Answered step by step

Verified Expert Solution

Question

1 Approved Answer

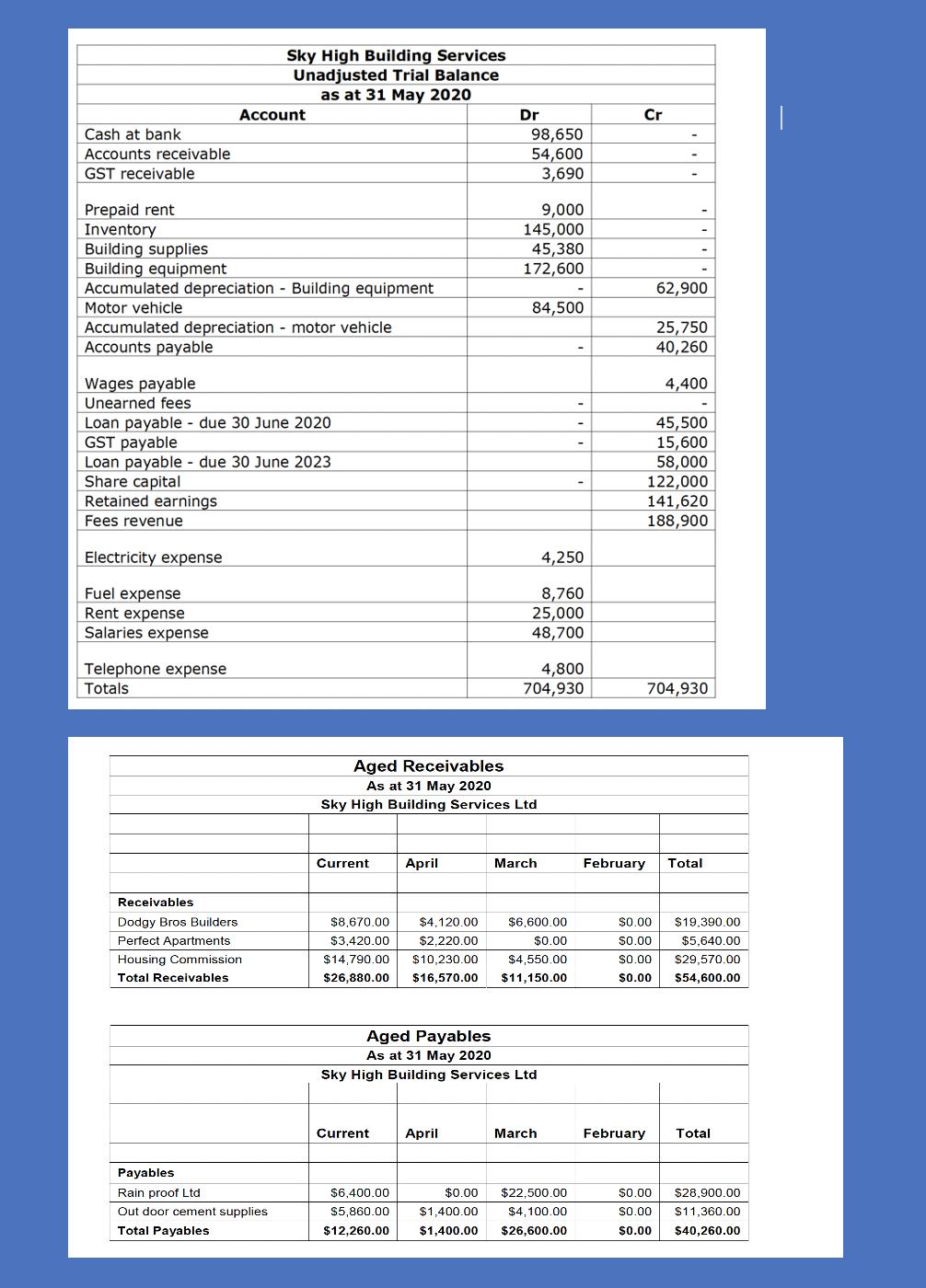

Make an adjusted trial Balance with the information provided. GST rates 10% Cash at bank Accounts receivable GST receivable Wages payable Unearned fees Prepaid rent

Make an adjusted trial Balance with the information provided.

GST rates 10%

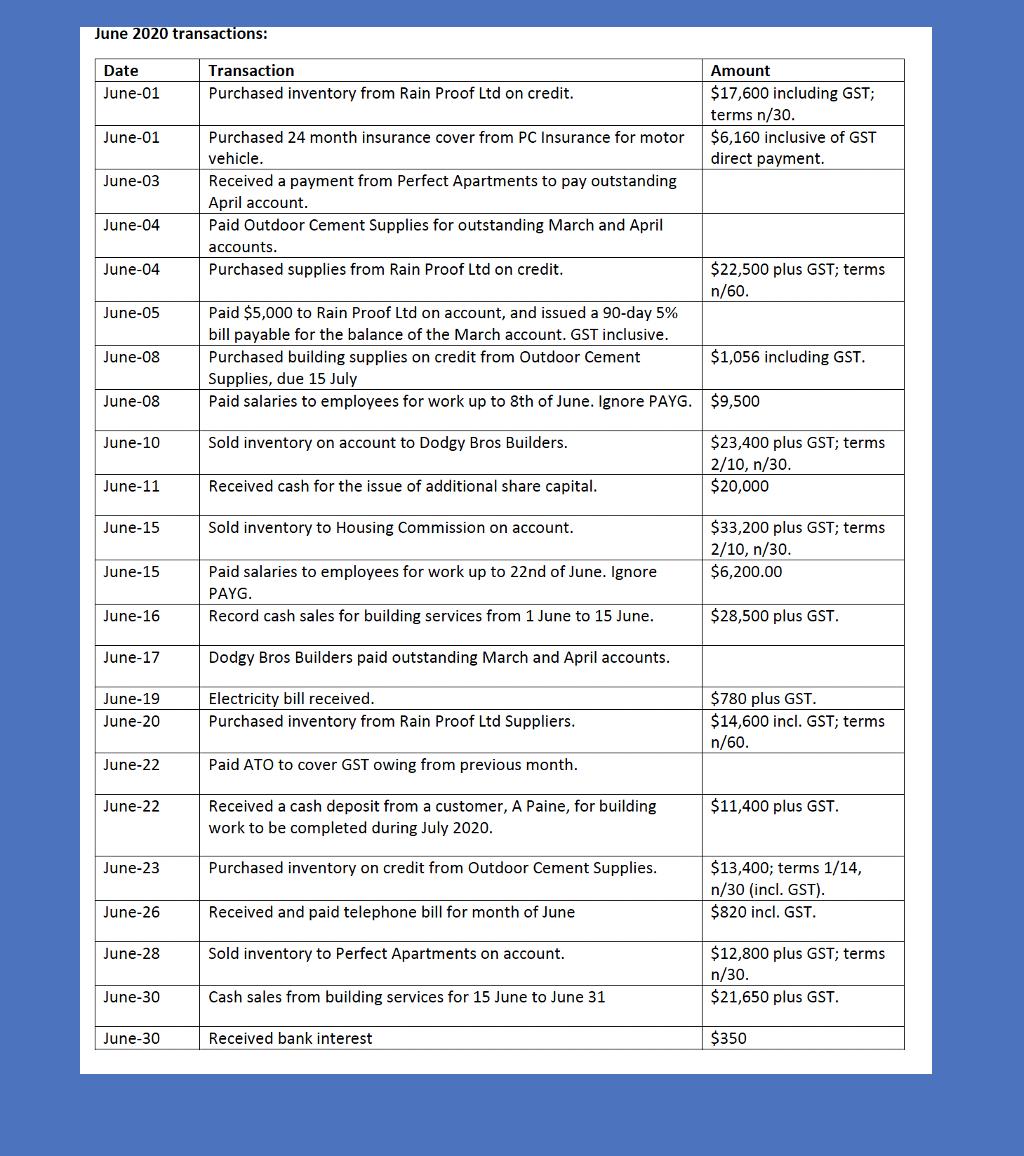

Cash at bank Accounts receivable GST receivable Wages payable Unearned fees Prepaid rent Inventory Building supplies Building equipment Accumulated depreciation Building equipment Motor vehicle Accumulated depreciation - motor vehicle Accounts payable Account Loan payable due 30 June 2020 GST payable Electricity expense Fuel expense Rent expense Salaries expense Sky High Building Services Unadjusted Trial Balance as at 31 May 2020 Loan payable due 30 June 2023 Share capital Retained earnings Fees revenue Telephone expense Totals Receivables Dodgy Bros Builders Perfect Apartments Housing Commission Total Receivables Payables Rain proof Ltd Out door cement supplies Total Payables Current April Current Dr 98,650 54,600 3,690 Aged Receivables As at 31 May 2020 Sky High Building Services Ltd April 9,000 145,000 45,380 172,600 $6,400.00 $0.00 $5,860.00 $1,400.00 $12,260.00 $1,400.00 84,500 4,250 8,760 25,000 48,700 4,800 704,930 $8,670.00 $4,120.00 $3,420.00 $2,220.00 $14,790.00 $10,230.00 $4,550.00 $26,880.00 $16,570.00 $11,150.00 March Aged Payables As at 31 May 2020 Sky High Building Services Ltd $6,600.00 $0.00 March $22,500.00 $4,100.00 $26,600.00 Cr 62,900 25,750 40,260 4,400 45,500 15,600 58,000 122,000 141,620 188,900 704,930 February Total $0.00 $19,390.00 $0.00 $5,640.00 $0.00 $29,570.00 $0.00 $54,600.00 February Total $0.00 $28,900.00 $0.00 $11,360.00 $40,260.00 $0.00

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

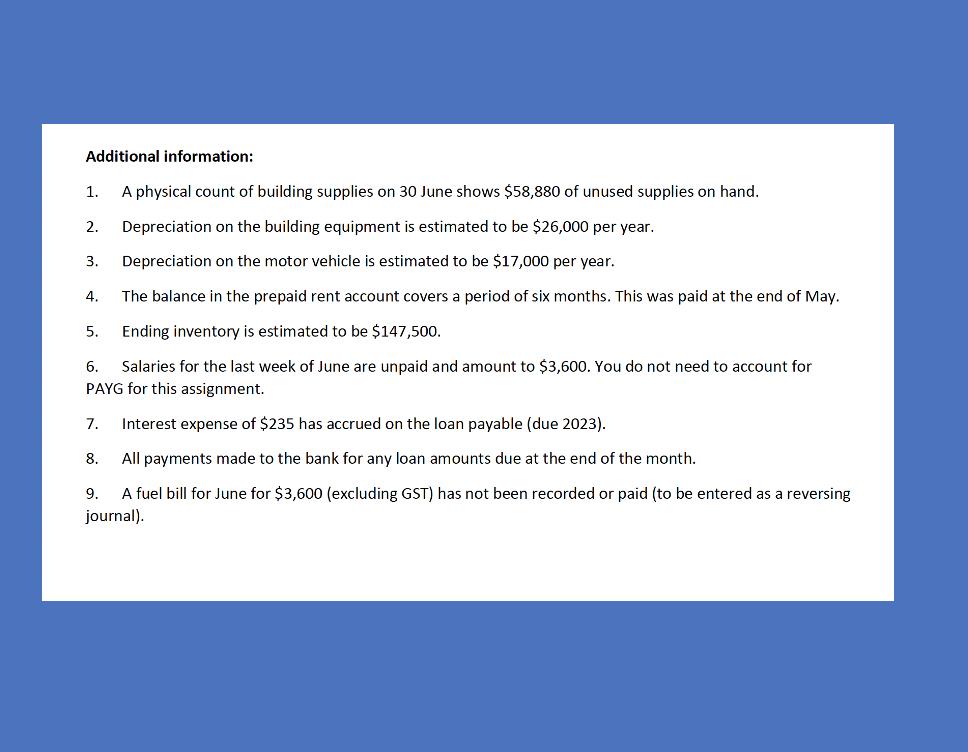

To create an adjusted trial balance we need to make adjustments for the transactions and additional information provided for the month of June 2020 He...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started