Make a summary of the 2 methods( Direct and Indirect) to make a cash flow statement and highlight their differences.

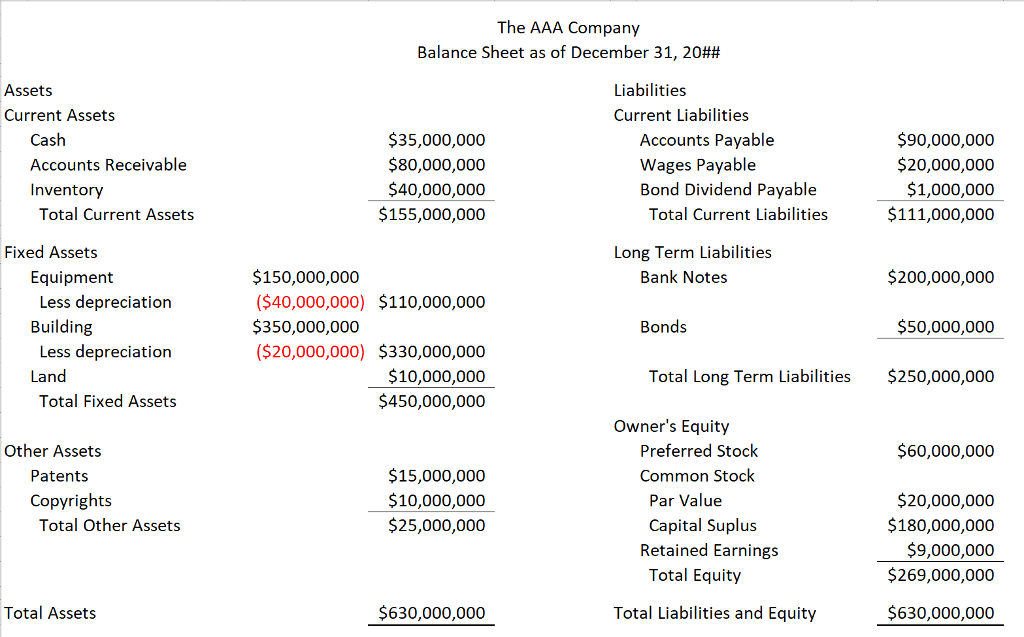

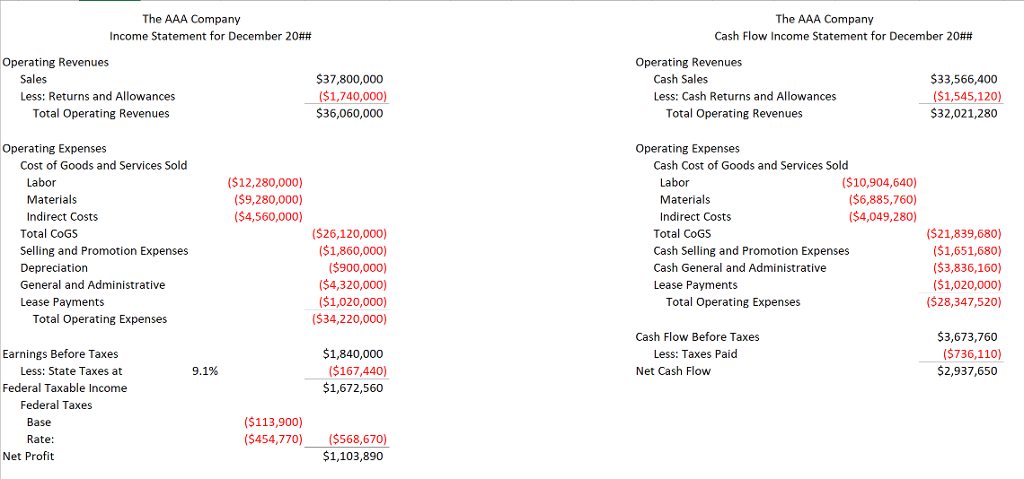

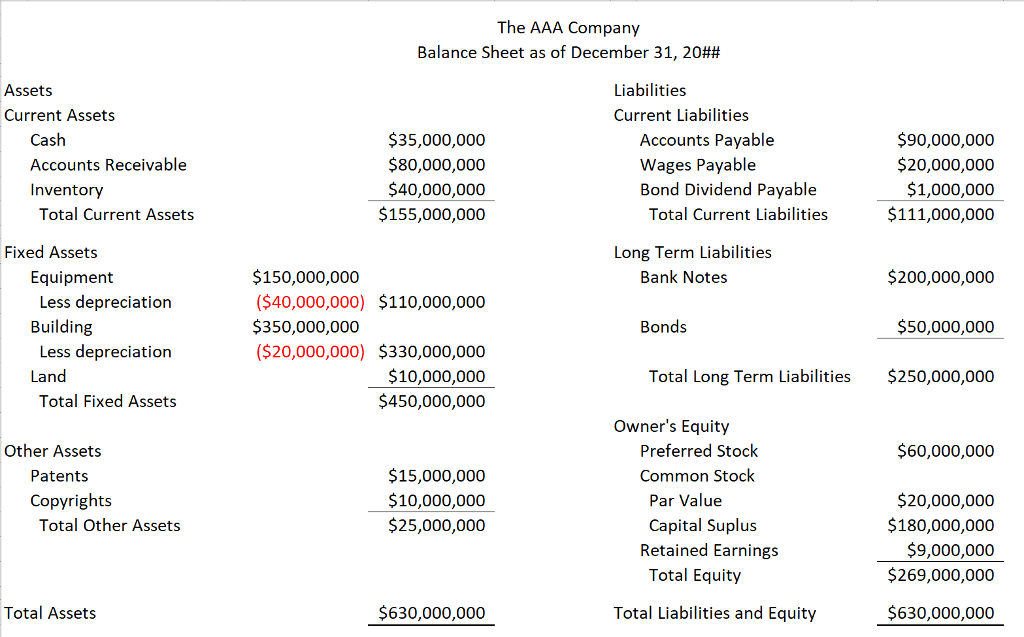

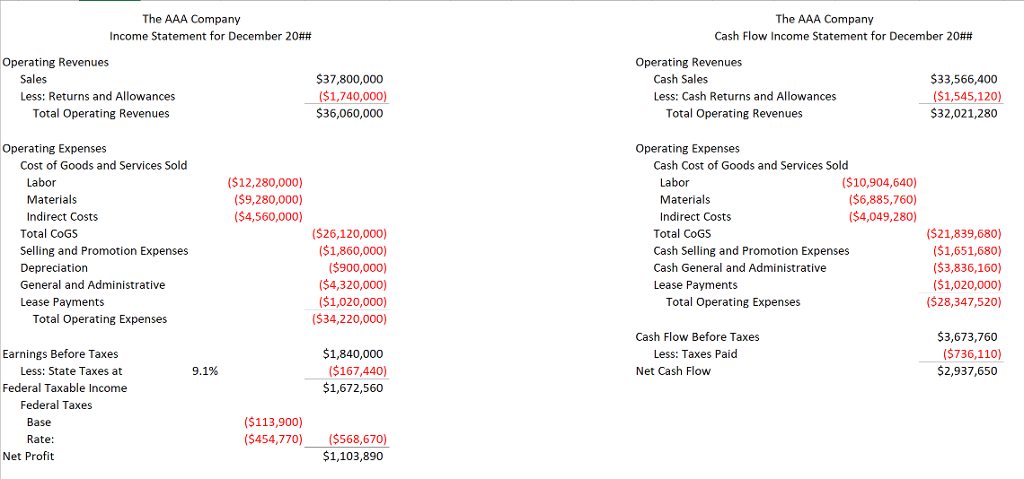

The AAA Company Balance Sheet as of December 31, 20## Liabilities Current Liabilities Assets Current Assets Cash Accounts Receivable Inventory $35,000,000 $80,000,000 $40,000,000 $155,000,000 Accounts Payable Wages Payable Bond Dividend Payable $90,000,000 $20,000,000 $1,000,000 $111,000,000 Total Current Assets Total Current Liabilities Fixed Assets Long Term Liabilities $150,000,000 ($40,000,000) $110,000,000 $350,000,000 $20,000,000) $330,000,000 $200,000,000 $50,000,000 $250,000,000 Equipment Bank Notes Less depreciation Less depreciation Total Fixed Assets Building Bonds $10,000,000 $450,000,000 Land Total Long Term Liabilities Owner's Equity Other Assets $60,000,000 Preferred Stock Common Stock $15,000,000 $10,000,000 $25,000,000 Patents Copyrights Par Value Capital Suplus $20,000,000 $180,000,000 $9,000,000 $269,000,000 Total Other Assets Retained Earnings Total Equity Total Assets $630,000,000 Total Liabilities and Equity $630,000,000 The AAA Company The AAA Company Income Statement for December 20## Cash Flow Income Statement for December 20## Operating Revenues Operating Revenues Sales Less: Returns and Allowances 37,800,000 ($1,740,000) 36,060,000 Cash Sales Less: Cash Returns and Allowances $33,566,400 ($1,545,120) 32,021,280 Total Operating Revenues Total Operating Revenues Operating Expenses Operating Expenses Cost of Goods and Services Sold Cash Cost of Goods and Services Sold Labor Labor (S12,280,000) ($9,280,000) ($4,560,000) ($10,904,640) ($6,885,760) ($4,049,280) Materials Materials Indirect Costs Total CoGS Selling and Promotion Expenses Depreciation General and Administrative Lease Payments ($26,120,000) ($1,860,000) ($900,000) ($4,320,000) ($1,020,000) ($34,220,000) Indirect Costs Total CoGS Cash Selling and Promotion Expenses Cash General and Administrative Lease Payments ($21,839,680) ($1,651,680) ($3,836,160) ($1,020,000 ($28,347,520) Total Operating Expenses Total Operating Expenses 1,840,000o ($167,440) $1,672,560 Cash Flow Before Taxes Less: Taxes Paid 3,673,760 ($736,110) $2,937,650 Earnings Before Taxes Less: State Taxes at 9.1% Net Cash Flow Federal Taxable Income Federal Taxes Base Rate: Net Profit ($113,900) ($454,770 ($568,670 $1,103,890