Question

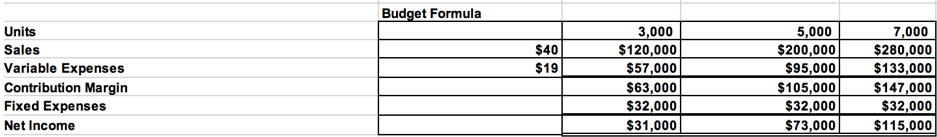

Magnet Technologies manufactures refrigerator magnets for companies as promotional items. The company's July 2019 Flexible Budget shows output levels of 3,000, 5,000 and 7,000 units.

Magnet Technologies manufactures refrigerator magnets for companies as promotional items. The company's July 2019 Flexible Budget shows output levels of 3,000, 5,000 and 7,000 units. The static budget was based on 5,000 units

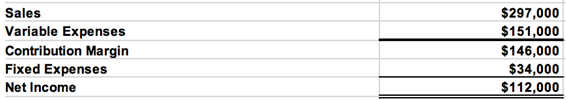

The company sold 7,000 units and it's actual results are as follows:

Required:

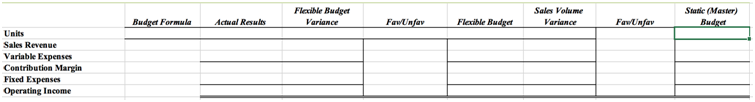

1. Prepare the Flexible Budget Performance Report

2. What is the effect on net income on Magnet Technologies from selling more units that the Master Budget anticipated?

3. Why are flexible budget reports useful to managers?

Units Sales Variable Expenses Contribution Margin Fixed Expenses Net Income Budget Formula $40 $19 3,000 $120,000 $57,000 $63,000 $32,000 $31,000 5,000 $200,000 $95,000 $105,000 $32,000 $73,000 7,000 $280,000 $133,000 $147,000 $32,000 $115,000 Sales Variable Expenses Contribution Margin Fixed Expenses Net Income $297,000 $151,000 $146,000 $34,000 $112,000 Units Sales Revenue Variable Expenses Contribution Margin Fixed Expenses Operating Income Budget Formula Actual Results Flexible Budget Variance FawUnfav Flexible Budget Sales Volume Variance Faw/Unfav Static (Master) Budget

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Budget Formula Actual Results Flexible Budget Variance FavUnfav Flexible Budget Sales V...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started