Answered step by step

Verified Expert Solution

Question

1 Approved Answer

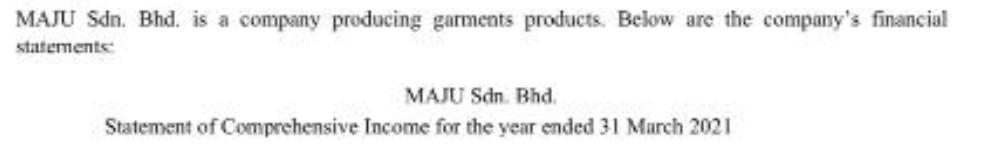

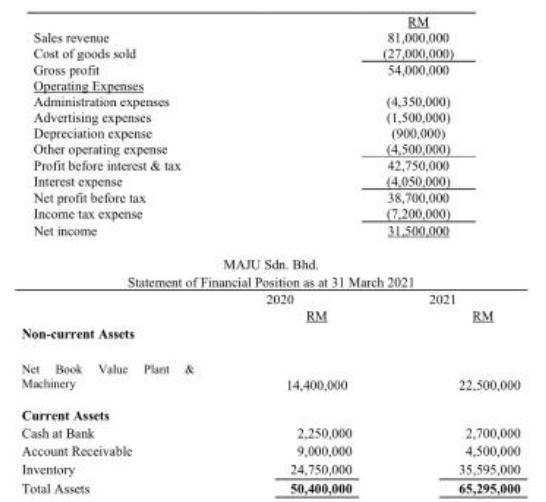

MAJU Sdn. Bhd. is a company producing garments products. Below are the company's financial statements: MAJU Sdn. Bhd. Statement of Comprehensive Income for the

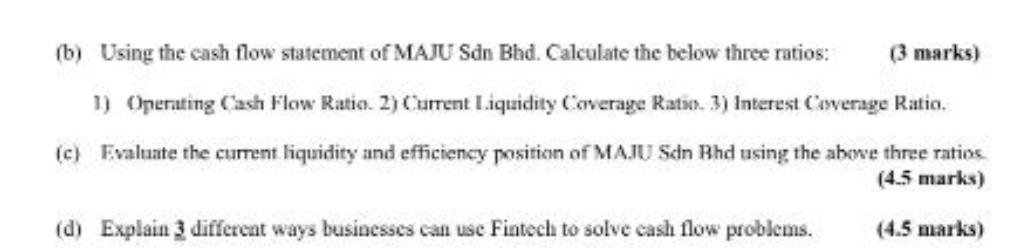

MAJU Sdn. Bhd. is a company producing garments products. Below are the company's financial statements: MAJU Sdn. Bhd. Statement of Comprehensive Income for the year ended 31 March 2021 Sales revenue Cost of goods sold Gross profit Operating Expenses Administration expenses Advertising expenses Depreciation expense Other operating expense Profit before interest & tax Interest expense Net profit before tax Income tax expense Net income Non-current Assets Net Book Value Plant & Machinery Current Assets Cash at Bank Account Receivable Inventory Total Assets MAJU Sdn. Bhd. Statement of Financial Position as at 31 March 2021 2020 RM 14,400,000 2,250,000 9,000,000 RM 81,000,000 (27,000,000) 54,000,000 24,750,000 50,400,000 (4,350,000) (1,500,000) (900,000) (4,500,000) 42,750,000 (4.050,000) 38,700,000 (7,200,000) 31.500.000 2021 RM 22.500,000 2,700,000 4,500,000 35,595,000 65,295,000 Non-current Liabilities Notes Payable Current Liabilities Accounts Payable Administration expenses payable Advertising payable Shareholders' Equity Ordinary share capital Retained earnings Total Liabilities & Equities 25,770,000 900,000 500,000 445.000 4,785,000 18,000,000 50,400,000 23,720,000 8,550,000 750,000 490,000 7,285,000 24,500,000 65,295,000 Required: (a) Prepare the statement of cash flows for MAJU Sdn. Bhd. for the year ended 31 March 2021 using the direct method. (Show all calculations) (18 marks) (b) Using the cash flow statement of MAJU Sdn Bhd. Calculate the below three ratios: 1) Operating Cash Flow Ratio. 2) Current Liquidity Coverage Ratio. 3) Interest Coverage Ratio. (c) Evaluate the current liquidity and efficiency position of MAJU Sdn Bhd using the above three ratios. (4.5 marks) (4.5 marks) (d) Explain 3 different ways businesses can use Fintech to solve cash flow problems. (3 marks) MAJU Sdn. Bhd. is a company producing garments products. Below are the company's financial statements: MAJU Sdn. Bhd. Statement of Comprehensive Income for the year ended 31 March 2021 Sales revenue Cost of goods sold Gross profit Operating Expenses Administration expenses Advertising expenses Depreciation expense Other operating expense Profit before interest & tax Interest expense Net profit before tax Income tax expense Net income Non-current Assets Net Book Value Plant & Machinery Current Assets Cash at Bank Account Receivable Inventory Total Assets MAJU Sdn. Bhd. Statement of Financial Position as at 31 March 2021 2020 RM 14,400,000 2,250,000 9,000,000 RM 81,000,000 (27,000,000) 54,000,000 24,750,000 50,400,000 (4,350,000) (1,500,000) (900,000) (4,500,000) 42,750,000 (4.050,000) 38,700,000 (7,200,000) 31.500.000 2021 RM 22.500,000 2,700,000 4,500,000 35,595,000 65,295,000 Non-current Liabilities Notes Payable Current Liabilities Accounts Payable Administration expenses payable Advertising payable Shareholders' Equity Ordinary share capital Retained earnings Total Liabilities & Equities 25,770,000 900,000 500,000 445.000 4,785,000 18,000,000 50,400,000 23,720,000 8,550,000 750,000 490,000 7,285,000 24,500,000 65,295,000 Required: (a) Prepare the statement of cash flows for MAJU Sdn. Bhd. for the year ended 31 March 2021 using the direct method. (Show all calculations) (18 marks) (b) Using the cash flow statement of MAJU Sdn Bhd. Calculate the below three ratios: 1) Operating Cash Flow Ratio. 2) Current Liquidity Coverage Ratio. 3) Interest Coverage Ratio. (c) Evaluate the current liquidity and efficiency position of MAJU Sdn Bhd using the above three ratios. (4.5 marks) (4.5 marks) (d) Explain 3 different ways businesses can use Fintech to solve cash flow problems. (3 marks) MAJU Sdn. Bhd. is a company producing garments products. Below are the company's financial statements: MAJU Sdn. Bhd. Statement of Comprehensive Income for the year ended 31 March 2021 Sales revenue Cost of goods sold Gross profit Operating Expenses Administration expenses Advertising expenses Depreciation expense Other operating expense Profit before interest & tax Interest expense Net profit before tax Income tax expense Net income Non-current Assets Net Book Value Plant & Machinery Current Assets Cash at Bank Account Receivable Inventory Total Assets MAJU Sdn. Bhd. Statement of Financial Position as at 31 March 2021 2020 RM 14,400,000 2,250,000 9,000,000 RM 81,000,000 (27,000,000) 54,000,000 24,750,000 50,400,000 (4,350,000) (1,500,000) (900,000) (4,500,000) 42,750,000 (4.050,000) 38,700,000 (7,200,000) 31.500.000 2021 RM 22.500,000 2,700,000 4,500,000 35,595,000 65,295,000 Non-current Liabilities Notes Payable Current Liabilities Accounts Payable Administration expenses payable Advertising payable Shareholders' Equity Ordinary share capital Retained earnings Total Liabilities & Equities 25,770,000 900,000 500,000 445.000 4,785,000 18,000,000 50,400,000 23,720,000 8,550,000 750,000 490,000 7,285,000 24,500,000 65,295,000 Required: (a) Prepare the statement of cash flows for MAJU Sdn. Bhd. for the year ended 31 March 2021 using the direct method. (Show all calculations) (18 marks) (b) Using the cash flow statement of MAJU Sdn Bhd. Calculate the below three ratios: 1) Operating Cash Flow Ratio. 2) Current Liquidity Coverage Ratio. 3) Interest Coverage Ratio. (c) Evaluate the current liquidity and efficiency position of MAJU Sdn Bhd using the above three ratios. (4.5 marks) (4.5 marks) (d) Explain 3 different ways businesses can use Fintech to solve cash flow problems. (3 marks)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

d Explain 3 different ways businesses can use Fintech to solve cash flow problems Investment and fin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started