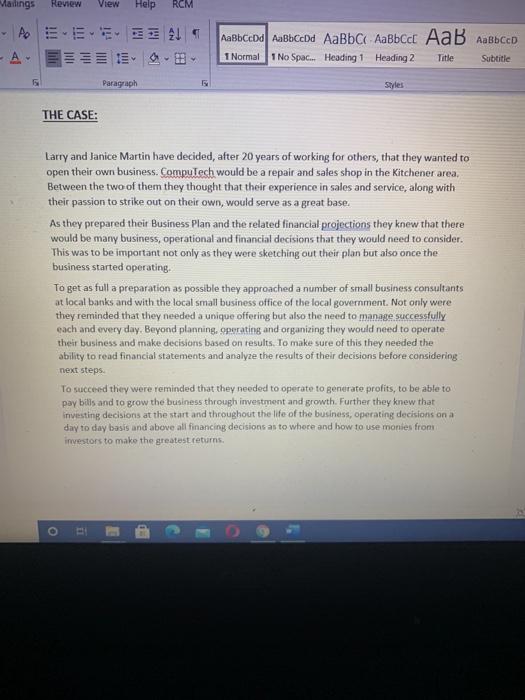

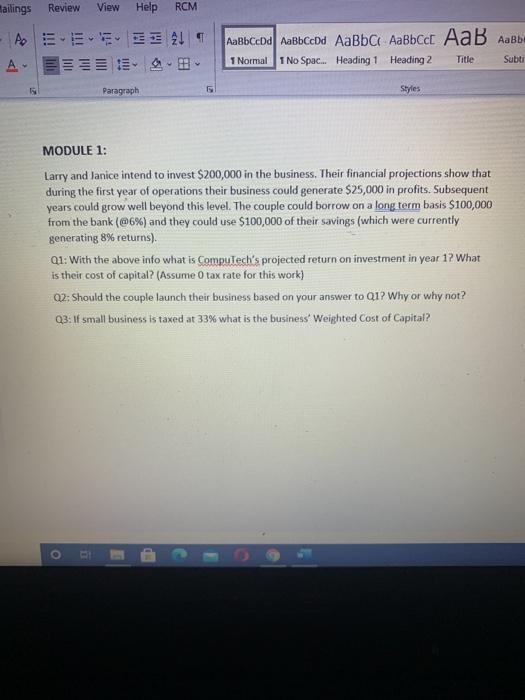

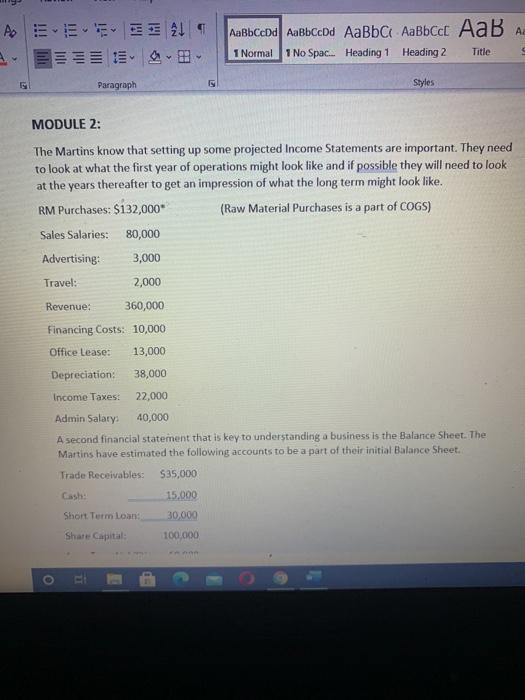

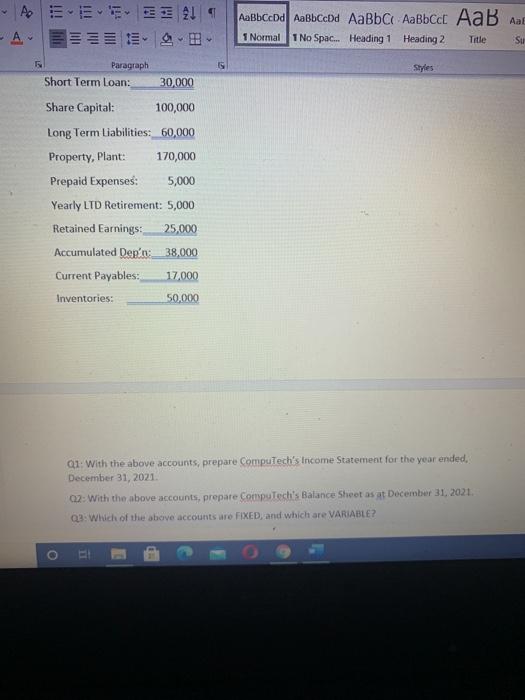

Mailings Review View Help RCM AO A - 1 Normal 1 No Spac... Heading 1 Heading 2 Title Subtitle Paragraph Styles THE CASE: Larry and Janice Martin have decided, after 20 years of working for others, that they wanted to open their own business. CompuTech would be a repair and sales shop in the Kitchener area, Between the two of them they thought that their experience in sales and service, along with their passion to strike out on their own, would serve as a great base. As they prepared their business Plan and the related financial projections they knew that there would be many business, operational and financial decisions that they would need to consider. This was to be important not only as they were sketching out their plan but also once the business started operating To get as full a preparation as possible they approached a number of small business consultants at local banks and with the local small business office of the local government. Not only were they reminded that they needed a unique offering but also the need to manage successfully qach and every day. Beyond planning, operating and organizing they would need to operate their business and make decisions based on results. To make sure of this they needed the ability to read financial statements and analyze the results of their decisions before considering next steps. To succeed they were reminded that they needed to operate to generate profits, to be able to pay bills and to grow the business through investment and growth. Further they knew that investing decisions at the start and throughout the life of the business, operating decisions on a day to day basis and above all financing decisions as to where and how to use monies from investors to make the greatest returns. o Mailings Review View Help RCM AO ES AU A - - 1 No Spac... Heading 1 Heading 2 1 Normal Title Subti Paragraph Styles MODULE 1: Larry and Janice intend to invest $200,000 in the business. Their financial projections show that during the first year of operations their business could generate $25,000 in profits. Subsequent years could grow well beyond this level. The couple could borrow on a long term basis $100,000 from the bank (@6%) and they could use $100,000 of their savings (which were currently generating 8% returns). Q1: With the above info what is CompuTech's projected return on investment in year 1? What is their cost of capital? (Assume o tax rate for this work) Q2: Should the couple launch their business based on your answer to Q1? Why or why not? 23:1f small business is taxed at 33% what is the business Weighted Cost of Capital? O A EEEE 21 AaBbccdd Aabbccdd AaBbci AaBbcct AaB A 1 No Spac... Heading 1 Heading 2 1 Normal Title Paragraph Styles MODULE 2: The Martins know that setting up some projected Income Statements are important. They need to look at what the first year of operations might look like and if possible they will need to look at the years thereafter to get an impression of what the long term might look like. RM Purchases: $132,000 (Raw Material Purchases is a part of COGS) Sales Salaries: 80,000 Advertising 3,000 Travel: 2,000 Revenue: 360,000 Financing Costs: 10,000 Office Lease: 13,000 Depreciation: 38,000 Income Taxes: 22,000 Admin Salary 40,000 A second financial statement that is key to understanding a business is the Balance Sheet. The Martins have estimated the following accounts to be a part of their initial Balance Sheet. Trade Receivables: $35,000 Gash: | 15.000 30,000 Short Term Loan Share Capital 100,000 s = =.= = = = g! | - Aal 1 No Spac... Heading 1 Heading 2 Title Su 1 Normal IS Paragraph Short Term Loan: 30.000 Share Capital: 100,000 Long Term Liabilities: 60,000 Property, Plant: 170,000 Prepaid Expenses: 5,000 Yearly LTD Retirement: 5,000 Retained Earnings: 25,000 Accumulated Dep'n:_38,000 Current Payables: 17.000 Inventories: 50.000 Q1: With the above accounts, prepare Computech's income Statement for the year ended, December 31, 2021 0.2: With the above accounts, prepare CompuTech's Balance Sheet as at December 31, 2021 Q2: Which of the above accounts are FIXED, and which are VARIABLE? Normal 1 No Spac... Heading Heading 2 Title Paragraph Current Payables: 17000 Styles Inventories: 50,000 Q1: With the above accounts, prepare CompuTech's Income Statement for the year ended, December 31, 2021. Q2: With the above accounts, prepare CompuTech's Balance Sheet as at December 31, 2021. Q3: Which of the above accounts are FIXED, and which are VARIABLE? Q4: What is the COGS for the year 2021? o de