Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Macrosoft Gaming Inc. is a private company with cash flows of $0.75 per share, earnings of $1.20 per share and 100,000 shares outstanding. Gamers.tv

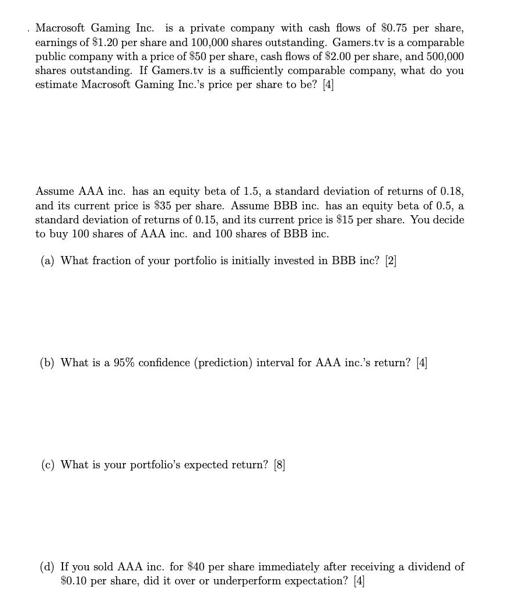

Macrosoft Gaming Inc. is a private company with cash flows of $0.75 per share, earnings of $1.20 per share and 100,000 shares outstanding. Gamers.tv is a comparable public company with a price of $50 per share, cash flows of $2.00 per share, and 500,000 shares outstanding. If Gamers.tv is a sufficiently comparable company, what do you estimate Macrosoft Gaming Inc.'s price per share to be? [4] Assume AAA inc. has an equity beta of 1.5, a standard deviation of returns of 0.18, and its current price is $35 per share. Assume BBB inc. has an equity beta of 0.5, a standard deviation of returns of 0.15, and its current price is $15 per share. You decide to buy 100 shares of AAA inc. and 100 shares of BBB inc. (a) What fraction of your portfolio is initially invested in BBB inc? [2] (b) What is a 95% confidence (prediction) interval for AAA inc.'s return? [4] (c) What is your portfolio's expected return? [8] (d) If you sold AAA inc. for $40 per share immediately after receiving a dividend of $0.10 per share, did it over or underperform expectation? [4]

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the fraction of the portfolio initially invested in BBB Inc we need to calculate the total value of the portfolio and the value of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started