Madeleine owns 100% of Omega Corporation's common stock. On January 2 of the current year, Omega liquidates and distributes all property to Madeleine except that Omega retains cash to pay the accounts payable and any tax liability resulting from Omega's liquidation. Assume that Omega has no other taxable income or loss. Assume a 21% corporate tax rate.

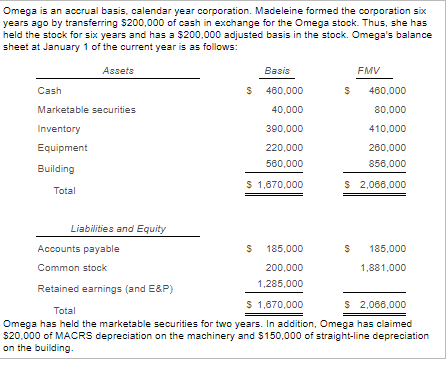

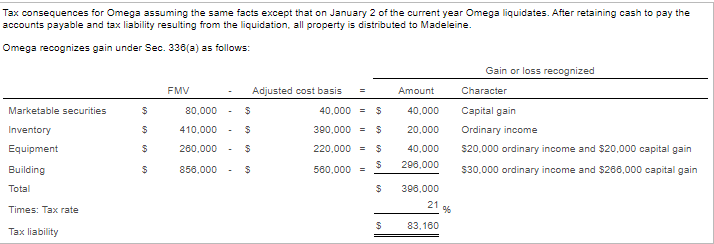

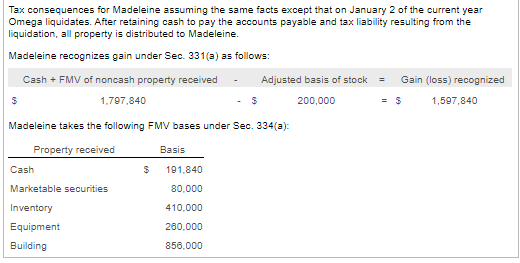

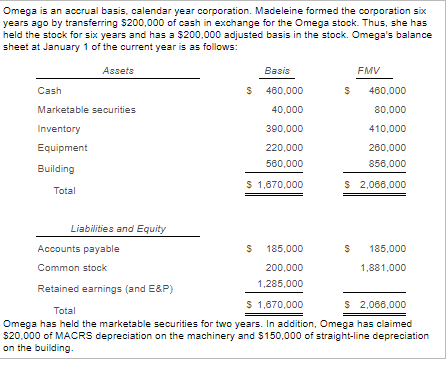

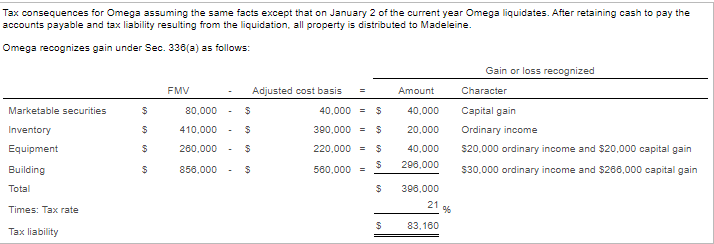

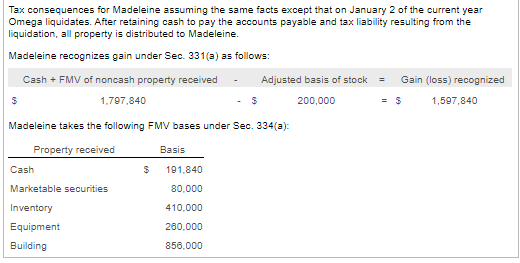

Omega is an accrual basis, calendar year corporation. Madeleine formed the corporation six years ago by transferring $200,000 of cash in exchange for the Omega stock. Thus, she has held the stock for six years and has a $200.000 adjusted basis in the stock. Omega's balance sheet at January 1 of the current year is as follows: Assets Basis FMV Cash S 460,000 Marketable securities 80.000 Inventory Equipment $ 460,000 40,000 390,000 220,000 560,000 410.000 260.000 856.000 Building Total $ 1,670,000 $ 2,068,000 Liabilities and Equity Accounts payable $ 185,000 S 185,000 Common stock 200,000 1.881,000 1,285,000 Retained earnings (and E&P) $ 1,670,000 $ 2,066,000 Total Omega has held the marketable securities for two years. In addition, Omega has claimed $20.000 of MACRS depreciation on the machinery and $150,000 of straight-line depreciation on the building Tax consequences for Omega assuming the same facts except that on January 2 of the current year Omega liquidates. After retaining cash to pay the accounts payable and tax liability resulting from the liquidation, all property is distributed to Madeleine. Omega recognizes gain under Sec. 336(a) as follows: Gain or loss recognized FMV Adjusted cost basis Amount Character Marketable securities $ 80.000 $ 40,000 = $ 40,000 $ $ 390,000 = $ 20.000 Inventory Equipment Building 410.000 260.000 Capital gain Ordinary income $20.000 ordinary income and $20,000 capital gain $30.000 ordinary income and $266,000 capital gain $ $ 40.000 290.000 $ 858,000 220,000 = $ 560.000 = $ $ $ Total 398,000 21 Times: Tax rate $ 83.160 Tax liability Tax consequences for Madeleine assuming the same facts except that on January 2 of the current year Omega liquidates. After retaining cash to pay the accounts payable and tax liability resulting from the liquidation, all property is distributed to Madeleine. Madeleine recognizes gain under Sec. 331(a) as follows: Cash + FMV of noncash property received Adjusted basis of stock Gain (loss) recognized $ 1.797.840 200,000 1,597,840 Madeleine takes the following FMV bases under Sec. 334(a): Property received Basis Cash $ 191.840 Marketable securities 80.000 Inventory 410.000 Equipment 260.000 Building 856,000 Gain or loss recognized Amount Character Omega is an accrual basis, calendar year corporation. Madeleine formed the corporation six years ago by transferring $200,000 of cash in exchange for the Omega stock. Thus, she has held the stock for six years and has a $200.000 adjusted basis in the stock. Omega's balance sheet at January 1 of the current year is as follows: Assets Basis FMV Cash S 460,000 Marketable securities 80.000 Inventory Equipment $ 460,000 40,000 390,000 220,000 560,000 410.000 260.000 856.000 Building Total $ 1,670,000 $ 2,068,000 Liabilities and Equity Accounts payable $ 185,000 S 185,000 Common stock 200,000 1.881,000 1,285,000 Retained earnings (and E&P) $ 1,670,000 $ 2,066,000 Total Omega has held the marketable securities for two years. In addition, Omega has claimed $20.000 of MACRS depreciation on the machinery and $150,000 of straight-line depreciation on the building Tax consequences for Omega assuming the same facts except that on January 2 of the current year Omega liquidates. After retaining cash to pay the accounts payable and tax liability resulting from the liquidation, all property is distributed to Madeleine. Omega recognizes gain under Sec. 336(a) as follows: Gain or loss recognized FMV Adjusted cost basis Amount Character Marketable securities $ 80.000 $ 40,000 = $ 40,000 $ $ 390,000 = $ 20.000 Inventory Equipment Building 410.000 260.000 Capital gain Ordinary income $20.000 ordinary income and $20,000 capital gain $30.000 ordinary income and $266,000 capital gain $ $ 40.000 290.000 $ 858,000 220,000 = $ 560.000 = $ $ $ Total 398,000 21 Times: Tax rate $ 83.160 Tax liability Tax consequences for Madeleine assuming the same facts except that on January 2 of the current year Omega liquidates. After retaining cash to pay the accounts payable and tax liability resulting from the liquidation, all property is distributed to Madeleine. Madeleine recognizes gain under Sec. 331(a) as follows: Cash + FMV of noncash property received Adjusted basis of stock Gain (loss) recognized $ 1.797.840 200,000 1,597,840 Madeleine takes the following FMV bases under Sec. 334(a): Property received Basis Cash $ 191.840 Marketable securities 80.000 Inventory 410.000 Equipment 260.000 Building 856,000 Gain or loss recognized Amount Character