Question

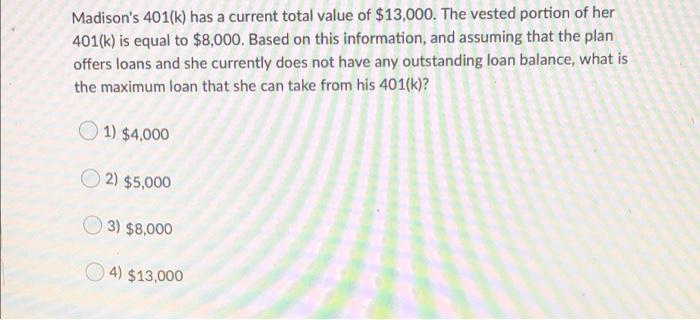

Madison's 401(k) has a current total value of $13,000. The vested portion of her 401(k) is equal to $8,000. Based on this information, and

Madison's 401(k) has a current total value of $13,000. The vested portion of her 401(k) is equal to $8,000. Based on this information, and assuming that the plan offers loans and she currently does not have any outstanding loan balance, what is the maximum loan that she can take from his 401(k)? 1) $4,000 2) $5,000 (3) $8,000 4) $13,000

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution what is the maximum loan that she can take from her 401k A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Business Statistics

Authors: Ronald M. Weiers

7th Edition

978-0538452175, 538452196, 053845217X, 2900538452198, 978-1111524081

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App