Answered step by step

Verified Expert Solution

Question

1 Approved Answer

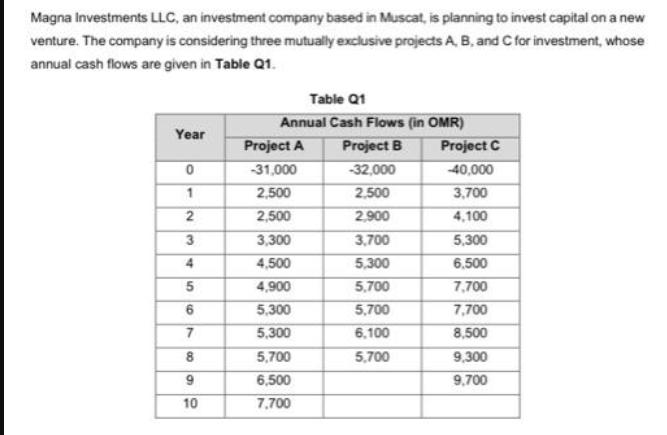

Magna Investments LLC, an investment company based in Muscat, is planning to invest capital on a new venture. The company is considering three mutually

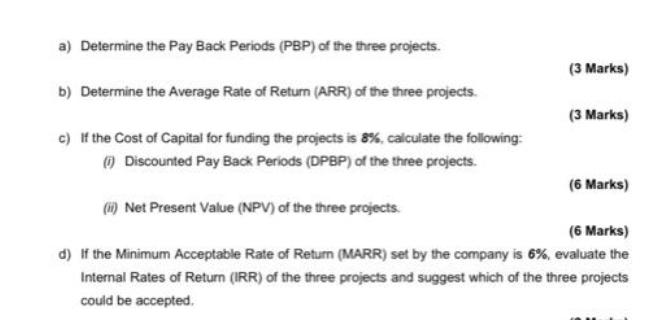

Magna Investments LLC, an investment company based in Muscat, is planning to invest capital on a new venture. The company is considering three mutually exclusive projects A, B, and C for investment, whose annual cash flows are given in Table Q1. Table Q1 Annual Cash Flows (in OMR) Year Project A Project B Project C 0 -31,000 -32,000 -40,000 1 2,500 2,500 3,700 2 2,500 2,900 4,100 3 3,300 3,700 5,300 456 4,500 5,300 6,500 4,900 5,700 7,700 5,300 5,700 7,700 7 5,300 6,100 8,500 8 5,700 5,700 9,300 10 99 6,500 9,700 7,700 a) Determine the Pay Back Periods (PBP) of the three projects. b) Determine the Average Rate of Return (ARR) of the three projects. c) If the Cost of Capital for funding the projects is 8%, calculate the following: (i) Discounted Pay Back Periods (DPBP) of the three projects. (ii) Net Present Value (NPV) of the three projects. (3 Marks) (3 Marks) (6 Marks) (6 Marks) d) If the Minimum Acceptable Rate of Return (MARR) set by the company is 6%, evaluate the Internal Rates of Return (IRR) of the three projects and suggest which of the three projects could be accepted.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To determine the Payback Periods PBP of the three projects we need to calculate the time it takes for the cumulative cash inflows to recover the initial investment Project A Year 0 31000 OMR Year 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started