Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Make a general journal, unadjusted trail balance and adjusted trail balance Thank You Transactions (for the month of May 20x5) 1- Rent payment of $2,400

Make a general journal, unadjusted trail balance and adjusted trail balance

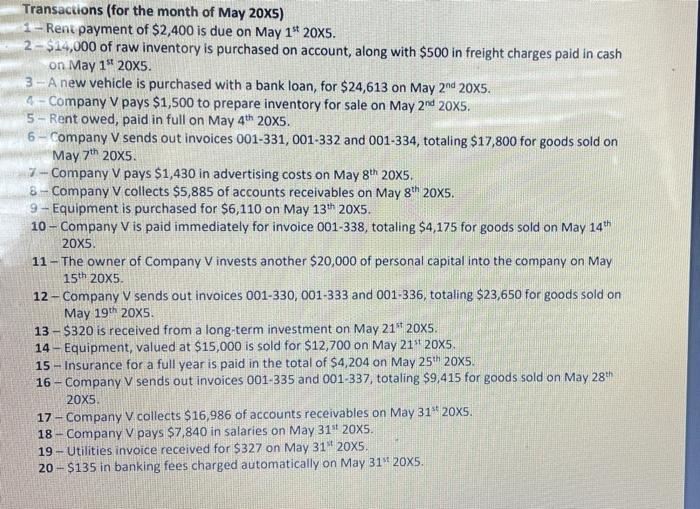

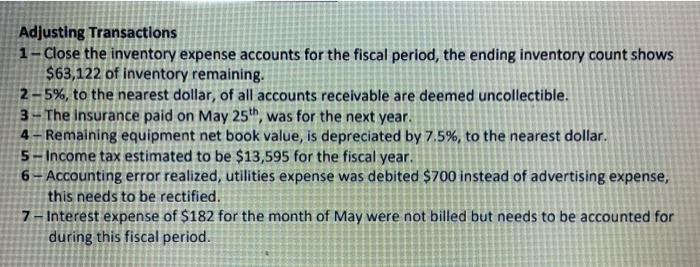

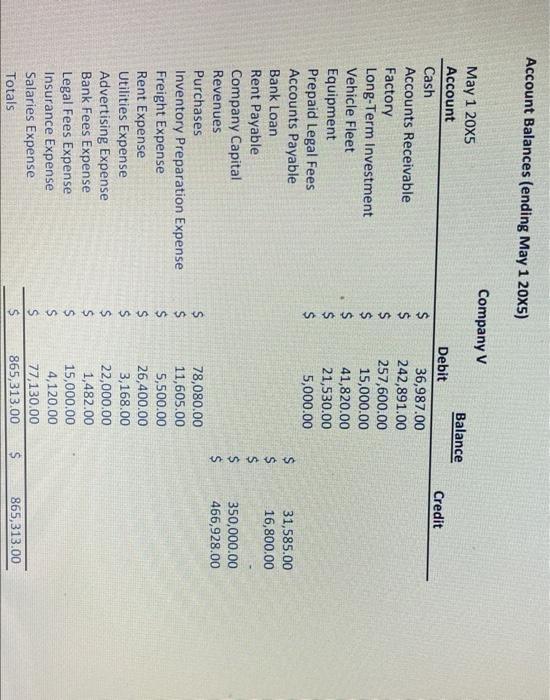

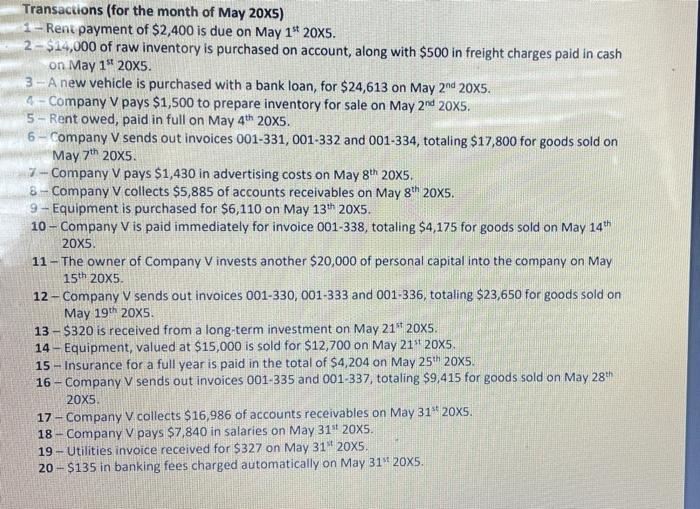

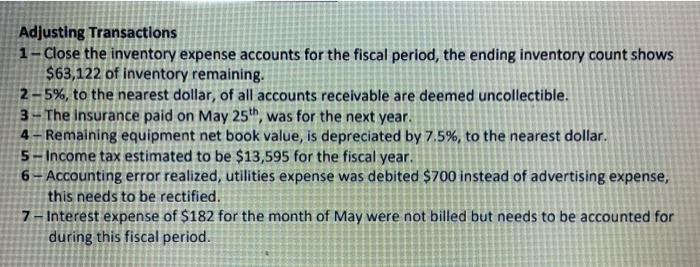

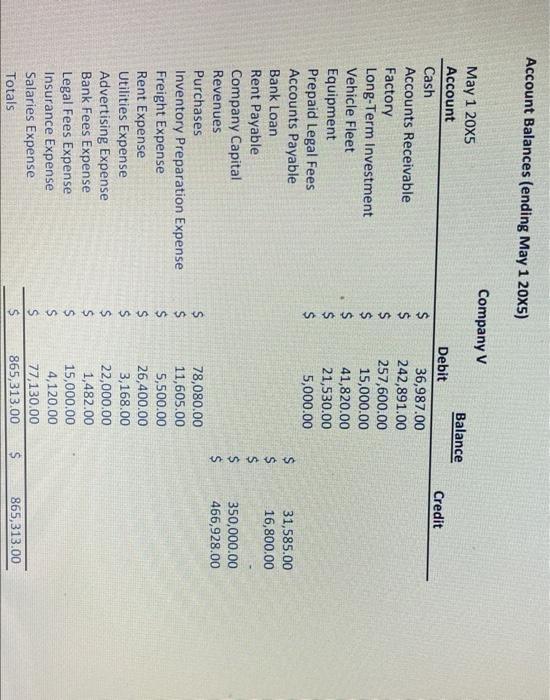

Transactions (for the month of May 20x5) 1- Rent payment of $2,400 is due on May 1st 20X5. 2 - $14,000 of raw inventory is purchased on account, along with $500 in freight charges paid in cash on May 19 20X5. 3- A new vehicle is purchased with a bank loan, for $24,613 on May 2nd 20X5. 4 - Company V pays $1,500 to prepare inventory for sale on May 2nd 20x5. 5- Rent owed, paid in full on May 4th 20X5. 6 - Company V sends out invoices 001-331, 001-332 and 001-334, totaling $17,800 for goods sold on May 7th 20x5. 7-Company V pays $1,430 in advertising costs on May 8th 20X5. 8 - Company V collects $5,885 of accounts receivables on May 8th 20x5. 9 -- Equipment is purchased for $6,110 on May 13th 20X5. 10 - Company V is paid immediately for invoice 001-338, totaling $4,175 for goods sold on May 14th 20X5 11 - The owner of Company V invests another $20,000 of personal capital into the company on May 15th 20X5. 12 - Company V sends out invoices 001-330, 001-333 and 001-336, totaling $23,650 for goods sold on May 19th 20x5. 13 - $320 is received from a long-term investment on May 21" 20x5. 14 - Equipment, valued at $15,000 is sold for $12,700 on May 21st 20x5. 15 - Insurance for a full year is paid in the total of $4,204 on May 25th 20x5. 16 - Company V sends out invoices 001-335 and 001-337, totaling $9,415 for goods sold on May 28th 20X5 17 - Company V collects $16,986 of accounts receivables on May 31 20x5. 18 - Company V pays $7,840 in salaries on May 31" 20x5. 19- Utilities invoice received for $327 on May 31 20X5. 20 - $135 in banking fees charged automatically on May 31M 20x5. - Adjusting Transactions 1-Close the inventory expense accounts for the fiscal period, the ending inventory count shows $63,122 of inventory remaining. 2-5%, to the nearest dollar, of all accounts receivable are deemed uncollectible. 3- The insurance paid on May 25th, was for the next year. 4 - Remaining equipment net book value, is depreciated by 7.5%, to the nearest dollar. 5 - Income tax estimated to be $13,595 for the fiscal year. 6 - Accounting error realized, utilities expense was debited $700 instead of advertising expense, this needs to be rectified. 7 - Interest expense of $182 for the month of May were not billed but needs to be accounted for during this fiscal period. Account Balances (ending May 1 20x5) Company V Balance Debit Credit $ $ $ $ $ $ $ 36,987.00 242,891.00 257,600.00 15,000.00 41,820.00 21,530.00 5,000.00 $ 31,585.00 16,800.00 May 1 20X5 Account Cash Accounts Receivable Factory Long-Term Investment Vehicle Fleet Equipment Prepaid Legal Fees Accounts Payable Bank Loan Rent Payable Company Capital Revenues Purchases Inventory Preparation Expense Freight Expense Rent Expense Utilities Expense Advertising Expense Bank Fees Expense Legal Fees Expense Insurance Expense Salaries Expense Totals s $ 350,000.00 466,928.00 $ $ $ $ $ s $ $ $ 78,080.00 11,605.00 5,500.00 26,400.00 3,168.00 22,000.00 1,482.00 15,000.00 4,120.00 77,130.00 865,313.00 $ 865,313.00 Thank You

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started