Question

Macrosoft Inc. would like to acquire its smaller competitor RedHat Corp. using a stock swap. Data on both firms before the transaction can be found

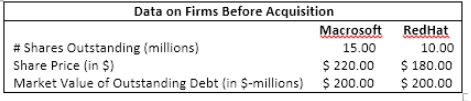

Macrosoft Inc. would like to acquire its smaller competitor RedHat Corp. using a stock swap. Data on both firms before the transaction can be found in the table below. Macrosoft offers to exchange each share of RedHat for 0.85 shares of Macrosoft. As part of the deal Macrosoft will also assume the outstanding debt of RedHat. Synergies from the merger are expected to be $550 million. Assume that neither firm has any excess cash. What is the share price of Macrosoft after the acquisition? Select the best one.

I.

$244.18

II.

$240.43

III.

$220.00

IV.

$256.67

V.

$242.00

Data on Firms Before Acquisition Macrosoft RedHat #Shares Outstanding (millions) 15.00 10.00 Share Price (in $) $ 220.00 $ 180.00 Market value of Outstanding Debt (in S-millions) $200.00 $ 200.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started