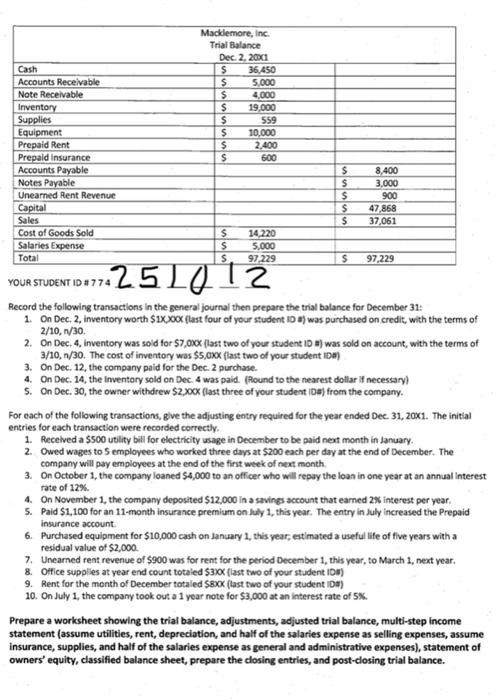

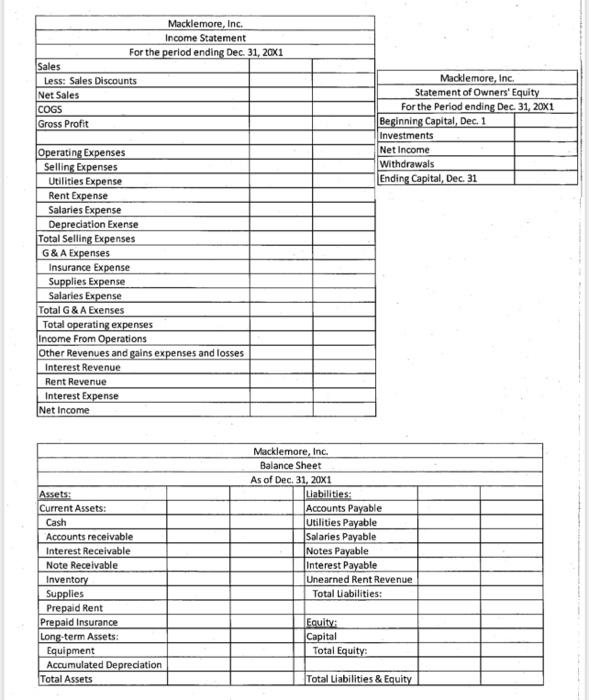

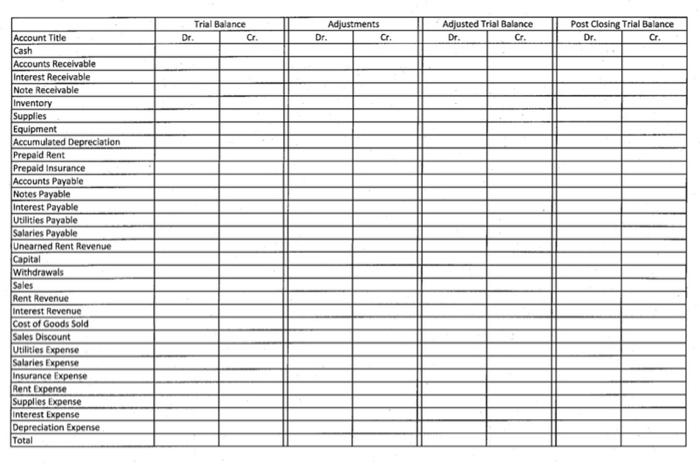

Macklemore, Inc. Trial Balance Dec. 2, 20X1 $ 36,450 $ 5.000 $ 4,000 $ 19,000 $ 559 $ 10,000 $ 2.400 $ 600 Cash Accounts Receivable Note Receivable Inventory Supplies Equipment Prepaid Rent Prepaid Insurance Accounts Payable Notes Payable Unearned Rent Revenue Capital Sales Cost of Goods Sold Salaries Expense Total 8,400 3,000 900 $ $ $ $ 47,868 37,061 $ $ $ 14220 5.000 97 229 $ 97.229 -251012 YOUR STUDENT ID#774 Record the following transactions in the general journal then prepare the trial balance for December 31: 1. On Dec. 2, inventory worth $1XXOOX (last four of your student was purchased on credit with the terms of 2/10, 1/30 2. On Dec. 4. Inventory was sold for $7,0xx (last two of your student ID ) was sold on account, with the terms of 3/10, 1/30. The cost of inventory was $5,0xx (last two of your student 15) 3. On Dec. 12, the company paid for the Dec. 2 purchase. 4. On Dec. 14, the Inventory sold on Dec. 4 was paid. (Round to the nearest dollar if necessary) S. On Dec. 30, the owner withdrew $2 xocx (last three of your student 18) from the company. For each of the following transactions, give the adjusting entry required for the year ended Dec 31, 20X1. The initial entries for each transaction were recorded correctly. 1. Received a $500 utility bill for electricity usage in December to be paid next month in January 2. Owed wages to employees who worked three days at $200 each per day at the end of December. The company will pay employees at the end of the first week of next month, 3. On October 1, the company loaned $4,000 to an officer who will repay the loan in one year at an annual interest rate of 12% 4. On November 1, the company deposited $12,000 in a savings account that earned 2% interest per year. 5. Paid $1,100 for an 11-month insurance premium on kdy 1, this year. The entry in July increased the Prepaid insurance account 6. Purchased equipment for $10,000 cash on January 1, this year, estimated a useful life of five years with a residual value of $2,000 7. Unearned rent revenue of $900 was for rent for the period December 1, this year, to March 1, next year. 8. Office Supplies at year end count totaled $3/06 (last two of your student ID#) 9. Rent for the month of December totaled $8x (last two of your student ID#} 10. On July 1, the company took out a 1 year note for $3,000 at an interest rate of 5%. Prepare a worksheet showing the trial balance, adjustments, adjusted trial balance, multi-step income statement (assume utilities, rent, depreciation, and half of the salaries expense as selling expenses, assume insurance, supplies, and half of the salaries expense as general and administrative expenses), statement of owners' equity, classified balance sheet, prepare the closing entries, and post-closing trial balance. 12:23 X Macklemore Set Spring 2021 PDF - 204 KB Accounts Payable Notes Panable Interest Payable katalities Pagable Ta on the temple Salarieskauphle naguned heat herenue Capital withdrawals Sales Rent Revenue Interest Revenue Expenses Sales Rent Revenue Interest Revenue Revenue Expenses Castof guds sold Utilities Expense Salariesponse Ingwanubgense test Reut Eprense Supplies Spense Depressaten Epense Interest Expert T Sales Discount Incine Sunary Trial Balance Dr. Cr Adjustments Dr. Cr. Adjusted Trial Balance Dr Cr. Post Closing Trial Balance Dr. Cr. Account Title Cash Accounts Receivable Interest Receivable Note Receivable Inventory Supplies Equipment Accumulated Depreciation Prepaid Rent Prepaid Insurance Accounts Payable Notes Payable Interest Payable Utilities Payable Salaries Payable Unearned Rent Revenue Capital Withdrawals Sales Rent Revenue Interest Revenue Cost of Goods Sold Sales Discount Utilities Expense Salaries Expense Insurance Expense Rent Expense Supplies Expense interest Expense Depreciation Expense Total