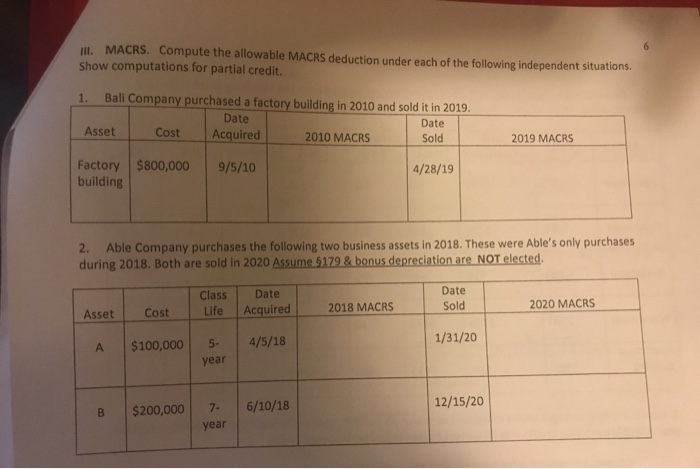

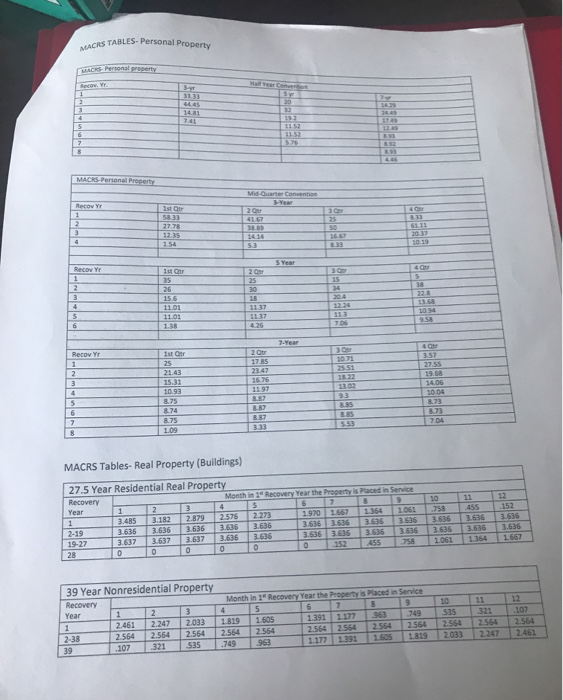

MACRS. Compute the allowable MACRS deduction under each of the following independent situations, Show computations for partial credit. 1. Bali Company purchased a factory building in 2010 and sold it in 2019. Date Date Asset Cost Acquired 2010 MACRS Sold 2019 MACRS Factory building $800,000 9/5/10 4/28/19 2. Able Company purchases the following two business assets in 2018. These were Able's only purchases during 2018. Both are sold in 2020 Assume 5179 & bonus depreciation are NOT elected. Date Class Life Date Acquired Sold 2018 MACRS 2020 MACRS Asset Cost 1/31/20 $100,000 4/5/18 year B 12/15/20 $200,000 6/10/18 7 year RS TABLES- Personal Proper 351 599 SEE asla 399 10.04 MACRS Tables- Real Property (Buildings) 27.5 Year Residential Real Property Recovery 2.273 3.63 2-19 19-27 3.485 3 .182 2.879 2.576 3535 3536 3616 3525 3.637 2637 3.637 3.636 TO DOO 1.061 1.364 1.667 39 Year Nonresidential Property Recovery Month in 1 Recovery Year the Property is placed in Service 1 2 3 4 5 2.461 2.247 2.0331 8191505 13911177 .963 749 -38 2.564 2.564 2564 2.554 2554 2.564 2.554 2.5642.564 107 321 535 .749 963 1177 172 1101115051319 535 2.554 2033 321 2554 2247 102 2554 1461 MACRS. Compute the allowable MACRS deduction under each of the following independent situations, Show computations for partial credit. 1. Bali Company purchased a factory building in 2010 and sold it in 2019. Date Date Asset Cost Acquired 2010 MACRS Sold 2019 MACRS Factory building $800,000 9/5/10 4/28/19 2. Able Company purchases the following two business assets in 2018. These were Able's only purchases during 2018. Both are sold in 2020 Assume 5179 & bonus depreciation are NOT elected. Date Class Life Date Acquired Sold 2018 MACRS 2020 MACRS Asset Cost 1/31/20 $100,000 4/5/18 year B 12/15/20 $200,000 6/10/18 7 year RS TABLES- Personal Proper 351 599 SEE asla 399 10.04 MACRS Tables- Real Property (Buildings) 27.5 Year Residential Real Property Recovery 2.273 3.63 2-19 19-27 3.485 3 .182 2.879 2.576 3535 3536 3616 3525 3.637 2637 3.637 3.636 TO DOO 1.061 1.364 1.667 39 Year Nonresidential Property Recovery Month in 1 Recovery Year the Property is placed in Service 1 2 3 4 5 2.461 2.247 2.0331 8191505 13911177 .963 749 -38 2.564 2.564 2564 2.554 2554 2.564 2.554 2.5642.564 107 321 535 .749 963 1177 172 1101115051319 535 2.554 2033 321 2554 2247 102 2554 1461