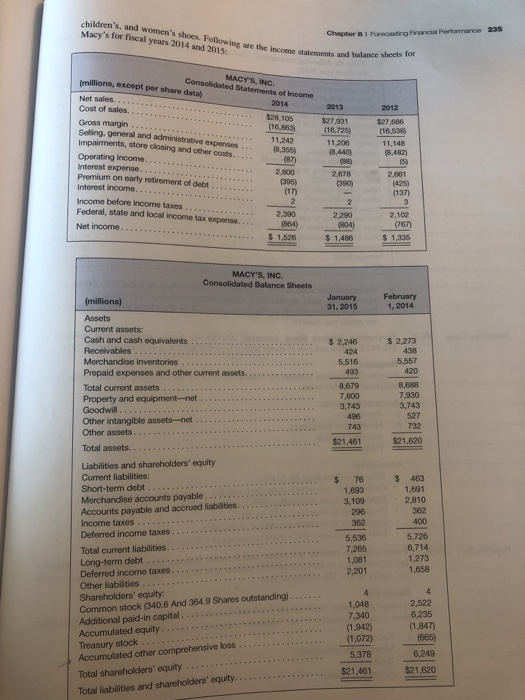

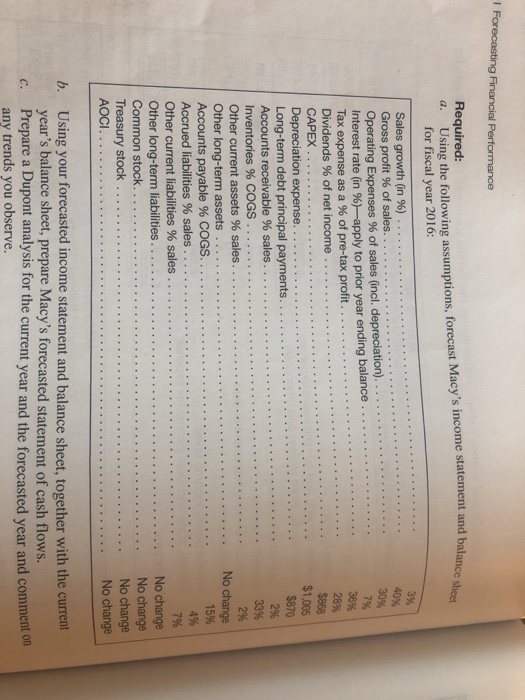

Macy's, Inc. P8-6. Forecasting an Income Statement, Balance Sheet, Statement of Cash Flows, and Dupont Analysis Macy's operates stores and Internet websites in the United States. Its stores and websites sell a range of merchandise, including apparel and accessories for men, women, and children; cosmetics; home furnishings; and other consumer goods. The company also operates Bloomingdale's Outlet stores that offer a range of apparel and accessories, including women's ready-to-wear, fashion accessories, jewelry, handbags, and intimate apparel, as well as men's, children's s, and women's shoes. Followi y's for fiscal years 2014 and 2015 Chapter Bl ng are the income statements and balance s sheets for MACY'S, ING millions, except per share data) Net sales. Cost of sales Gross margin Selling, general and administrative expenses Impairments, store closing and other costs 2013 $27.931 (16,725) 11,206 2012 $27,686 (16.538) 11,148 $28,105 11,242 (8,355) (87) Operating income Interest expense 2,800 2,661 (425) 137 (395) Interest income. Income before income taxes Federal, state and local income tax expense. 2.390 2,102 2,290 (8046r 1.526 1,486 $1,335 MACY'S, INC. Consolidated Balance Sheets Februar 1, 2014 January 31, 2015 Assets Current assets: Cash and cash equivalents $ 2.273 $ 2246 5,516 493 Prepaid expenses and other current assets. Total current assets Property and equipment net 8,679 7,800 3,743 496 743 8,688 7,930 3,743 527 732 Other intangible assets-net Other assets. $21,620 $21,461 Total assets. Liabilities and shareholders' equity Current liabilities: Short-term debt Merchandise accounts payable Accounts payable and accrued liabilities Income taxes $ 463 1,691 2,810 362 400 76 1,693 3,109 296 5,726 6,714 1,273 1,658 5,536 7,265 1,081 Total current liabilities Long-term debt Deferred income taxes.... Other liabilities Shareholders' equity Common stock (340.6 And 364.9 Shares outstanding) 2,522 6,235 (1,847) 1,048 7,340 (1,942) (1,072) 5,378 $21,461 Accumulated equity Treasury stock Accumulated other comprehensive koss Total shareholders' equity 6,249 $21,620 Required: a. Using the following assumptions, forecast Macy's income statement and balance s for fiscal year 2016: 3% Sales growth (in %) . . Gross profit % of sales. Operating Expenses % of sales (incl. depreciation) Interest rate (in %-apply to prior year ending balance . Tax expense as a % of pre-tax profit Dividends % of net income CAPEX 7% . . . . . . . . . . . . . . $1,005 $870 2% Long-term debt principal payments. 33% Inventories % COGS . Other current assets % sales. . No change 15% 4% 7% No change No change Accounts payable % COGS Other current liabilities 96 sales . No change Treasury stock AOCI Using your forecasted income statement and balance sheet, together with the current year's balance sheet, prepare Macy's forecasted statement of cash flows. Prepare a Dupont analysis for the current year and the forecasted year and comment on any trends you observe b. c