Answered step by step

Verified Expert Solution

Question

1 Approved Answer

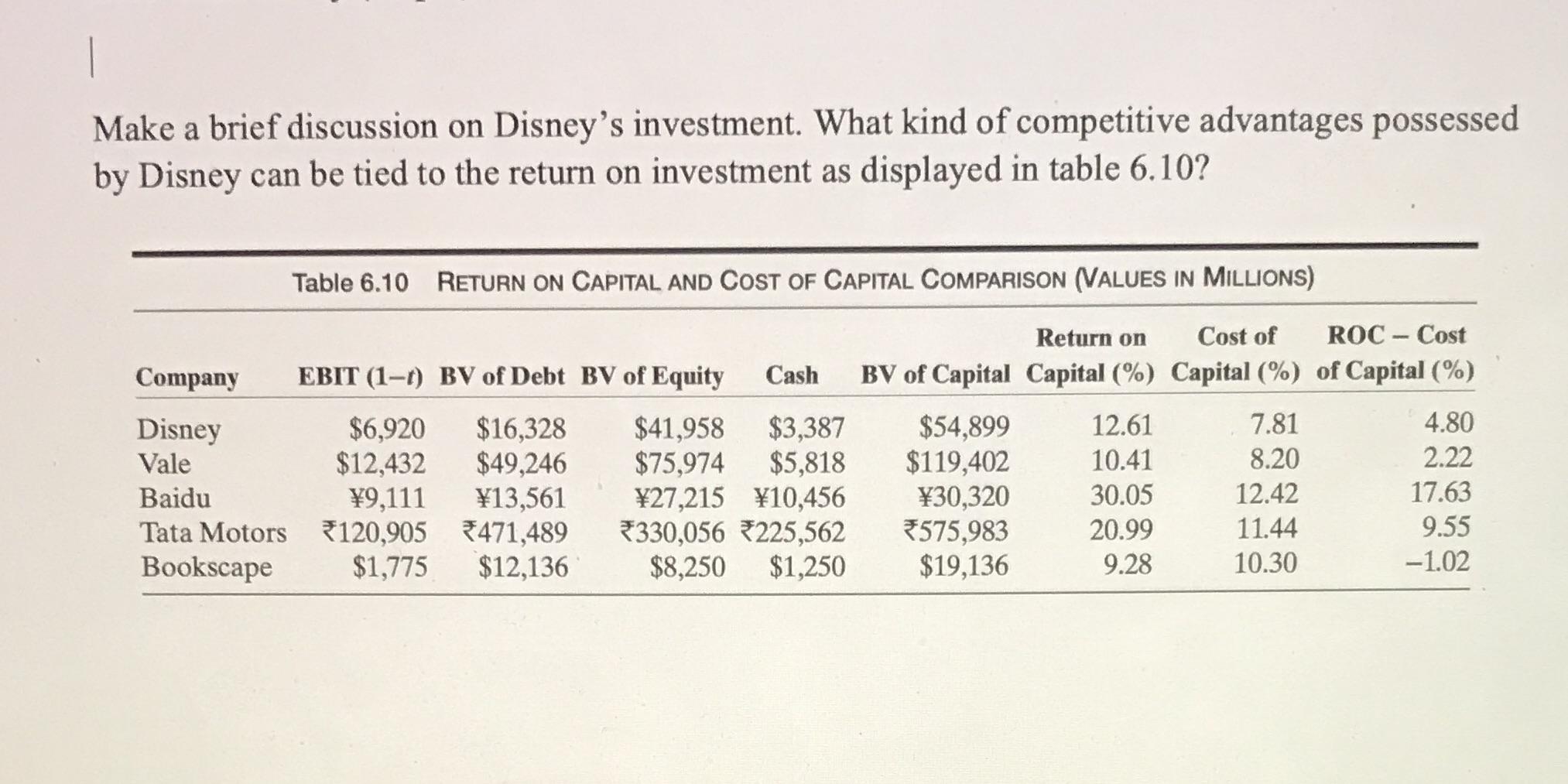

Make a brief discussion on Disney's investment. What kind of competitive advantages possessed by Disney can be tied to the return on investment as

Make a brief discussion on Disney's investment. What kind of competitive advantages possessed by Disney can be tied to the return on investment as displayed in table 6.10? Company Disney Vale Baidu Tata Motors Bookscape Table 6.10 RETURN ON CAPITAL AND COST OF CAPITAL COMPARISON (VALUES IN MILLIONS) Return on Cost of Cash BV of Capital Capital (%) Capital (%) 12.61 10.41 30.05 20.99 9.28 EBIT (1-1) BV of Debt BV of Equity $6,920 $16,328 $41,958 $3,387 $12,432 $49,246 9,111 13,561 120,905 471,489 $1,775 $12,136 $54,899 $75,974 $5,818 $119,402 27,215 10,456 330,056 225,562 $8,250 $1,250 30,320 *575,983 $19,136 7.81 8.20 12.42 11.44 10.30 ROC- Cost of Capital (%) 4.80 2.22 17.63 9.55 -1.02

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

In Table 610 we can see the return on capital ROC and cost of capital for various companies including Disney Disney with a return on capital of 781 an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started