Question

Maersk Line is a world-wide container shipping company. It is considering entering the Air Transport business and desires to estimate its cost of capital for

Maersk Line is a world-wide container shipping company. It is considering entering the AirTransport business and desires to estimate its cost of capital for air transport projects. Assume the debt betas for all firms are zero and that there are no personal taxes or bankruptcy costs (or other capital market imperfections besides corporate taxes).

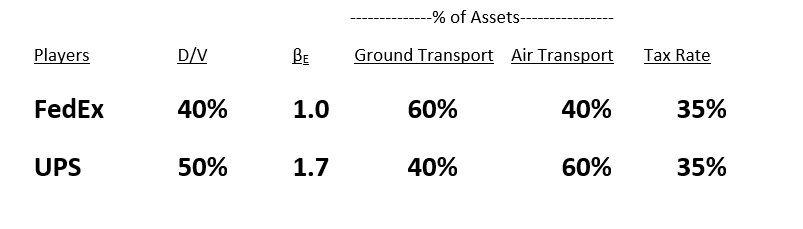

Maersk managers have collected the following corporate players to analyze:

The market conditions are such that rf=3% and the expected market risk premium is 7%. Maersk has a target leverage ratio of 30% and a tax rate of T=35%.

Calculate the WACC appropriate for Maersk projects in the Air Transport industry.

Players D/V BE -% of Assets- Ground Transport Air Transport Tax Rate FedEx 40% 1.0 60% 40% 35% UPS 50% 1.7 40% 60% 35%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculating WACC for Maersks Air Transport Projects Heres how to calculate the Weighted Average Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started