Question

made the following transactions: Date Transaction Amount () 3-1-2019 Paid annual rent of the shop 3,500 18-1-2019 Purchased keep fit equipment on credit 5,000

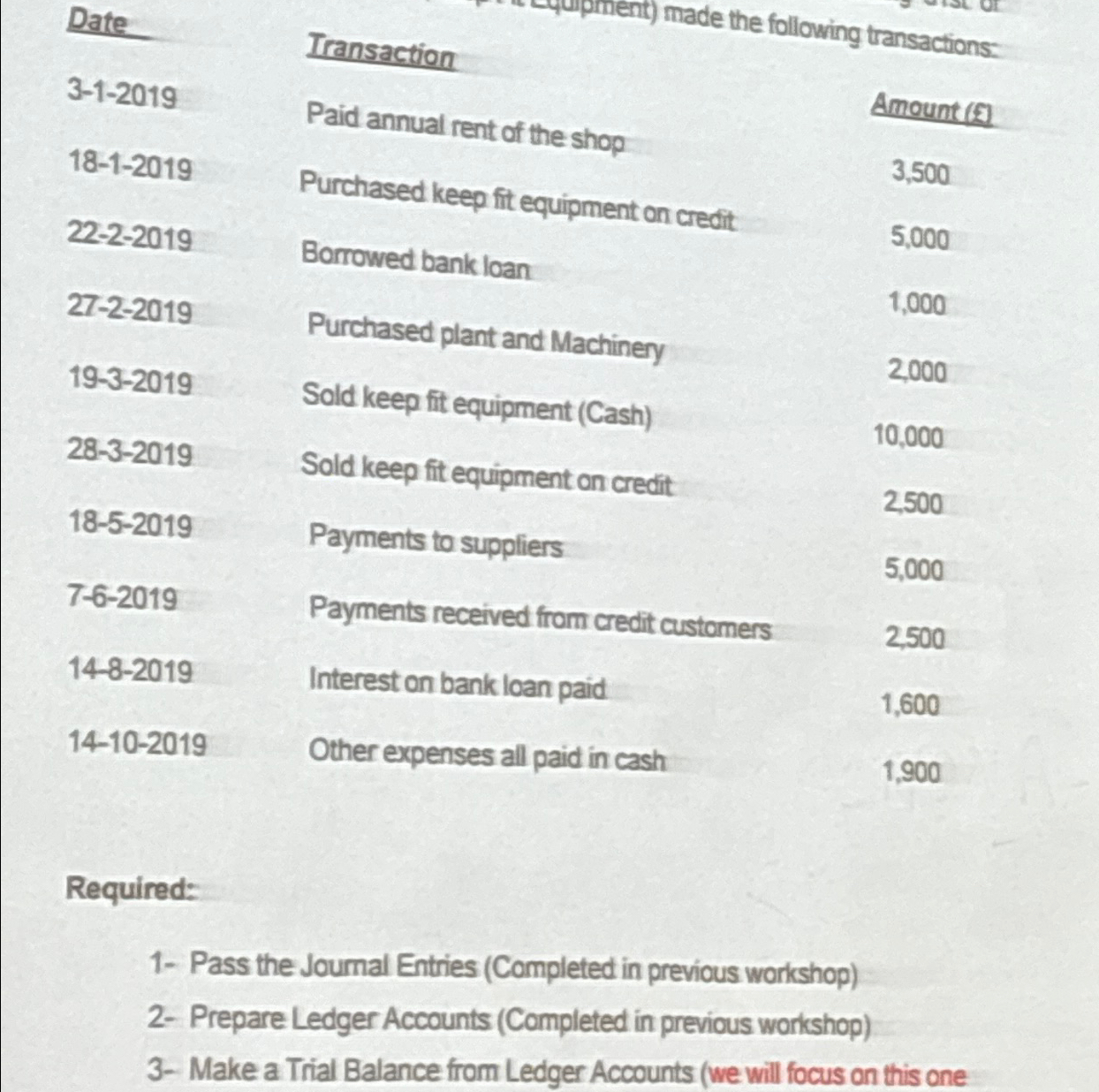

made the following transactions: Date Transaction Amount () 3-1-2019 Paid annual rent of the shop 3,500 18-1-2019 Purchased keep fit equipment on credit 5,000 22-2-2019 Borrowed bank loan 1,000 27-2-2019 Purchased plant and Machinery 2,000 19-3-2019 Sold keep fit equipment (Cash) 10,000 28-3-2019 Sold keep fit equipment on credit 2,500 18-5-2019 Payments to suppliers 5,000 7-6-2019 Payments received from credit customers 2,500 14-8-2019 Interest on bank loan paid 1,600 14-10-2019 Other expenses all paid in cash 1,900 Required: 1- Pass the Journal Entries (Completed in previous workshop) 2- Prepare Ledger Accounts (Completed in previous workshop) 3- Make a Trial Balance from Ledger Accounts (we will focus on this one

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

College Accounting A Practical Approach

Authors: Jeffrey Slater, Brian Zwicker

11th Canadian Edition

132564440, 978-0132564441

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App