Question

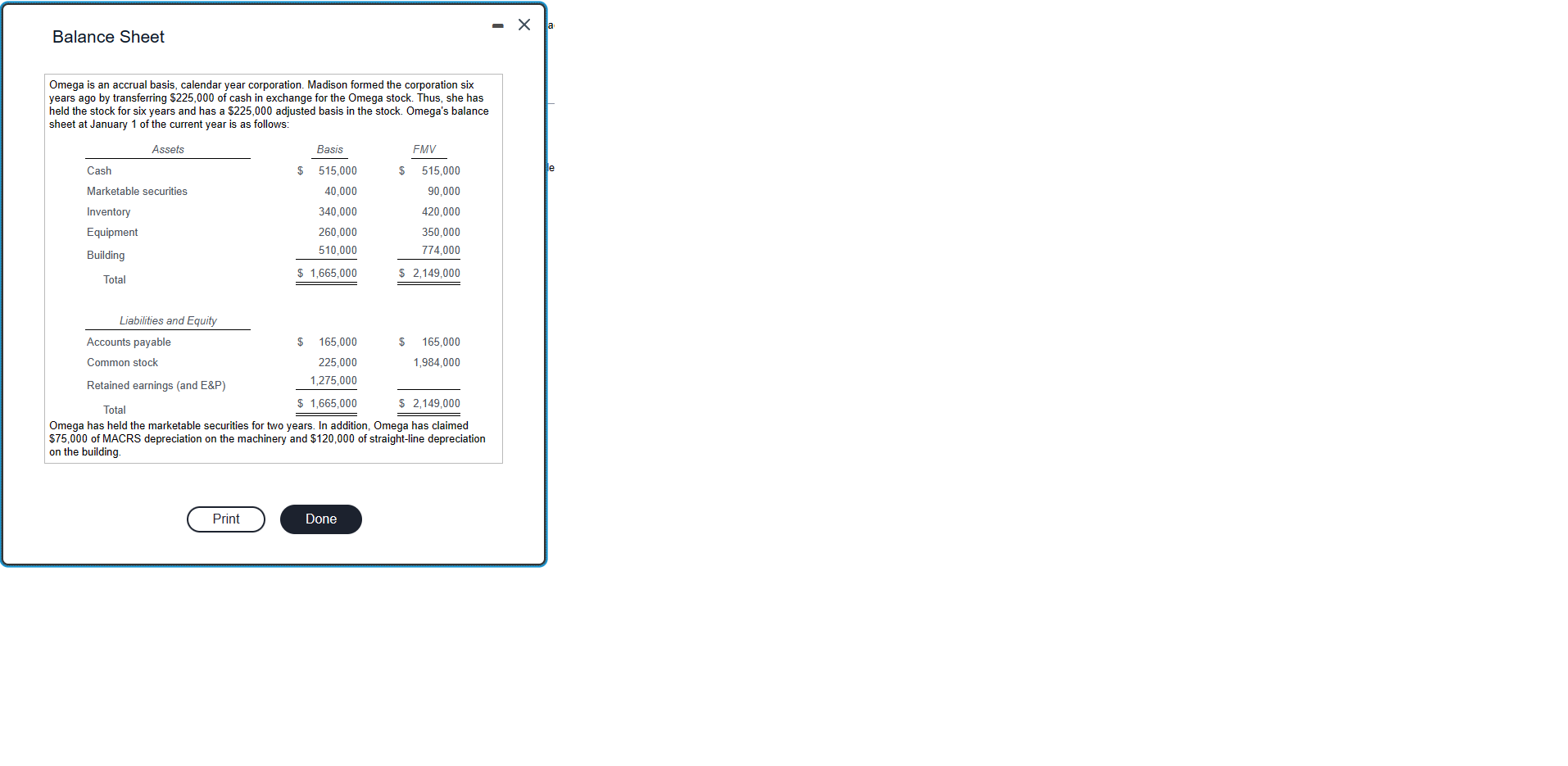

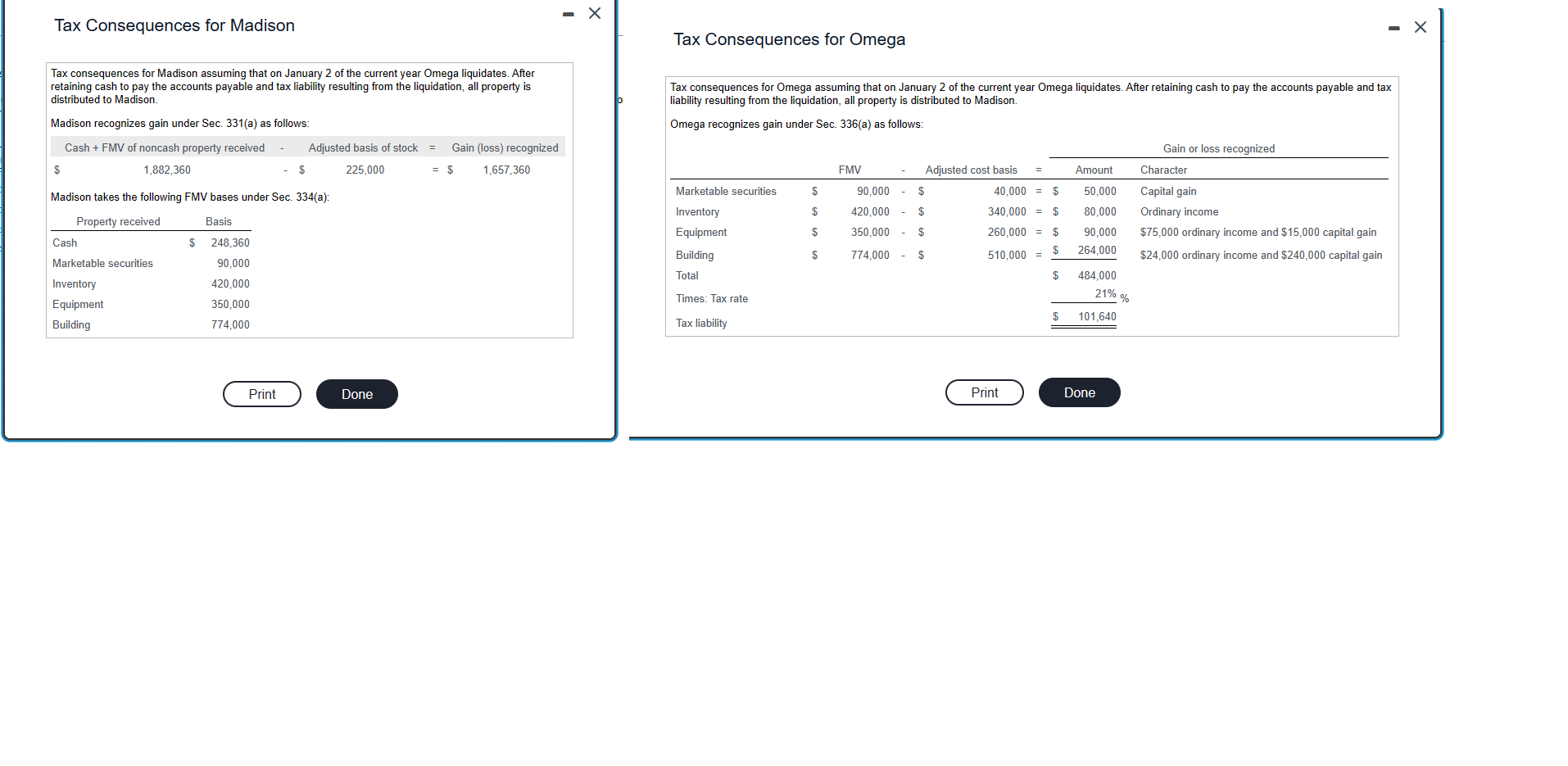

Madison owns 100% of Omega Corporation's common stock. View the balance sheet.LOADING... The following are the tax consquequences for Omega and Madison if we assume

Madison owns 100% of Omega Corporation's common stock. View the balance sheet.LOADING... The following are the tax consquequences for Omega and Madison if we assume that on January 2 of the current year, Omega liquidated and distributed all property to Madison except that Omega retained cash to pay the accounts payable and any tax liability resulting from Omega's liquidation. These results also assume that Omega had no other taxable income or loss and a 21% corporate tax rate Assume the same facts as in this problem except, on January 2 of the current year, Omega Corporation sells all property other than cash to Aggregate Corporation for FMV. Omega pays off the accounts payable and retains cash to pay any tax liability resulting from Omega's liquidation. Omega then liquidates and distributes all remaining cash to Madison. Assume that Omega has no other taxable income or loss. Determine the tax consequences to Omega, Aggregate, and Madison. How do these results compare to those originally presented in the problem?

Madison owns 100% of Omega Corporation's common stock. View the balance sheet.LOADING... The following are the tax consquequences for Omega and Madison if we assume that on January 2 of the current year, Omega liquidated and distributed all property to Madison except that Omega retained cash to pay the accounts payable and any tax liability resulting from Omega's liquidation. These results also assume that Omega had no other taxable income or loss and a 21% corporate tax rate Assume the same facts as in this problem except, on January 2 of the current year, Omega Corporation sells all property other than cash to Aggregate Corporation for FMV. Omega pays off the accounts payable and retains cash to pay any tax liability resulting from Omega's liquidation. Omega then liquidates and distributes all remaining cash to Madison. Assume that Omega has no other taxable income or loss. Determine the tax consequences to Omega, Aggregate, and Madison. How do these results compare to those originally presented in the problem?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started