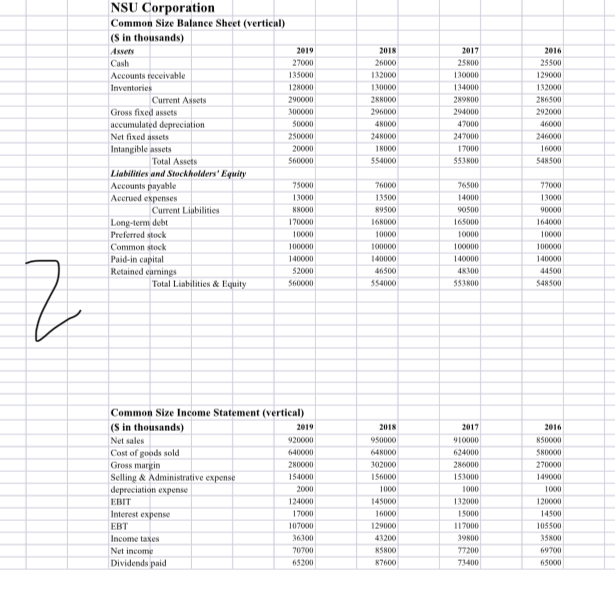

- Make a vertical common size balance sheet and income statement for each year

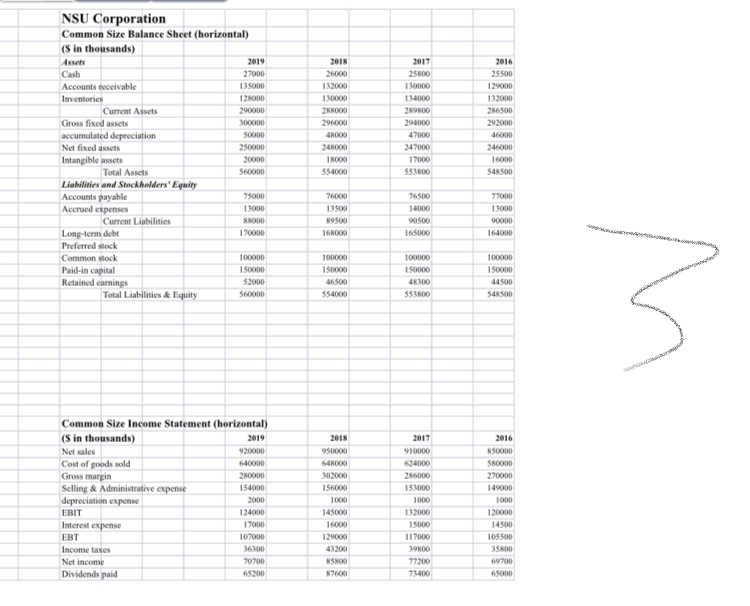

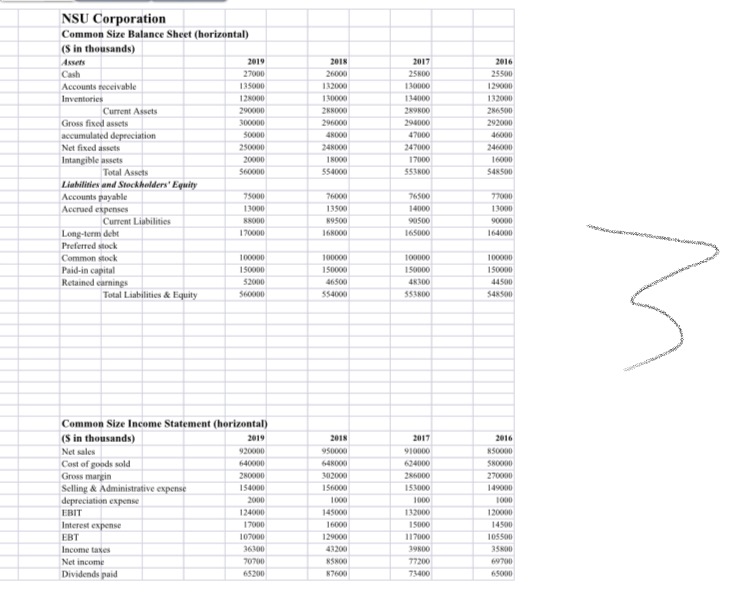

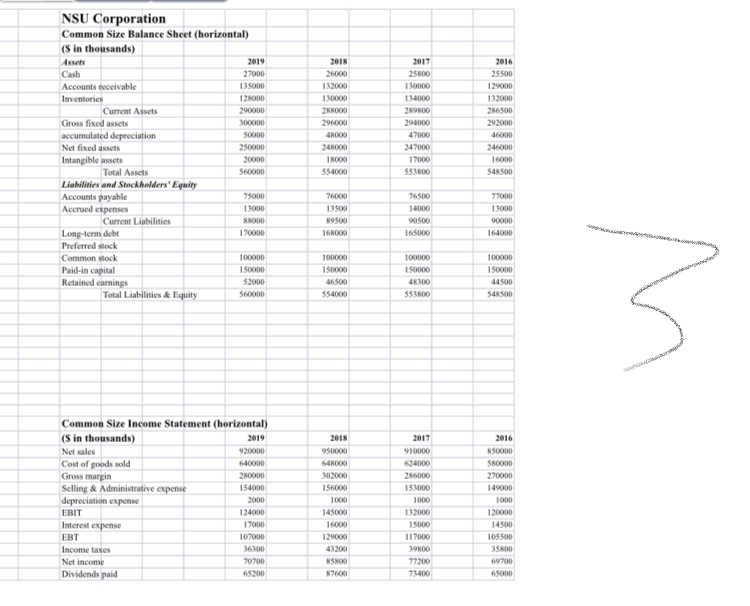

- Make a horizontal common size balance sheet and income statement for each year.

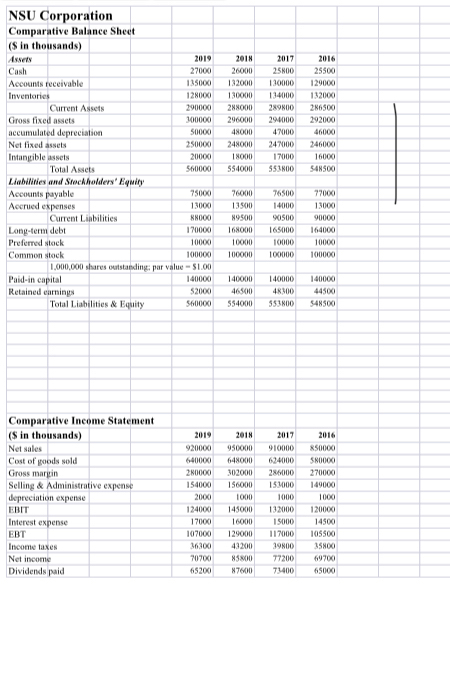

the attached data is the format for all common size statements. Only requirement is to include percentages.

NSU Corporation Common Size Balance Sheet (vertical) (S in thousands) Assen 2019 2017 2016 Cash 270 0 26000 25800 25500 Accounts receivable 135000 132000 30000 129000 Inventories 128000 1 30000 134000 132090 Current Assets 290000 289800 286500 Gross fixed assets 296000 294000 292000 accumulated depreciation 50000 47000 46090 Net fixed assets 250900 248000 247000 246090 Intangible assets 20090 1 8000 1 7000 16000 Total Assets 560000 $54000 553800 S48500 Liabilities and Stockholders' Equity Accounts payable 75001 7600 76500 77090 Accrued expenses 1300 1350 14000 13900 Current Liabilities NHOO 40500 90090 Long-term debt 170000 168000 165000 164000 Preferred stock 1000 10000 10090 Common stock 100900 10ongo 109000 100090 Paid-in capital 1 40090 1 40800 140000 140090 Retained comings $2000 46500 48100 44500 Total Liabilities & Equity 560600 354000 353800 548500 Common Size Income Statement (vertical) (S in thousands) 2019 2018 2017 2016 Net sales 920600 950000 #10000 850000 Cost of goods sold 640900 548000 624000 Gross margin 30200 285000 270090 Selling & Administrative expense 15400 156000 153000 149000 depreciation expense 2090 1000 1000 1090 EBIT 124000 145000 132000 120000 Interest expense 1 7090 16000 1 5000 14500 EBT 10700 129000 1 7000 105500 Income bases 43200 19800 25800 Net income 70700 77200 69700 Dividends paid 65200 8760 73-400 65000NSU Corporation Comparative Balance Sheet (S in thousands) 2019 201H 2017 2016 Cash 27000 26000 25800 25500 Accounts receivable 135000 132000 1 30000 129060 Inventories 128060 130900 13-4000 1 32090 Current Assets 290090 288000 289800 286500 Gross fixed assets 100000 296000 294000 292000 accumulated depreciation 50000 48000 47000 46000 Net fixed assets 250090 248000 247000 246090 Intangible assets 20000 1 7000 16090 Total Assets 560000 $54000 553800 $48500 Liabilities and Stockholders' Equiry Accounts payable 75060 76000 76500 77060 Accrued expenses 13060 13500 1 4000 13090 Current Liabilities KHOOD 89500 90500 90000 Long-term debt 170060 1 68000 165000 164060 Preferred stock 10060 10000 10000 10909 Common stock 100090 1 00000 190000 100060 1,000.090 shares outstanding: par value = $1.00 Paid-in capital 1 40000 1 40000 140000 1 40000 Retained earnings $2060 46400 48400 44500 Total Liabilities & Equity $60090 $54000 $53800 548500 Comparative Income Statement ($ in thousands) 2019 201H 2017 2016 Net sales 920060 950000 910000 8500GO Cost of goods sold 640040 624000 $80090 Gross margin 280090 302000 286000 270000 Selling & Administrative expense 154000 156000 153000 1 49000 depreciation expense 2000 1000 1000 EBIT 124000 145000 132000 120090 Interest expense 17000 16000 1 5000 14500 EBT 107000 129000 1 1 7000 105500 Income taxes 26300 43200 39800 2580 0 Net income 70760 85800 77200 69700 Dividends paid 65200 87600 71400 65000NSU Corporation Common Size Balance Sheet (horizontal) (S in thousands) Assets 2019 3017 2016 Cash 2700 26004 15800 25500 Accounts receivable 125000 132000 130000 1 29000 Inventories 1 28000 130009 134000 1 3200 Current Assets 290900 286500 Gross fixed assets 300900 296000 294000 292000 accumulated depreciation 50000 47000 46090 Net fixed assets 250900 248009 247000 246090 Intangible assets 20900 17000 Total Assets 560000 554000 551800 548500 Liabilities and Stockholders' Equiry Accounts payable 750600 76004 76500 77000 Accrued expenses 1350 1 4000 1 3000 Current Liabilities 90500 Long-term deb 170900 165000 164000 Preferred stock Common stock 100900 100009 109000 100200 Paid-in capital 150000 150000 50000 Retained carings 46500 44500 Total Liabilities & Equity $54009 45 1800 5 Common Size Income Statement (horizontal) (S in thousands) 2019 2018 Net sales 920200 950009 910000 850 00 Cast of goods sold 640000 648000 624000 480000 Gross margin 280900 302000 286000 270900 Selling & Administrative expense 1 54000 156000 15 1000 149000 depreciation expense 2000 1009 1000 1000 EBIT 124000 143009 132000 120200 Interest expense 16000 19000 14500 ERT 107000 129009 11 7000 105500 Income Lases 26 100 43200 19800 25600 Net income 70 700 77204 GAPTOO Dividends paid 73400 65000