Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mainstay Ltd, a company whose shareholders are residents and to whom it pays fully franked dividends, is planning to expand its existing operations by

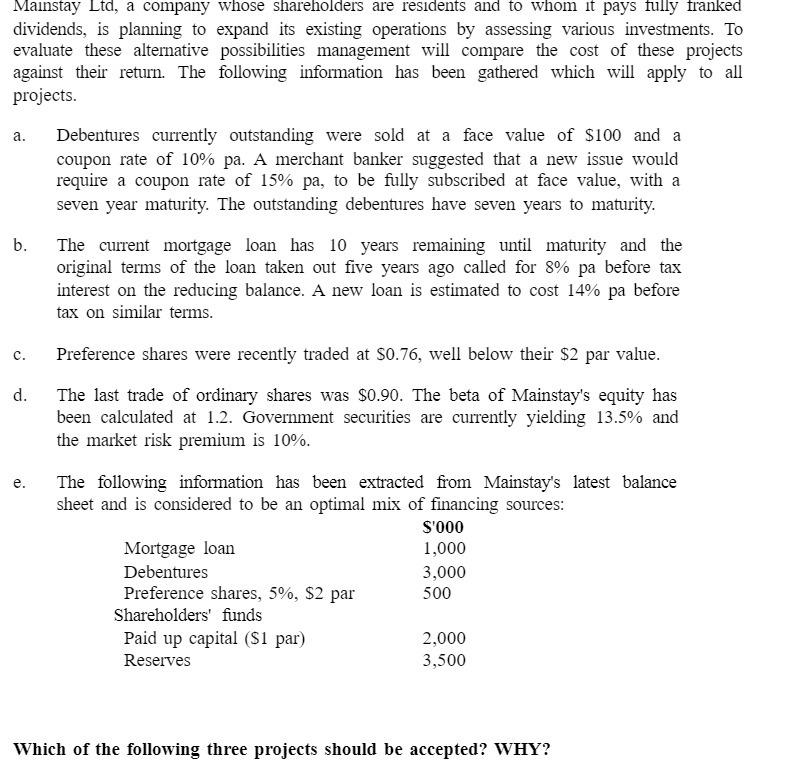

Mainstay Ltd, a company whose shareholders are residents and to whom it pays fully franked dividends, is planning to expand its existing operations by assessing various investments. To evaluate these alternative possibilities management will compare the cost of these projects against their return. The following information has been gathered which will apply to all projects. a. b. C. d. e. Debentures currently outstanding were sold at a face value of $100 and a coupon rate of 10% pa. A merchant banker suggested that a new issue would require a coupon rate of 15% pa, to be fully subscribed at face value, with a seven year maturity. The outstanding debentures have seven years to maturity. The current mortgage loan has 10 years remaining until maturity and the original terms of the loan taken out five years ago called for 8% pa before tax interest on the reducing balance. A new loan is estimated to cost 14% pa before tax on similar terms. Preference shares were recently traded at $0.76, well below their $2 par value. The last trade of ordinary shares was $0.90. The beta of Mainstay's equity has been calculated at 1.2. Government securities are currently yielding 13.5% and the market risk premium is 10%. The following information has been extracted from Mainstay's latest balance sheet and is considered to be an optimal mix of financing sources: Mortgage loan Debentures Preference shares, 5%, $2 par Shareholders' funds Paid up capital ($1 par) Reserves S'000 1,000 3,000 500 2,000 3,500 Which of the following three projects should be accepted? WHY?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To determine which of the three projects should be accepted we need to evaluate each projects cost of capital and compare it to the expected return of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started