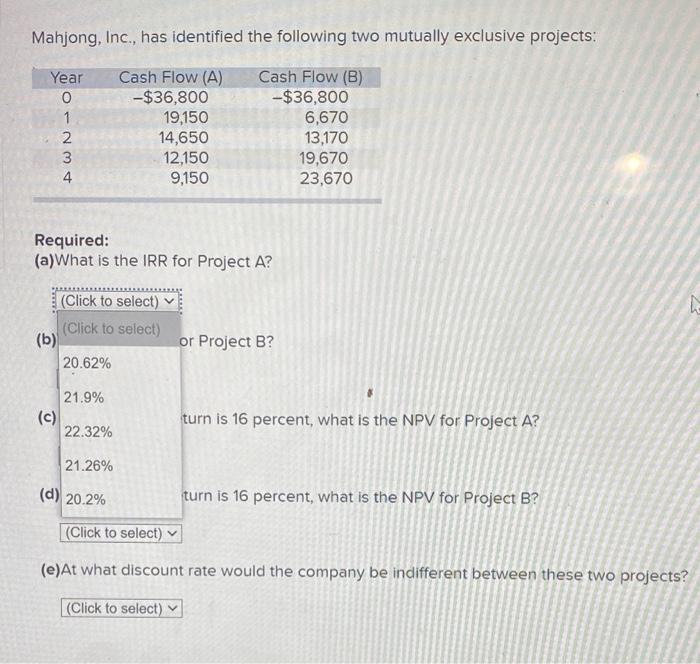

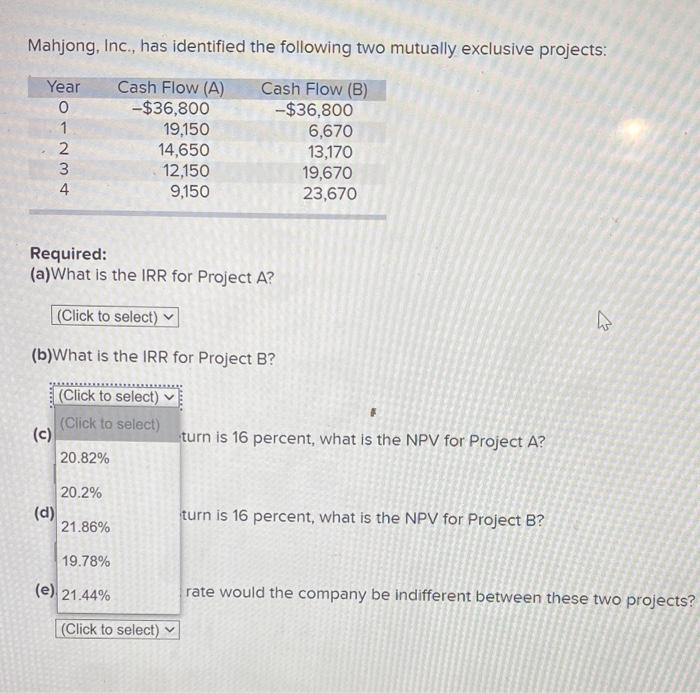

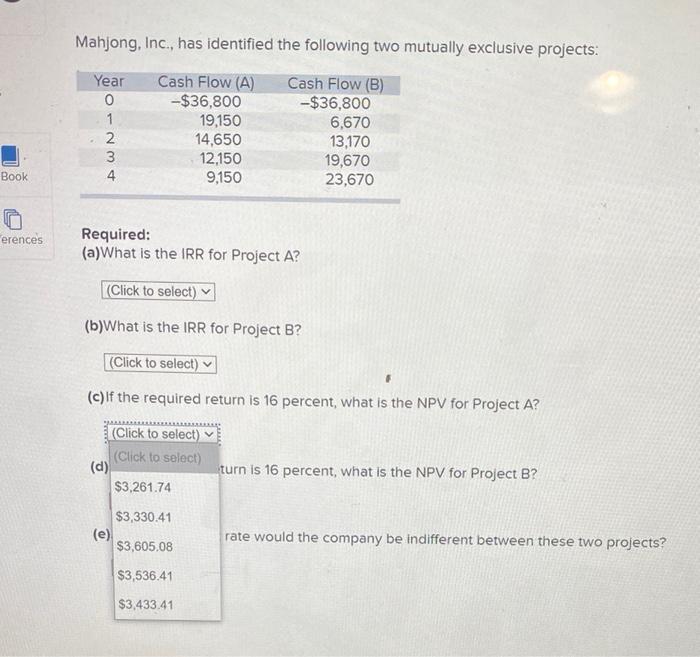

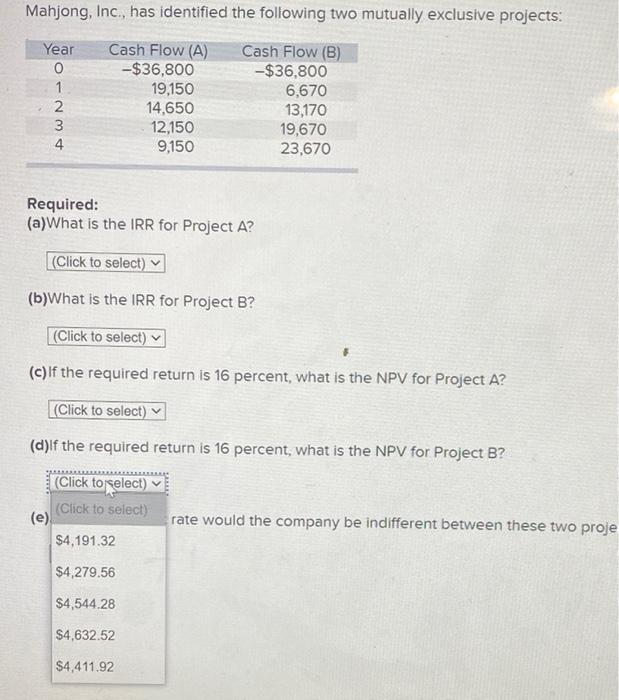

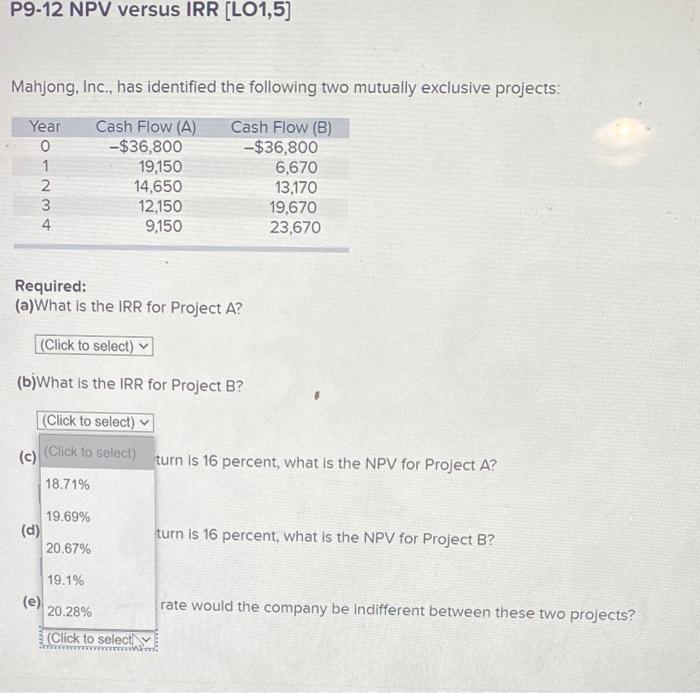

Mahjong, Inc., has identified the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) -$36,800 -$36,800 1 19,150 6,670 2 14,650 13,170 3 12,150 19,670 4 9,150 23,670 WNO Required: (a)What is the IRR for Project A? (Click to select) (Click to select) (b) 20.62% or Project B? 21.9% (c) turn is 16 percent, what is the NPV for Project A? 22.32% 21.26% (d) 20.2% turn is 16 percent, what is the NPV for Project B? (Click to select) (e)At what discount rate would the company be indifferent between these two projects? (Click to select) Mahjong, Inc., has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Cash Flow (A) -$36,800 19,150 14,650 12,150 9,150 Cash Flow (B) -$36,800 6,670 13,170 19,670 23,670 Required: (a)What is the IRR for Project A? (Click to select) ns (b)What is the IRR for Project B? (Click to select) (Click to select) (c) turn is 16 percent, what is the NPV for Project A? 20.82% 20.2% (d) 21.86% turn is 16 percent, what is the NPV for Project B? 19.78% (e) 21.44% rate would the company be indifferent between these two projects? (Click to select) Mahjong, Inc., has identified the following two mutually exclusive projects: Year ON Cash Flow (A) -$36,800 19,150 14,650 12,150 9,150 Cash Flow (B) -$36,800 6,670 13,170 19,670 23,670 3 4 Book erences Required: (a)What is the IRR for Project A? Click to select) (b)What is the IRR for Project B? (Click to select) (c) If the required return is 16 percent, what is the NPV for Project A? (Click to select) (Click to select (d) $3,261.74 turn is 16 percent, what is the NPV for Project B? $3,330.41 (e) $3,605.08 rate would the company be indifferent between these two projects? $3,536.41 $3,433.41 Mahjong, Inc., has identified the following two mutually exclusive projects: Year 1 2 3 4 Cash Flow (A) -$36,800 19,150 14,650 12,150 9,150 Cash Flow (B) -$36,800 6,670 13,170 19,670 23,670 Required: (a)What is the IRR for Project A? (Click to select) (b)What is the IRR for Project B? (Click to select) (c) If the required return is 16 percent, what is the NPV for Project A? (Click to select) (d)If the required return is 16 percent, what is the NPV for Project B? (Click to select) (Click to select) rate would the company be indifferent between these two proje $4,191.32 $4,279.56 $4,544.28 $4,632.52 $4,411.92 P9-12 NPV versus IRR (LO1,5) Mahjong, Inc., has identified the following two mutually exclusive projects: Year 0 1 2 3 4 Cash Flow (A) -$36,800 19,150 14,650 12,150 9,150 Cash Flow (B) -$36,800 6,670 13,170 19,670 23,670 Required: (a)What is the IRR for Project A? (Click to select) (b)What is the IRR for Project B? (Click to select) (c) (Click to select turn is 16 percent, what is the NPV for Project A? 18.71% 19.69% (d) 20.67% turn is 16 percent, what is the NPV for Project B? 19.1% (e) 20.28% (Click to select rate would the company be indifferent between these two projects? WA