Answered step by step

Verified Expert Solution

Question

1 Approved Answer

magnetic corporation expects dividends to grow at a rate of 10.5% for the next few years. After two years dividends are expected to grow at

magnetic corporation expects dividends to grow at a rate of 10.5% for the next few years. After two years dividends are expected to grow at a constant rate of 4.2% indefinitely. Magnetics required rate of return is 12.97% and they paid $2.79 dividend today. Find the value of magnetic corporations common stock per-share by computing.

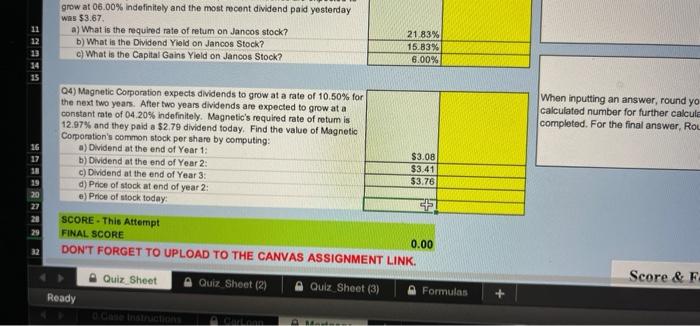

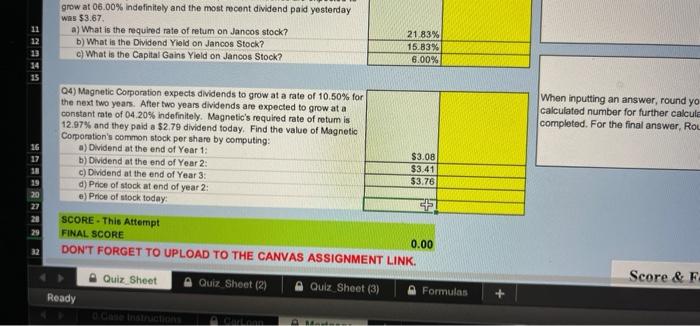

grow at 06.00% indefinitely and the most recent dividend paid yesterday was $3.67. a) What is the required rate of retum on Jancos stock? 21.83% 15.83% 6.00% b) What is the Dividend Yield on Jancos Stock? c) What is the Capital Gains Yield on Jancos Stock? Q4) Magnetic Corporation expects dividends to grow at a rate of 10.50% for the next two years. After two years dividends are expected to grow at a constant rate of 04.20% indefinitely. Magnetic's required rate of retum is 12.97% and they paid a $2.79 dividend today. Find the value of Magnetic Corporation's common stock per share by computing: a) Dividend at the end of Year 1: $3.08 $3.41 $3.76 b) Dividend at the end of Year 2: c) Dividend at the end of Year 3: d) Price of stock at end of year 2: e) Price of stock today: SCORE-This Attempt FINAL SCORE 0.00 DON'T FORGET TO UPLOAD TO THE CANVAS ASSIGNMENT LINK. 32 Quiz Sheet Quiz Sheet (2) Quiz Sheet (3) Ready Cartoon CHEE 11 12 14 15 HAHARAAN 17 38 19 20 Formulas When inputting an answer, round yo calculated number for further calcula completed. For the final answer, Rou Score & F d) price of stock at end of year 2

e) price of stock today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started