Answered step by step

Verified Expert Solution

Question

1 Approved Answer

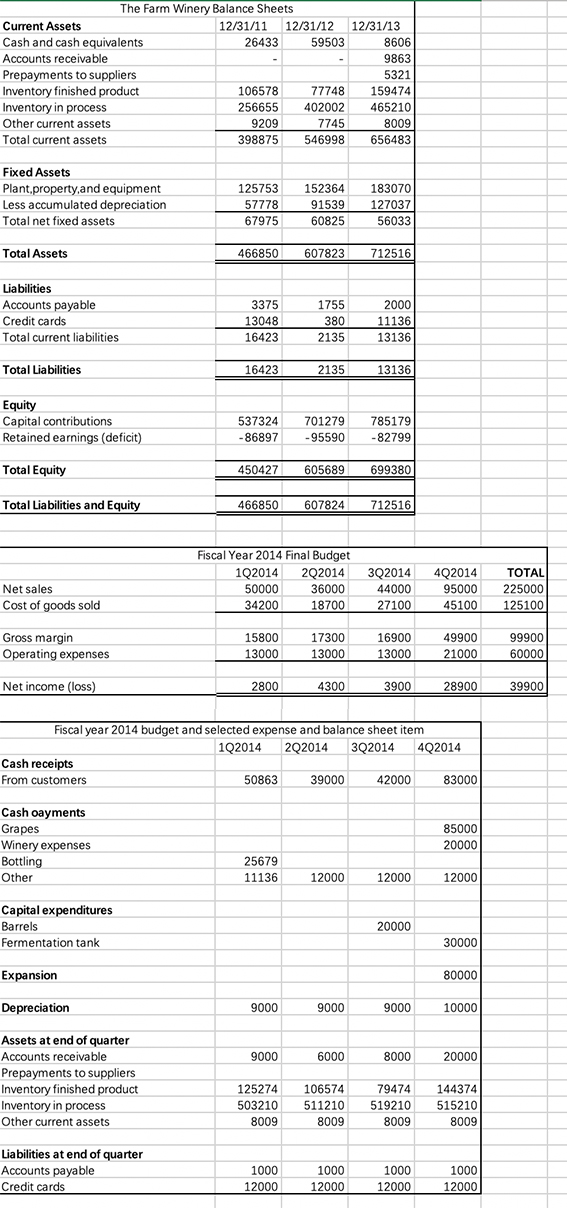

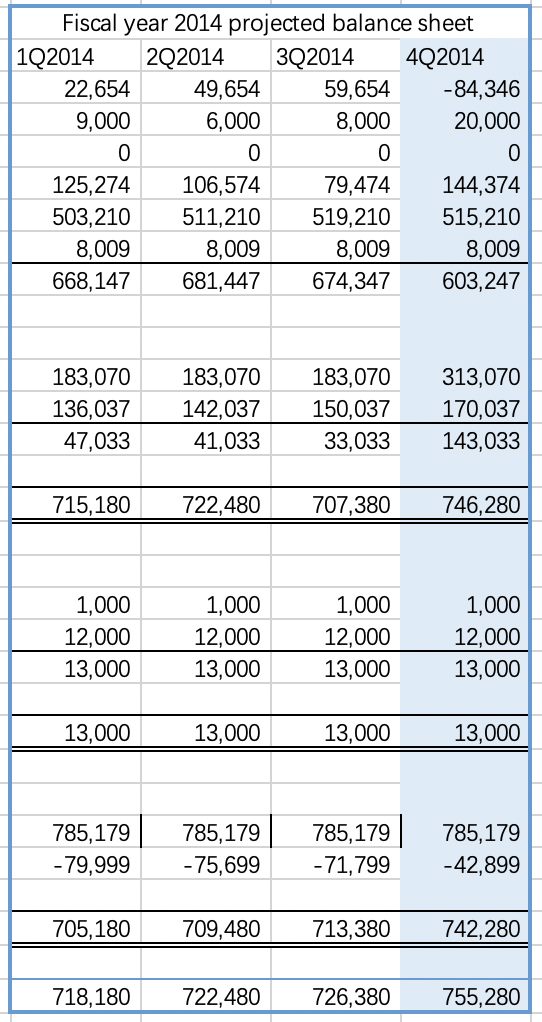

Madsen is particularly concerned that the business be self-sustaining in order to return capital to shareholders. Given this goal, address the following items: 1.Based on

Madsen is particularly concerned that the business be self-sustaining in order to return capital to shareholders. Given this goal, address the following items:

1.Based on your analysis, to what extent will Madsen achieve the financial goals he has for The Farm Winery in 2014, 2015, and beyond?

2.Based on your analysis thus far, determine whether the winery should pursue the $80,000 investment in an additional vineyard development. Explain why or why not.

The Farm Winery Balance Sheets Current Assets 12/31/11 12/31/12 12/31/13 Cash and cash equivalents 26433 59503 8606 Accounts receivable 9863 Prepayments to suppliers 5321 Inventory finished product 106578 77748 159474 Inventory in process 256655 402002465210 Other current assets 92097745 8009 Total current assets 398875 546998 656483 Fixed Assets Plant,property and equipment Less accumulated depreciation Total net fixed assets 125753 57778 67975 152364 91539 60825 183070 127037 56033 Total Assets 466850 607823 712516 Liabilities Accounts payable Credit cards Total current liabilities 3375 13048 16423 1755 380 2135 2000 11136 13136 Total Liabilities 16423 2135 13136 Equity Capital contributions Retained earnings (deficit) 537324 -86897 701279785179 -95590 -82799 Total Equity 450427 605689 699380 Total Liabilities and Equity 466850 607824 712516 Fiscal Year 2014 Final Budget 122014 2Q2014 3Q2014 4Q2014 50000 36000 44000 95000 34200 187002710045100 Net sales Cost of goods sold TOTAL 225000 125100 Gross margin Operating expenses 16900 13000 49900 21000 99900 60000 13000 13000 Net income (loss) 2800 4300 3900 28900 39900 Fiscal year 2014 budget and selected expense and balance sheet item 1Q2014 2Q2014 3Q2014 4Q2014 Cash receipts From customers 50863 39000 42000 83000 Cash oayments Grapes Winery expenses Bottling Other 85000 20000 25679 11136 12000 12000 12000 Capital expenditures Barrels Fermentation tank 20000 30000 Expansion 80000 Depreciation 9000 9000 9000 10000 9000 6000 8000 20000 Assets at end of quarter Accounts receivable Prepayments to suppliers Inventory finished product Inventory in process Other current assets 125274 503210 8009 106574 511210 8009 79474 519210 8009 144374 515210 8009 Liabilities at end of quarter Accounts payable Credit cards 1000 12000 1000 12000 1000 12000 1000 12000 Fiscal year 2014 projected balance sheet 1Q2014 2Q2014 3Q2014 4Q2014 22,654 49,654 59,654 -84,346 9,000 6.000 8.000 20,000 0 0 0 125,274 106,574 79,474 144,374 503,210 511,210 519.210 515,210 8.009 8,009 8.009 8,009 668,147 681,447 674,347 603,247 O 183,070 136,037 47,033 183,070 142,037 41,033 183,070 150,037 33,033 313,070 170,037 | 143,033 715,180 722,480 707,380 746,280 1,000 12,000 13,000 1,000 12,000 13,000 1,000 12,000 13,000 1,000 12,000 13,000 13,000 13,000 13,000 13,000 785,179 - 79,999 785,179 - 75,699 785,179 -71,799 785,179 -42,899 705,180 709,480 713,380 742,280 718,180 722,480 726,380 755,280 The Farm Winery Balance Sheets Current Assets 12/31/11 12/31/12 12/31/13 Cash and cash equivalents 26433 59503 8606 Accounts receivable 9863 Prepayments to suppliers 5321 Inventory finished product 106578 77748 159474 Inventory in process 256655 402002465210 Other current assets 92097745 8009 Total current assets 398875 546998 656483 Fixed Assets Plant,property and equipment Less accumulated depreciation Total net fixed assets 125753 57778 67975 152364 91539 60825 183070 127037 56033 Total Assets 466850 607823 712516 Liabilities Accounts payable Credit cards Total current liabilities 3375 13048 16423 1755 380 2135 2000 11136 13136 Total Liabilities 16423 2135 13136 Equity Capital contributions Retained earnings (deficit) 537324 -86897 701279785179 -95590 -82799 Total Equity 450427 605689 699380 Total Liabilities and Equity 466850 607824 712516 Fiscal Year 2014 Final Budget 122014 2Q2014 3Q2014 4Q2014 50000 36000 44000 95000 34200 187002710045100 Net sales Cost of goods sold TOTAL 225000 125100 Gross margin Operating expenses 16900 13000 49900 21000 99900 60000 13000 13000 Net income (loss) 2800 4300 3900 28900 39900 Fiscal year 2014 budget and selected expense and balance sheet item 1Q2014 2Q2014 3Q2014 4Q2014 Cash receipts From customers 50863 39000 42000 83000 Cash oayments Grapes Winery expenses Bottling Other 85000 20000 25679 11136 12000 12000 12000 Capital expenditures Barrels Fermentation tank 20000 30000 Expansion 80000 Depreciation 9000 9000 9000 10000 9000 6000 8000 20000 Assets at end of quarter Accounts receivable Prepayments to suppliers Inventory finished product Inventory in process Other current assets 125274 503210 8009 106574 511210 8009 79474 519210 8009 144374 515210 8009 Liabilities at end of quarter Accounts payable Credit cards 1000 12000 1000 12000 1000 12000 1000 12000 Fiscal year 2014 projected balance sheet 1Q2014 2Q2014 3Q2014 4Q2014 22,654 49,654 59,654 -84,346 9,000 6.000 8.000 20,000 0 0 0 125,274 106,574 79,474 144,374 503,210 511,210 519.210 515,210 8.009 8,009 8.009 8,009 668,147 681,447 674,347 603,247 O 183,070 136,037 47,033 183,070 142,037 41,033 183,070 150,037 33,033 313,070 170,037 | 143,033 715,180 722,480 707,380 746,280 1,000 12,000 13,000 1,000 12,000 13,000 1,000 12,000 13,000 1,000 12,000 13,000 13,000 13,000 13,000 13,000 785,179 - 79,999 785,179 - 75,699 785,179 -71,799 785,179 -42,899 705,180 709,480 713,380 742,280 718,180 722,480 726,380 755,280Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started