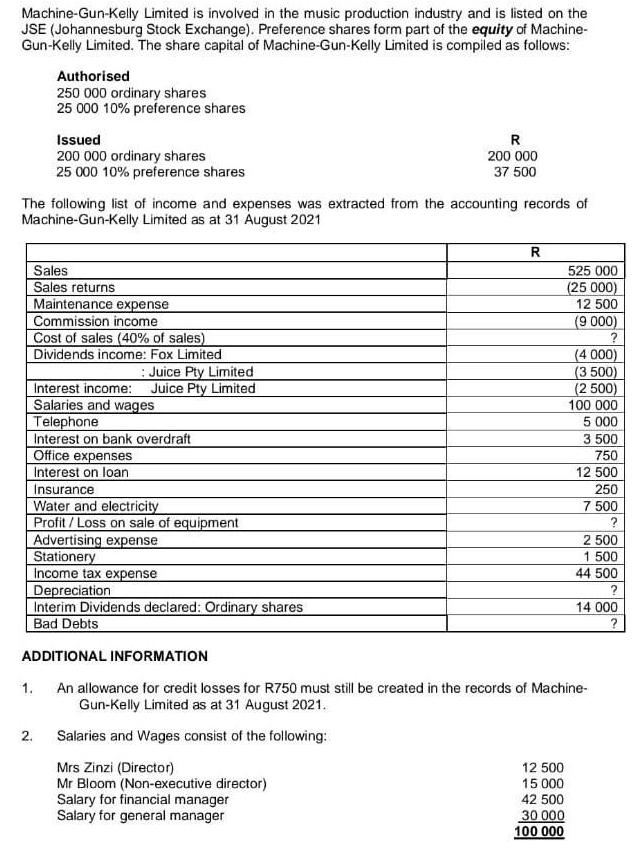

Machine-Gun-Kelly Limited is involved in the music production industry and is listed on the JSE (Johannesburg Stock Exchange). Preference shares form part of the

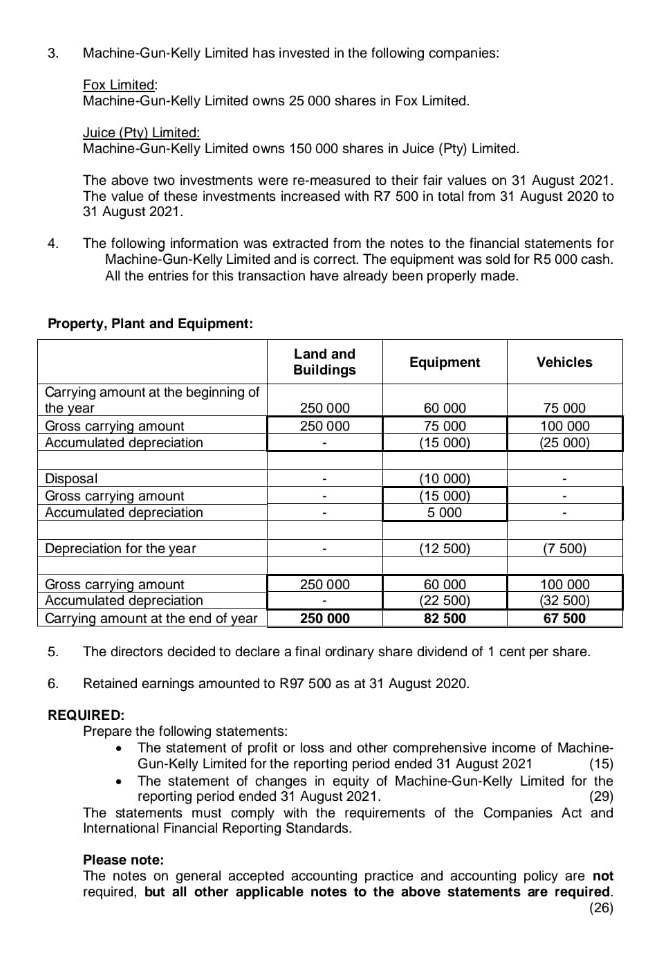

Machine-Gun-Kelly Limited is involved in the music production industry and is listed on the JSE (Johannesburg Stock Exchange). Preference shares form part of the equity of Machine- Gun-Kelly Limited. The share capital of Machine-Gun-Kelly Limited is compiled as follows: Authorised 250 000 ordinary shares 25 000 10% preference shares Issued 200 000 ordinary shares 25 000 10% preference shares The following list of income and expenses was extracted from the accounting records of Machine-Gun-Kelly Limited as at 31 August 2021 2. Sales Sales returns Maintenance expense Commission income Cost of sales (40% of sales) Dividends income: Fox Limited : Juice Pty Limited Interest income: Juice Pty Limited Salaries and wages Telephone Interest on bank overdraft Office expenses Interest on loan Insurance 1. Water and electricity Profit/Loss on sale of equipment Advertising expense Stationery Income tax expense Depreciation Interim Dividends declared: Ordinary shares Bad Debts R 200 000 37 500 Mrs Zinzi (Director) Mr Bloom (Non-executive director) Salary for financial manager Salary for general manager R 12 500 15 000 42 500 525 000 (25 000) 12 500 30 000 100 000 (9 000) ? ADDITIONAL INFORMATION An allowance for credit losses for R750 must still be created in the records of Machine- Gun-Kelly Limited as at 31 August 2021. Salaries and Wages consist of the following: (4 000) (3 500) (2 500) 100 000 5 000 3 500 750 12 500 250 7 500 ? 2 500 1 500 44 500 ? 14 000 ? 3. 4. Machine-Gun-Kelly Limited has invested in the following companies: Fox Limited: Machine-Gun-Kelly Limited owns 25 000 shares in Fox Limited. Juice (Pty) Limited: Machine-Gun-Kelly Limited owns 150 000 shares in Juice (Pty) Limited. The above two investments were re-measured to their fair values on 31 August 2021. The value of these investments increased with R7 500 in total from 31 August 2020 to 31 August 2021. The following information was extracted from the notes to the financial statements for Machine-Gun-Kelly Limited and is correct. The equipment was sold for R5 000 cash. All the entries for this transaction have already been properly made. Property, Plant and Equipment: Carrying amount at the beginning of the year Gross carrying amount Accumulated depreciation Land and Buildings REQUIRED: 250 000 250 000 250 000 Equipment 250 000 60 000 75 000 (15 000) Disposal Gross carrying amount Accumulated depreciation Depreciation for the year Gross carrying amount Accumulated depreciation Carrying amount at the end of year 5. The directors decided to declare a final ordinary share dividend of 1 cent per share. 6. Retained earnings amounted to R97 500 as at 31 August 2020. (10 000) (15 000) 5 000 Vehicles (12 500) 60 000 (22 500) 82 500 75 000 100 000 (25 000) (7 500) 100 000 (32 500) 67 500 Prepare the following statements: The statement of profit or loss and other comprehensive income of Machine- Gun-Kelly Limited for the reporting period ended 31 August 2021 (15) The statement of changes in equity of Machine-Gun-Kelly Limited for the reporting period ended 31 August 2021. (29) The statements must comply with the requirements of the Companies Act and International Financial Reporting Standards. Please note: The notes on general accepted accounting practice and accounting policy are not required, but all other applicable notes to the above statements are required. (26)

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

1 Statement of Profit or Loss and Other Comprehensive Income for MachineGunKelly Limited Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started