macroeconomics q5-6

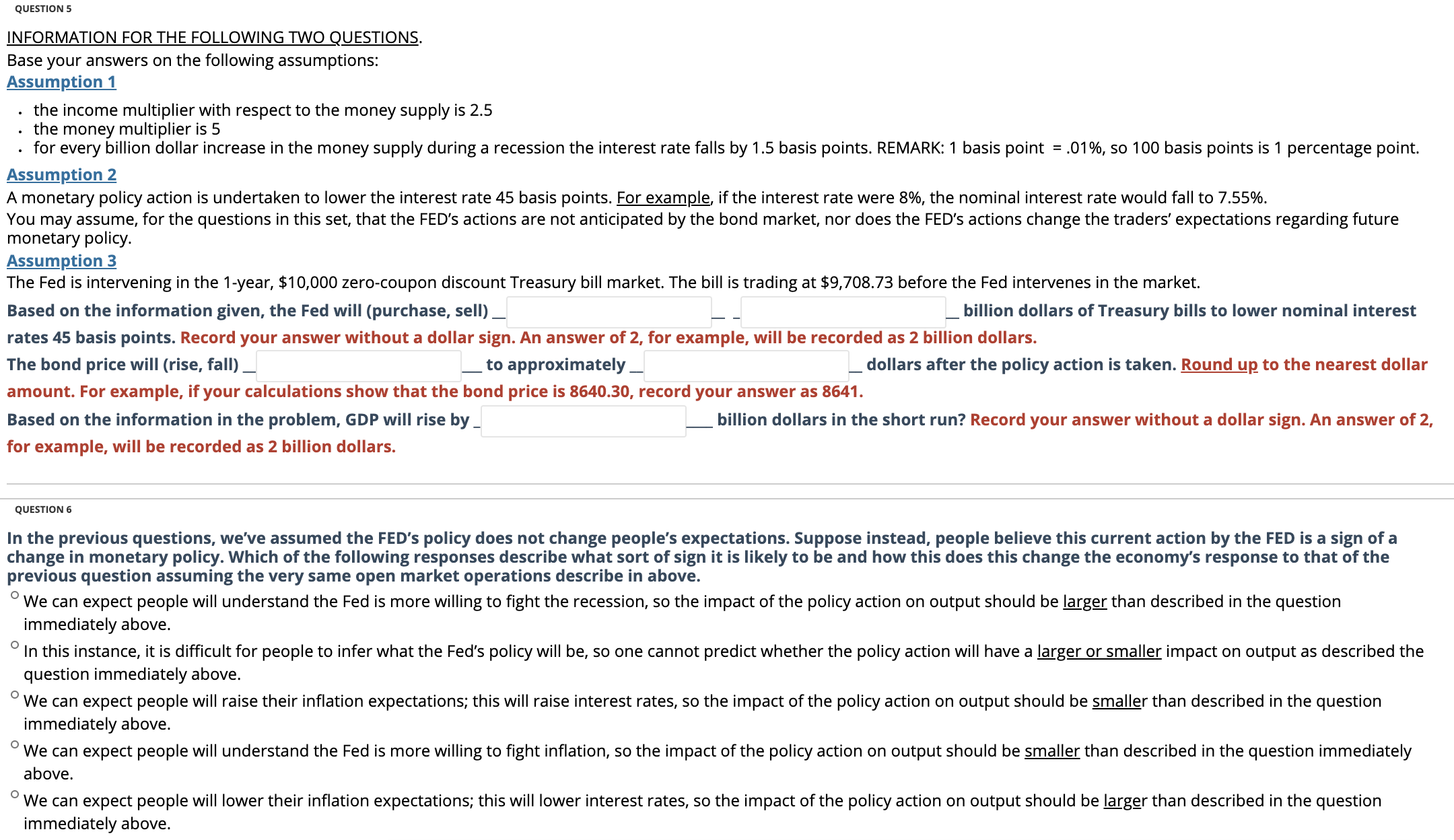

ouEsrlou 5 INFORMATION FOR THE FOLLOWING TWO QUESTIONS. Base your answers on the following assumptions: Assumption 1 . the income multiplier with respect to the money supply is 2.5 . the money multiplier is 5 . for every billion dollar increase in the money supply during a recession the interest rate falls by 1 .5 basis points. REMARK: 1 basis point = .01%, so 100 basis points is 1 percentage point. Assumption 2 A monetary policy action is undertaken to lower the interest rate 45 basis points. For exampl_e, if the interest rate were 8%, the nominal interest rate would fall to 7.55%. You may assume, for the questions in this set, that the FED's actions are not anticipated by the bond market, nor does the FED's actions change the traders' expectations regarding future monetary policy. Assumption 3 The Fed is intervening in the 1-year, $10,000 zero-coupon discount Treasury bill market. The bill is trading at $9,708.73 before the Fed intervenes in the market. Based on the information given, the Fed will (purchase, sell) _ _ billion dollars ofTreasury bills to lower nominal interest rates 45 basis points. Record your answer without a dollar sign. An answer of 2, for example, will be recorded as 2 billion dollars. The bond price will (rise, fall) _ _ to approximately _ _ dollars after the policy action is taken. Round up to the nearest dollar amount. For example, if your calculations show that the bond price is 8640.30, record your answer as 8641. Based on the information in the problem, GDP will rise by_ _ billion dollars in the short run? Record your answer without a dollar sign. An answer of 2, for example, will be recorded as 2 billion dollars. oussnou s In the previous questions, we've assumed the FED's policy does not change people's expectations. Suppose instead, people believe this current action by the FED is a sign of a change in monetary policy. Which ofthe following responses describe what sort of sign it is likely to be and how this does this change the economy's response to that of the previous question assuming the very same open market operations describe in above. We can expect people will understand the Fed is more willing to ght the recession, so the impact of the policy action on output should be Egg than described in the question immediately above. 0 In this instance, it is difficult for people to infer what the Fed's policy will be, so one cannot predict whether the policy action will have a L'ger or smaller impact on output as described the question immediately above. 0 We can expect people will raise their ination expectations; this will raise interest rates, so the impact of the policy action on output should be smaller than described in the question immediately above. We can expect people will understand the Fed is more willing to ght ination, so the impact of the policy action on output should be smaller than described in the question immediately above. We can expect people will lower their ination expectations; this will lower interest rates, so the impact of the policy action on output should be |a_rggr than described in the question immediately above