Answered step by step

Verified Expert Solution

Question

1 Approved Answer

main question help me please can you explain with formula thank you very much The following financial statement apply to the next six self-Test Problems

main question

help me

please can you explain with formula thank you very much

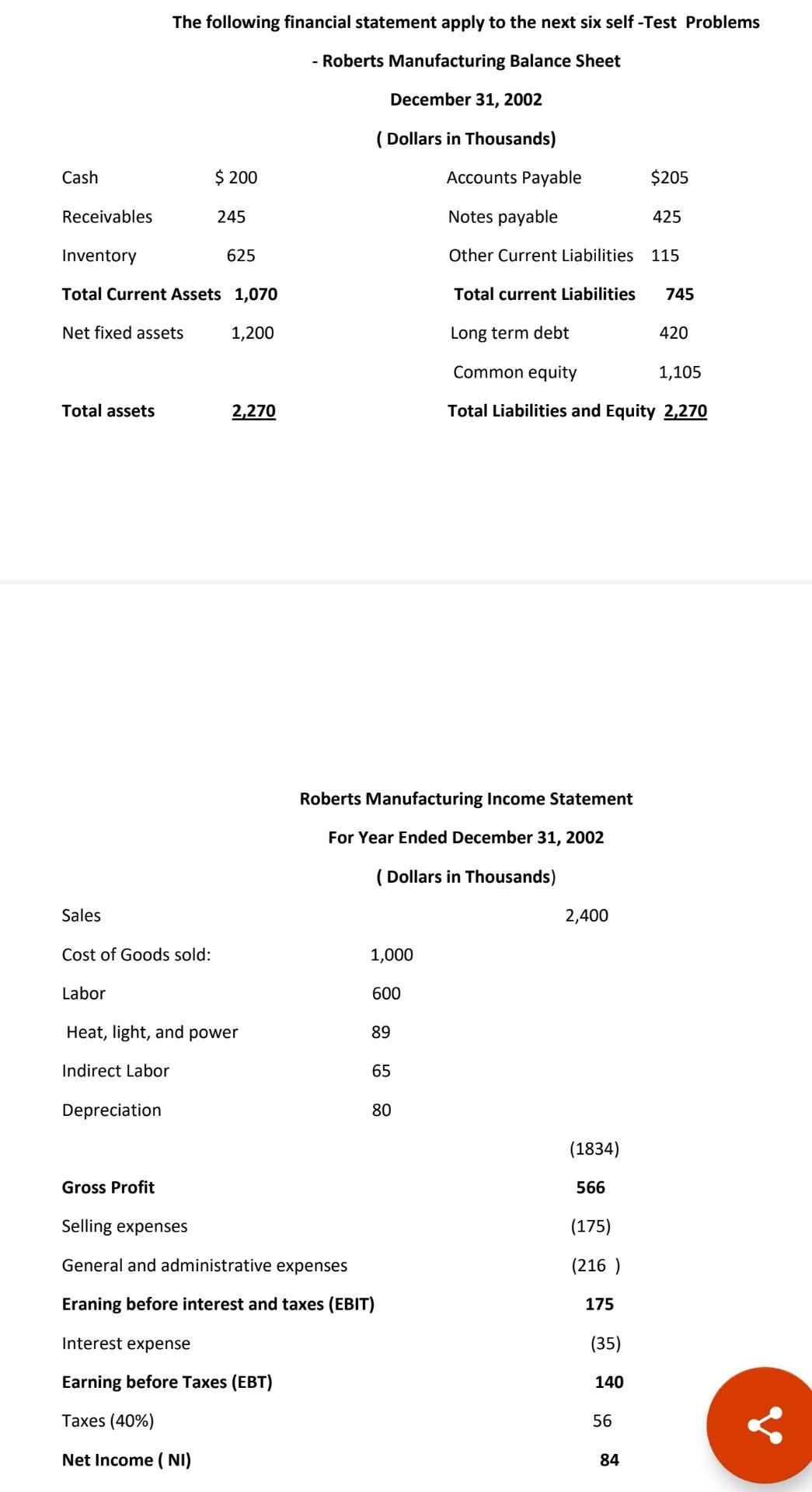

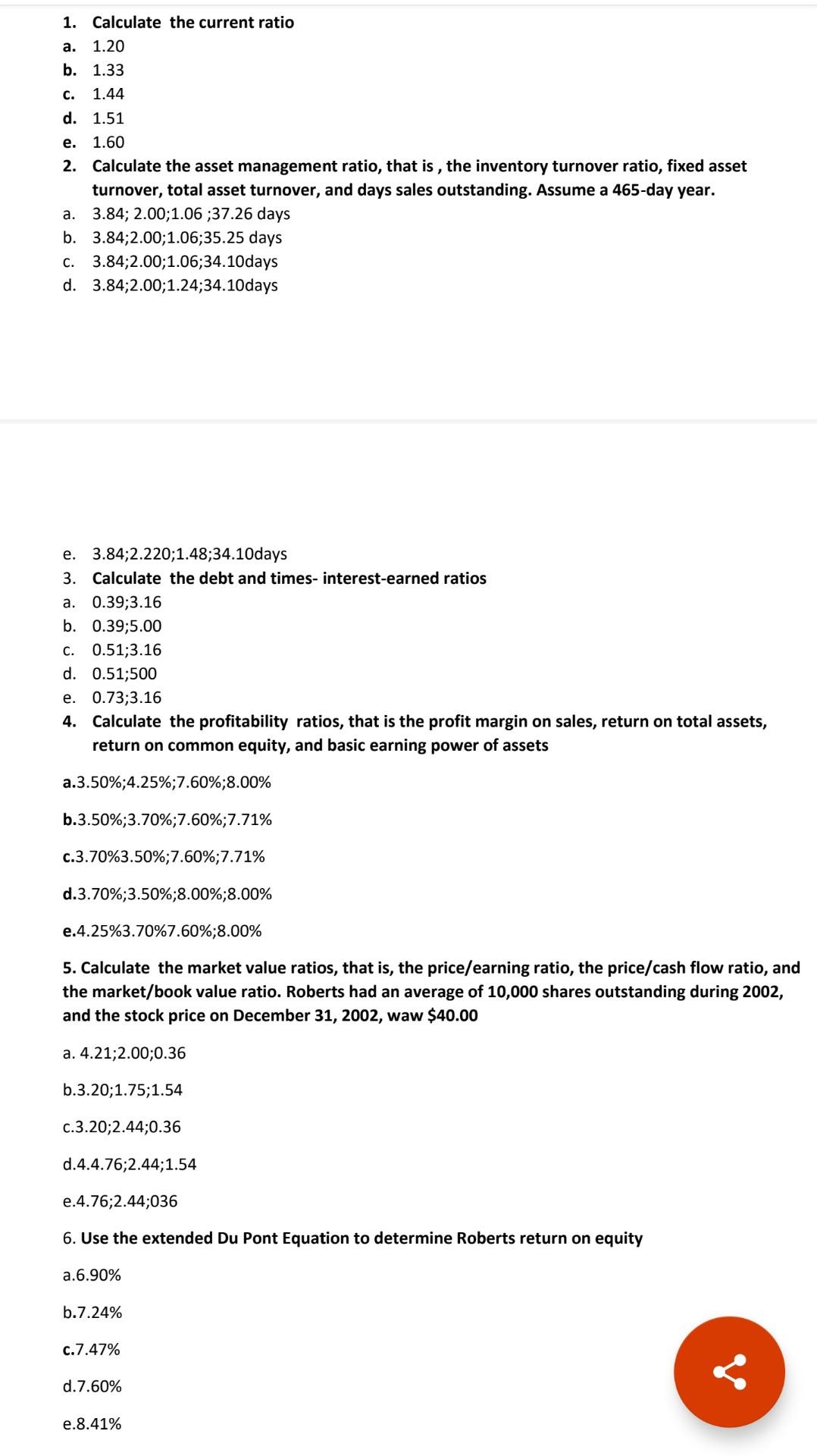

The following financial statement apply to the next six self-Test Problems Roberts Manufacturing Balance Sheet December 31, 2002 (Dollars in Thousands) Cash $ 200 Accounts Payable $205 Receivables 245 Notes payable 425 Inventory 625 Other Current Liabilities 115 Total Current Assets 1,070 Total current Liabilities 745 Net fixed assets 1,200 Long term debt 420 Common equity 1,105 Total assets 2,270 Total Liabilities and Equity 2,270 Roberts Manufacturing Income Statement For Year Ended December 31, 2002 (Dollars in Thousands) Sales 2,400 Cost of Goods sold: 1,000 Labor 600 Heat, light, and power 89 Indirect Labor 65 Depreciation 80 (1834) Gross Profit 566 Selling expenses (175) General and administrative expenses (216) Eraning before interest and taxes (EBIT) 175 Interest expense (35) Earning before Taxes (EBT) 140 Taxes (40%) 56 Net Income (NI) 84 1. Calculate the current ratio a. 1.20 b. 1.33 C. 1.44 e. d. 1.51 1.60 2. Calculate the asset management ratio, that is, the inventory turnover ratio, fixed asset turnover, total asset turnover, and days sales outstanding. Assume a 465-day year. a. 3.84; 2.00;1.06;37.26 days b. 3.84;2.00;1.06;35.25 days C. 3.84;2.00;1.06;34.10days d. 3.84;2.00;1.24;34.10days a. e. 3.84;2.220;1.48;34.10days 3. Calculate the debt and times- interest-earned ratios 0.39;3.16 b. 0.39;5.00 0.51;3.16 d. 0.51;500 e. 0.73;3.16 4. Calculate the profitability ratios, that is the profit margin on sales, return on total assets, return on common equity, and basic earning power of assets C. a.3.50%;4.25%;7.60%;8.00% b.3.50%;3.70%;7.60%;7.71% c.3.70%3.50%;7.60%;7.71% d.3.70%;3.50%;8.00%;8.00% e.4.25%3.70%7.60%;8.00% 5. Calculate the market value ratios, that is, the price/earning ratio, the price/cash flow ratio, and the market/book value ratio. Roberts had an average of 10,000 shares outstanding during 2002, and the stock price on December 31, 2002, waw $40.00 a. 4.21;2.00;0.36 b.3.20;1.75;1.54 c.3.20;2.44;0.36 d.4.4.76;2.44;1.54 e.4.76;2.44;036 6. Use the extended Du Pont Equation to determine Roberts return on equity a.6.90% b.7.24% c.7.47% d.7.60% e.8.41%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started