Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maju Bina Sdn Bhd (MBSB), is a manufacturing company since 2010. MBSB is a resident company in Malaysia with a paid-up capital of RM4.3 million.

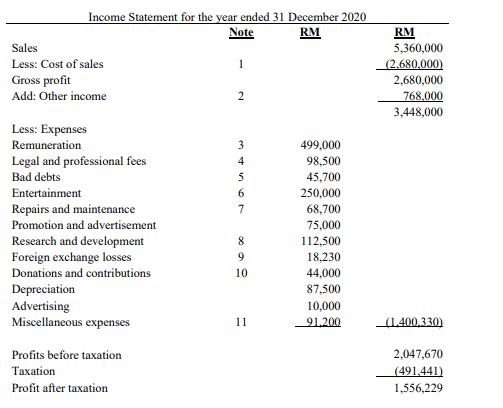

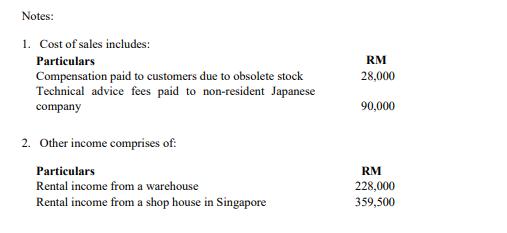

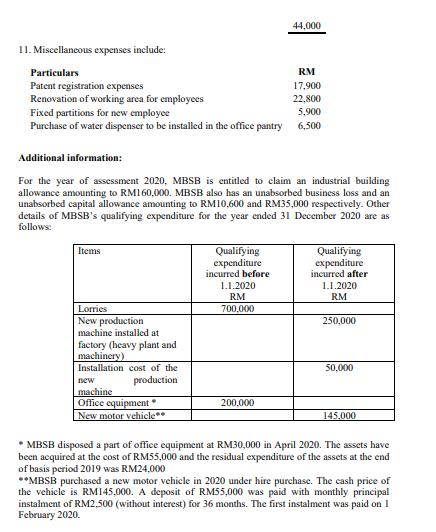

Maju Bina Sdn Bhd (MBSB), is a manufacturing company since 2010. MBSB is a resident company in Malaysia with a paid-up capital of RM4.3 million. The company makes up its accounts annually to 31 December. The income statement of MBSB for the financial year ended 31 December 2020 is as follows:

Required:

1. Compute income tax payable of MBSB for the year of assessment 2020. Please provide me with all the relevant work. Note: You should indicate by the use of the word 'nil' for any item referred to in the question for which no adjusting entry needs to be made in the tax computation

Sales Less: Cost of sales Income Statement for the year ended 31 December 2020 Note 1 RM RM 5,360,000 (2.680,000) Gross profit Add: Other income 2 2,680,000 768,000 3,448,000 Less: Expenses Remuneration Legal and professional fees Bad debts Entertainment Repairs and maintenance 34567 499,000 98,500 45,700 250,000 68,700 Promotion and advertisement 75,000 Research and development 8 112,500 Foreign exchange losses 9 18,230 Donations and contributions 10 44,000 Depreciation 87,500 Advertising 10,000 Miscellaneous expenses 11 91,200 (1.400,330) Profits before taxation 2,047,670 Taxation Profit after taxation (491,441) 1,556,229

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the income tax payable for Maju Bina Sdn Bhd MBSB for the year of assessment 2020 we need to adjust the accounting profit before tax to arr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started