Question

Kipling will use the Accrual Method of accounting due to the size of their business. Kipling is owned by VF Corporation, a publicly traded business

Kipling will use the Accrual Method of accounting due to the size of their business. Kipling is owned by VF Corporation, a publicly traded business that owns an abundance of apparel companies, including The North Face, Timberland, and Vans. For VF Corporation and Kipling to get the most accurate picture of Kipling’s profitability, they want to record their revenues as they are earned and their expenses as soon as they are incurred. As a large retail company where sales fluctuate by season, Kipling tracks their numbers quarterly. An accrual method gives a more accurate look at their profitability for the year.

Kipling will use a target price pricing strategy to determine the selling price. Currently, masks on the market range from $8 to $25 in price. Currently, all masks of the same type as Kipling masks are selling out in minutes as different retailers continue to replenish their website every few days. With demand being so high and Kipling being a well-known brand, a slight mark-up from the lower end of the price range will still remain competitive while still being conscious of the profit Kipling is aiming to make. Kipling masks will be priced at $12. Kipling currently produces fabric bags and accessories, meaning they already possess the necessary machinery and materials to produce masks. Non-medical grade masks are not expensive to produce; Kipling can produce the mask for 50 cents. The markup on Kipling masks is 2,300%, leaving Kipling with a large profit margin.

Create a 1year Master Budget (refers page 254 & 255 in the textbook) for the business/project.

Prepare Cash budget (and/or Cash Flow statement) and provide a brief analysis of cash flows from Operation, Investing and Financing activities (Cash flow statement analysis)

Break Even Analysis, Target Profit and Margin of Safety in units and Sales Dollars for the Business/Project

Discuss the Return on Investment and/or Economic Value Added for the business/program/project to measure its projected performance.

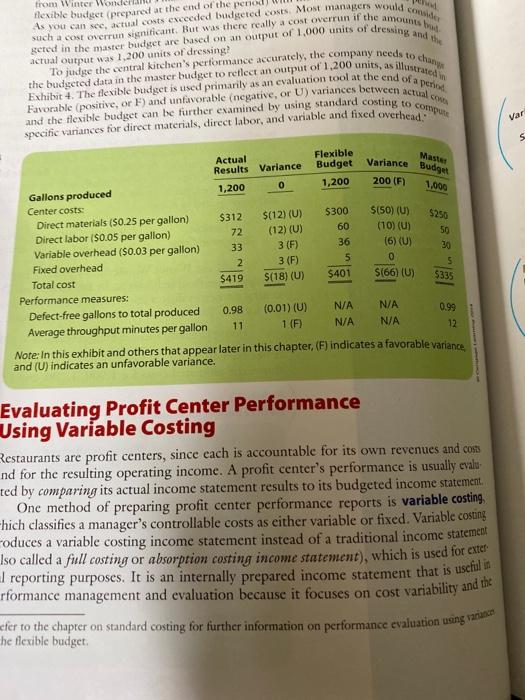

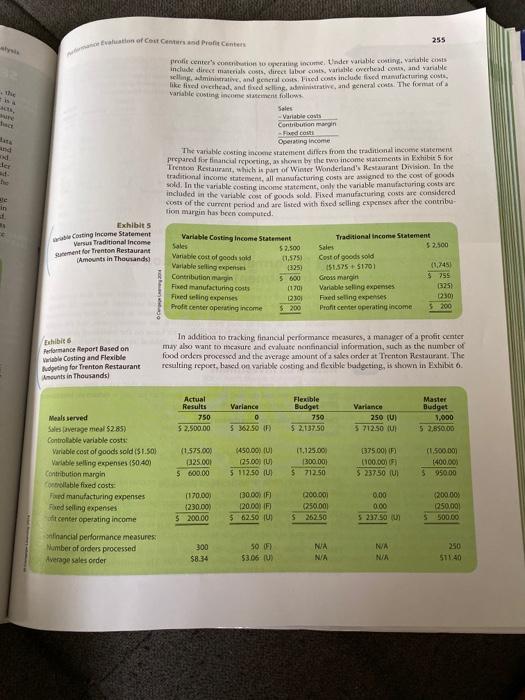

hod. from Winter Wonderl flexible budget (prepared at the end of the period actual output was 1,200 units of dressing? such a cost overrun significant. But was there really a cost overrun if the amounts bud As you can see, actual costs exceeded budgeted costs. Most managers would consider geted in the master budget are based on an output of 1,000 units of dressing and the To judge the central kitchen's performance accurately, the company needs to chang Exhibit 4. The flexible budget is used primarily as an evaluation tool at the end of a period the budgeted data in the master budget to reflect an output of 1,200 units, as illustrated in Favorable (positive, or F) and unfavorable (negative, or U) variances between actual com and the flexible budget can be further examined by using standard costing to compute specific variances for direct materials, direct labor, and variable and fixed overhead." Gallons produced Center costs: Direct materials ($0.25 per gallon) Direct labor ($0.05 per gallon) Variable overhead ($0.03 per gallon) Fixed overhead Total cost Performance measures: Defect-free gallons to total produced Average throughput minutes per gallon Actual Results Variance 1,200 0 $312 72 33 2 $419 $(12) (U) (12) (U) 3 (F) 3 (F) $(18) (U) 0.98 (0.01) (U) 1 (F) 11 Master Flexible Budget Variance Budget 200 (F) 1,000 1,200 $300 60 36 5 $401 N/A N/A $(50) (U) (10) (U) (6) (U) 0 $(66) (U) N/A N/A $250 50 30 5 $335 0.99 12 Note: In this exhibit and others that appear later in this chapter, (F) indicates a favorable variance and (U) indicates an unfavorable variance. Evaluating Profit Center Performance Using Variable Costing Restaurants are profit centers, since each is accountable for its own revenues and costs nd for the resulting operating income. A profit center's performance is usually evalu ted by comparing its actual income statement results to its budgeted income statement. One method of preparing profit center performance reports is variable costing. hich classifies a manager's controllable costs as either variable or fixed. Variable costing oduces a variable costing income statement instead of a traditional income statement Iso called a full costing or absorption costing income statement), which is used for exter reporting purposes. It is an internally prepared income statement that is useful in rformance management and evaluation because it focuses on cost variability and the fer to the chapter on standard costing for further information on performance evaluation using variances he flexible budget. Var S

Step by Step Solution

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The Company Name K i pling Indust ry App arel City New York State New York Zip 100 01 Country United States Phone 1 212 354 88 00 Website www ki pling usa com CEO He ather Sch ou est C FO David Mull e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started