Make a general journal for the following transactions

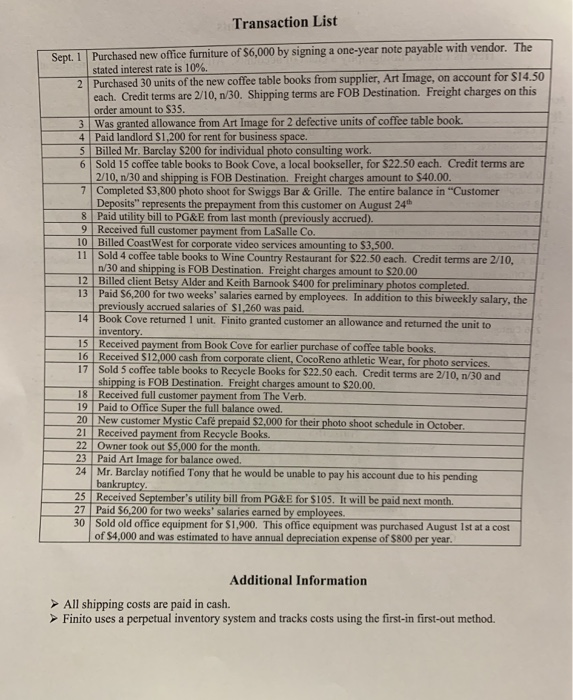

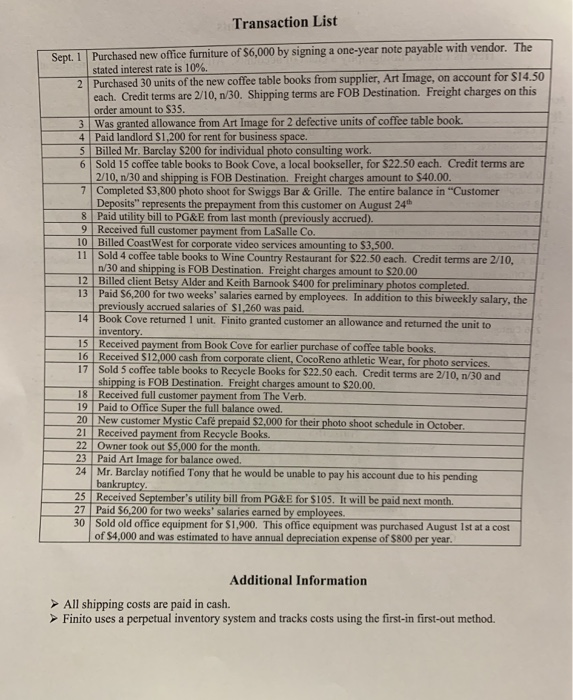

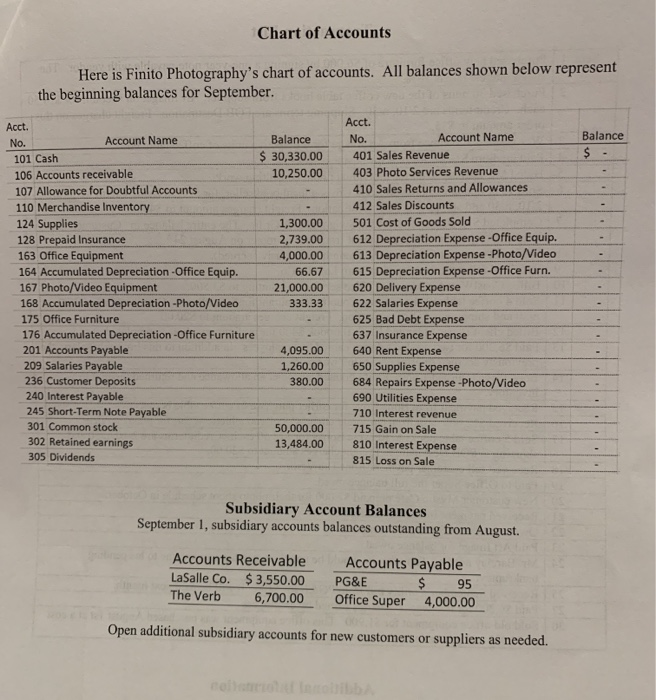

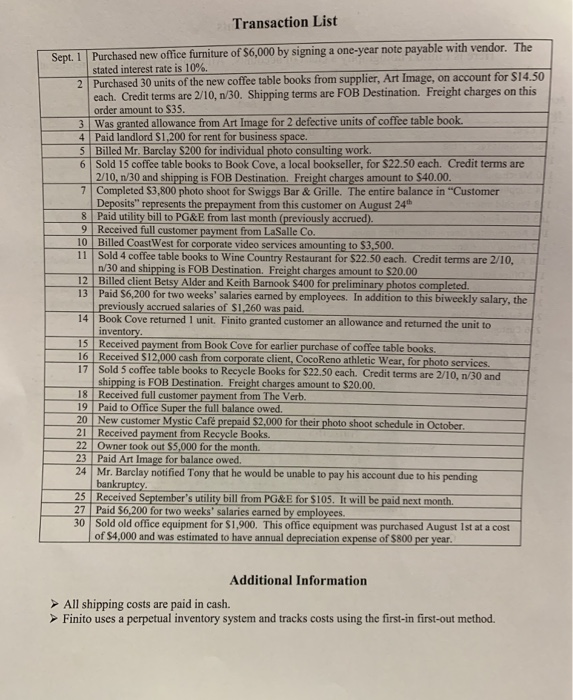

Transaction List Sept. 1Purchased new office furniture of S6,000 by signing a one-year note payable with vendor. The stated interest rate is 10%. 2 Purchased 30 units of the new coffee table books from supplier, Art Image, on account for $14.50 each. Credit terms are 2/10, 1/30. Shipping terms are FOB Destination. Freight charges on this order amount to $35. 3 Was granted allowance from Art Image for 2 defective units of coffee table book. 4 Paid landlord S1,200 for rent for business space. 5 Billed Mr. Barclay S200 for individual photo consulting work. 6 Sold 15 coffee table books to Book Cove, a local bookseller, for $22.50 each. Credit terms are 2/10,n/30 and shipping is FOB Destination. Freight charges amount to $40.00. 7 Completed $3,800 photo shoot for Swiggs Bar & Grille. The entire balance in "Customer Deposits" represents the prepayment from this customer on August 24th 8 Paid utility bill to PG&E from last month (previously accrued). 9 Received full customer payment from LaSalle Co. 10 Billed Coast West for corporate video services amounting to $3,500. 11 Sold 4 coffee table books to Wine Country Restaurant for $22.50 each. Credit terms are 2/10, n/30 and shipping is FOB Destination. Freight charges amount to $20.00 12 Billed client Betsy Alder and Keith Barnook $400 for preliminary photos completed. 13 Paid S6,200 for two weeks' salaries earned by employees. In addition to this biweekly salary, the previously accrued salaries of $1,260 was paid. 14 Book Cove returned 1 unit. Finito granted customer an allowance and returned the unit to inventory. 15 Received payment from Book Cove for earlier purchase of coffee table books. 16 Received $12,000 cash from corporate client, CocoReno athletic Wear, for photo services. 17 Sold 5 coffee table books to Recycle Books for $22.50 each. Credit terms are 2/10, n/30 and shipping is FOB Destination. Freight charges amount to $20.00. 18 Received full customer payment from The Verb. 19 Paid to Office Super the full balance owed. 20 New customer Mystic Caf prepaid $2,000 for their photo shoot schedule in October 21 Received payment from Recycle Books. 22 Owner took out $5,000 for the month. 23 Paid Art Image for balance owed. 24 Mr. Barclay notified Tony that he would be unable to pay his account due to his pending bankruptcy. 25 Received September's utility bill from PG&E for $105. It will be paid next month. 27 Paid S6,200 for two weeks' salaries earned by employees. 30 Sold old office equipment for $1,900. This office equipment was purchased August 1st at a cost of $4,000 and was estimated to have annual depreciation expense of $800 per year. Additional Information > All shipping costs are paid in cash. Finito uses a perpetual inventory system and tracks costs using the first-in first-out method. Chart of Accounts Here is Finito Photography's chart of accounts. All balances shown below represent the beginning balances for September. Balance Acct. No. Account Name Balance 101 Cash $ 30,330.00 106 Accounts receivable 10,250.00 107 Allowance for Doubtful Accounts 110 Merchandise Inventory 124 Supplies 1,300.00 128 Prepaid Insurance 2,739.00 163 Office Equipment 4,000.00 164 Accumulated Depreciation - Office Equip. 66.67 167 Photo/Video Equipment 21,000.00 168 Accumulated Depreciation -Photo/Video 333.33 175 Office Furniture 176 Accumulated Depreciation Office Furniture 201 Accounts Payable 4,095.00 209 Salaries Payable 1,260.00 236 Customer Deposits 380.00 240 Interest Payable 245 Short-Term Note Payable 301 Common stock 50,000.00 302 Retained earnings 13,484.00 305 Dividends Acct. No. Account Name 401 Sales Revenue 403 Photo Services Revenue 410 Sales Returns and Allowances 412 Sales Discounts 501 Cost of Goods Sold 612 Depreciation Expense-Office Equip. 613 Depreciation Expense - Photo/Video 615 Depreciation Expense-Office Furn. 620 Delivery Expense 622 Salaries Expense 625 Bad Debt Expense 637 Insurance Expense 640 Rent Expense 650 Supplies Expense 684 Repairs Expense -Photo/Video 690 Utilities Expense 710 Interest revenue 715 Gain on Sale 810 Interest Expense 815 Loss on Sale Subsidiary Account Balances September 1, subsidiary accounts balances outstanding from August. Accounts Receivable La Salle Co. $3,550.00 The Verb 6,700.00 Accounts Payable PG&E $ 95 Office Super 4,000.00 Open additional subsidiary accounts for new customers or suppliers as needed