Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MacLoren Automative manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling. The distributor sells the

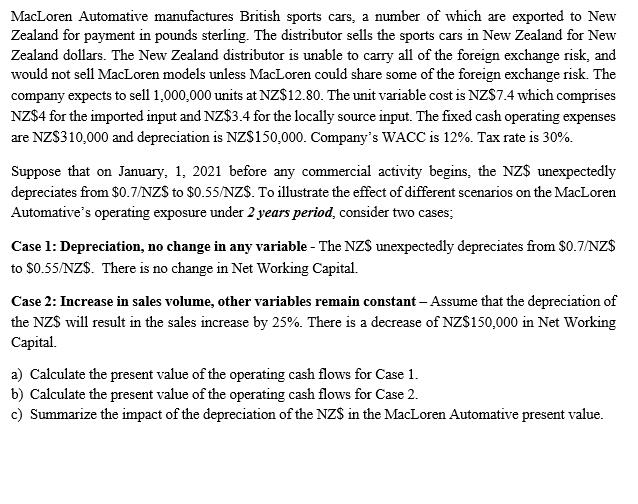

MacLoren Automative manufactures British sports cars, a number of which are exported to New Zealand for payment in pounds sterling. The distributor sells the sports cars in New Zealand for New Zealand dollars. The New Zealand distributor is unable to carry all of the foreign exchange risk, and would not sell MacLoren models unless MacLoren could share some of the foreign exchange risk. The company expects to sell 1,000,000 units at NZ$12.80. The unit variable cost is NZ$7.4 which comprises NZ$4 for the imported input and NZ$3.4 for the locally source input. The fixed cash operating expenses are NZ$310,000 and depreciation is NZ$150,000. Company's WACC is 12%. Tax rate is 30%. Suppose that on January, 1, 2021 before any commercial activity begins, the NZ$ unexpectedly depreciates from $0.7/NZ$ to $0.55/NZ$. To illustrate the effect of different scenarios on the MacLoren Automative's operating exposure under 2 years period, consider two cases; Case 1: Depreciation, no change in any variable - The NZS unexpectedly depreciates from $0.7/NZ$ to $0.55/NZ$. There is no change in Net Working Capital. Case 2: Increase in sales volume, other variables remain constant - Assume that the depreciation of the NZ$ will result in the sales increase by 25%. There is a decrease of NZ$150,000 in Net Working Capital. a) Calculate the present value of the operating cash flows for Case 1. b) Calculate the present value of the operating cash flows for Case 2. c) Summarize the impact of the depreciation of the NZ$ in the MacLoren Automative present value.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of the operating cash flows for Case 1 and Case 2 we need to follow these steps Given data Expected sales volume 100000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started