Question

Make a 5-year pro forma for the property. All analysis should be before-tax. Ignore depreciation and taxable income. What market rents per square foot are

Make a 5-year pro forma for the property. All analysis should be "before-tax". Ignore depreciation and taxable income.

What market rents per square foot are you assuming in the proforma? Explain and show calculations, if appropriate.

Create an amortization table (monthly) using the debt assumptions in the case:

If the property is sold at the end of Month 60, what is the loan balance at the time of sale?

What should Alexander pay for this property?

Explain your rationale for your purchase price?

Calculate the following, assuming an exit cap rate of 7% using your proforma and proposed purchase price:

Unlevered IRR, Equity Multiple, and Profit?

Levered IRR, Equity Multiple, and Profit?

Assumptions: List your assumptions?

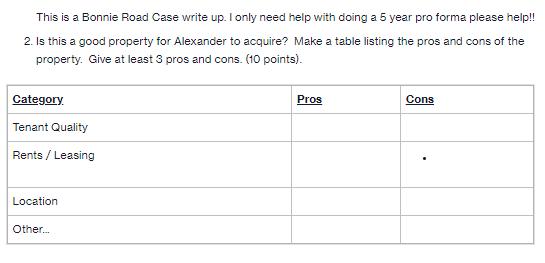

This is a Bonnie Road Case write up. I only need help with doing a 5 year pro forma please help!! 2. Is this a good property for Alexander to acquire? Make a table listing the pros and cons of the property. Give at least 3 pros and cons. (10 points). Category Tenant Quality Rents / Leasing Location Other... Pros Cons

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To create a 5year pro forma for the property we need to estimate the annual net operating income NOI for each year taking into account the expected re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started