Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Madhusudan Ltd makes an offer to the public for investors to subscribe for 10 million shares. The shares are issued at $2.00 per share. Applications

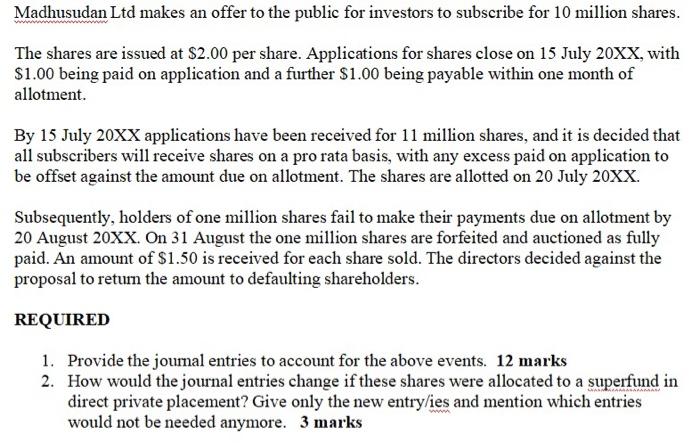

Madhusudan Ltd makes an offer to the public for investors to subscribe for 10 million shares.

The shares are issued at $2.00 per share. Applications for shares close on 15 July 20XX, with $1.00 being paid on application and a further $1.00 being payable within one month of allotment.

By 15 July 20XX applications have been received for 11 million shares, and it is decided that all subscribers will receive shares on a pro rata basis, with any excess paid on application to be offset against the amount due on allotment. The shares are allotted on 20 July 20XX.

Subsequently, holders of one million shares fail to make their payments due on allotment by 20 August 20XX. On 31 August the one million shares are forfeited and auctioned as fully paid. An amount of $1.50 is received for each share sold. The directors decided against the proposal to return the amount to defaulting shareholders.

Required

1.Provide the journal entries to account for the above events. 12 marks

2.How would the journal entries change if these shares were allocated to a superfund in direct private placement? Give only the new entry/ies and mention which entries would not be needed anymore. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started