Answered step by step

Verified Expert Solution

Question

1 Approved Answer

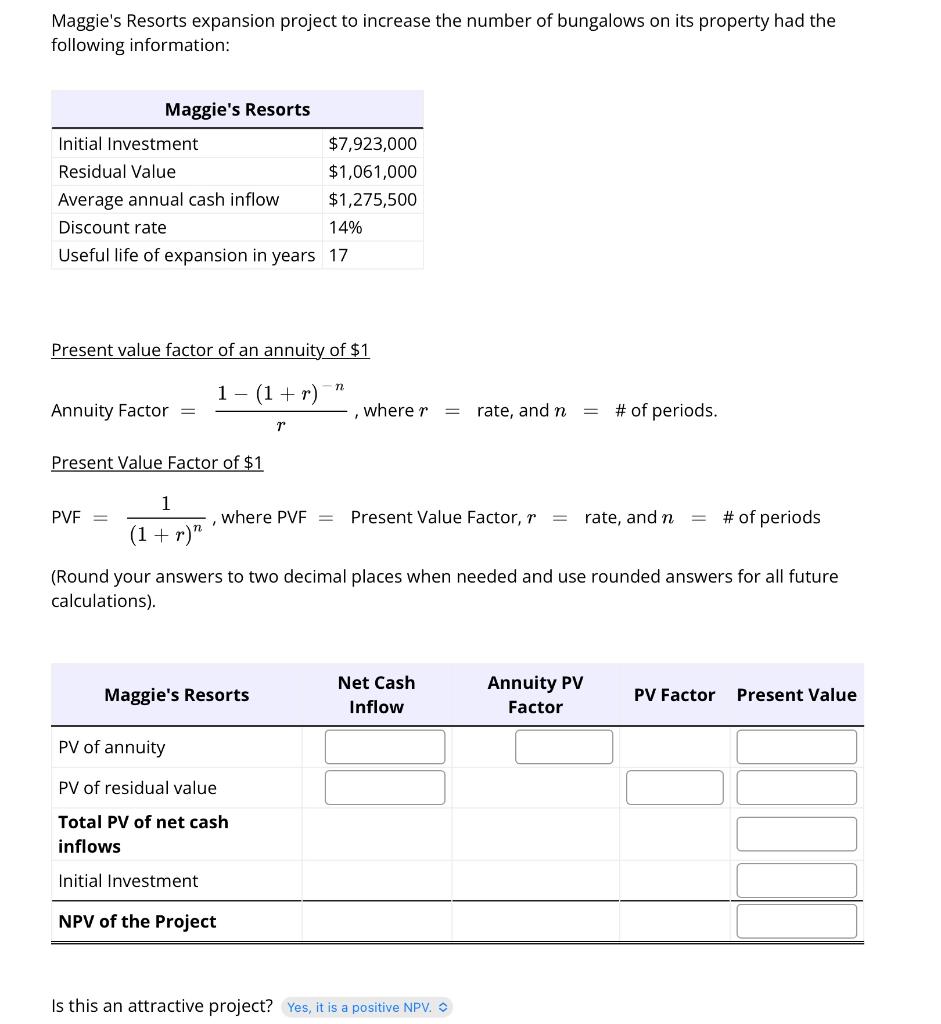

Maggie's Resorts expansion project to increase the number of bungalows on its property had the following information: Maggie's Resorts Initial Investment Residual Value Average

Maggie's Resorts expansion project to increase the number of bungalows on its property had the following information: Maggie's Resorts Initial Investment Residual Value Average annual cash inflow Discount rate 14% Useful life of expansion in years 17 Present value factor of an annuity of $1 1 (1+r) Annuity Factor = Present Value Factor of $1 PVF = 1 (1 + r)" 7 $7,923,000 $1,061,000 $1,275,500 r Maggie's Resorts where PVF = PV of annuity PV of residual value Total PV of net cash inflows Initial Investment NPV of the Project -n , where r =rate, and n (Round your answers to two decimal places when needed and use rounded answers for all future calculations). = Present Value Factor, r = rate, and n = # of periods Net Cash Inflow Is this an attractive project? Yes, it is a positive NPV. # of periods. Annuity PV Factor PV Factor Present Value

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether Maggies Resorts expansion project is attractive we need to calculate the Net Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started