Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mak Mah Sdn Bhd (MMSB) produces a single product that sells for RM500. Cost per unit: direct material RM70, direct labour cost RM50, variable

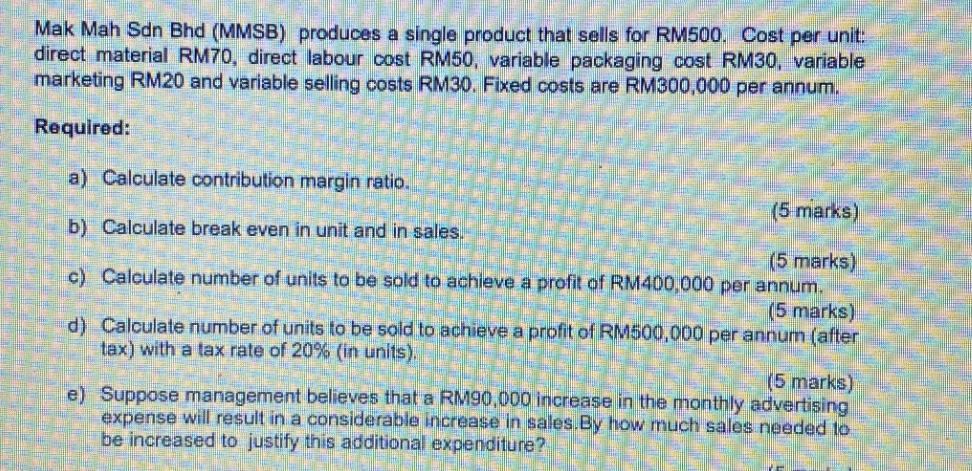

Mak Mah Sdn Bhd (MMSB) produces a single product that sells for RM500. Cost per unit: direct material RM70, direct labour cost RM50, variable packaging cost RM30, variable marketing RM20 and variable selling costs RM30. Fixed costs are RM300,000 per annum. Required: a) Calculate contribution margin ratio. b) Calculate break even in unit and in sales. (5 marks) (5 marks) c) Calculate number of units to be sold to achieve a profit of RM400,000 per annum. (5 marks) d) Calculate number of units to be sold to achieve a profit of RM500,000 per annum (after tax) with a tax rate of 20% (in units). (5 marks) e) Suppose management believes that a RM90,000 increase in the monthly advertising expense will result in a considerable increase in sales. By how much sales needed to be increased to justify this additional expenditure?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation of Contribution Margin Ratio Selling Price per Unit RM500 Variable Costs per Unit Direct Material RM70 Direct Labor RM50 Variable Packag...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started