Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maize Company is considering purchasing a new machine as a capital investment. The details of the new machine are summarized below: The cost of

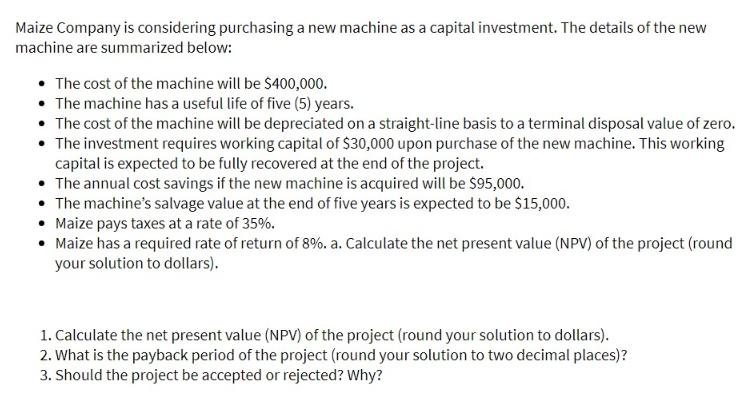

Maize Company is considering purchasing a new machine as a capital investment. The details of the new machine are summarized below: The cost of the machine will be $400,000. The machine has a useful life of five (5) years. The cost of the machine will be depreciated on a straight-line basis to a terminal disposal value of zero. The investment requires working capital of $30,000 upon purchase of the new machine. This working capital is expected to be fully recovered at the end of the project. The annual cost savings if the new machine is acquired will be $95,000. The machine's salvage value at the end of five years is expected to be $15,000. Maize pays taxes at a rate of 35%. Maize has a required rate of return of 8%. a. Calculate the net present value (NPV) of the project (round your solution to dollars). 1. Calculate the net present value (NPV) of the project (round your solution to dollars). 2. What is the payback period of the project (round your solution to two decimal places)? 3. Should the project be accepted or rejected? Why?

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 To calculate the net present value NPV of the project we need to discount the cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started