Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Make as many assumptions as you need to try to conduct your own DCF (or other type) of valuation of Finansbank. You will need to

Make as many assumptions as you need to try to conduct your own DCF (or other type) of valuation of Finansbank. You will need to make assumptions since the case does not provide enough information

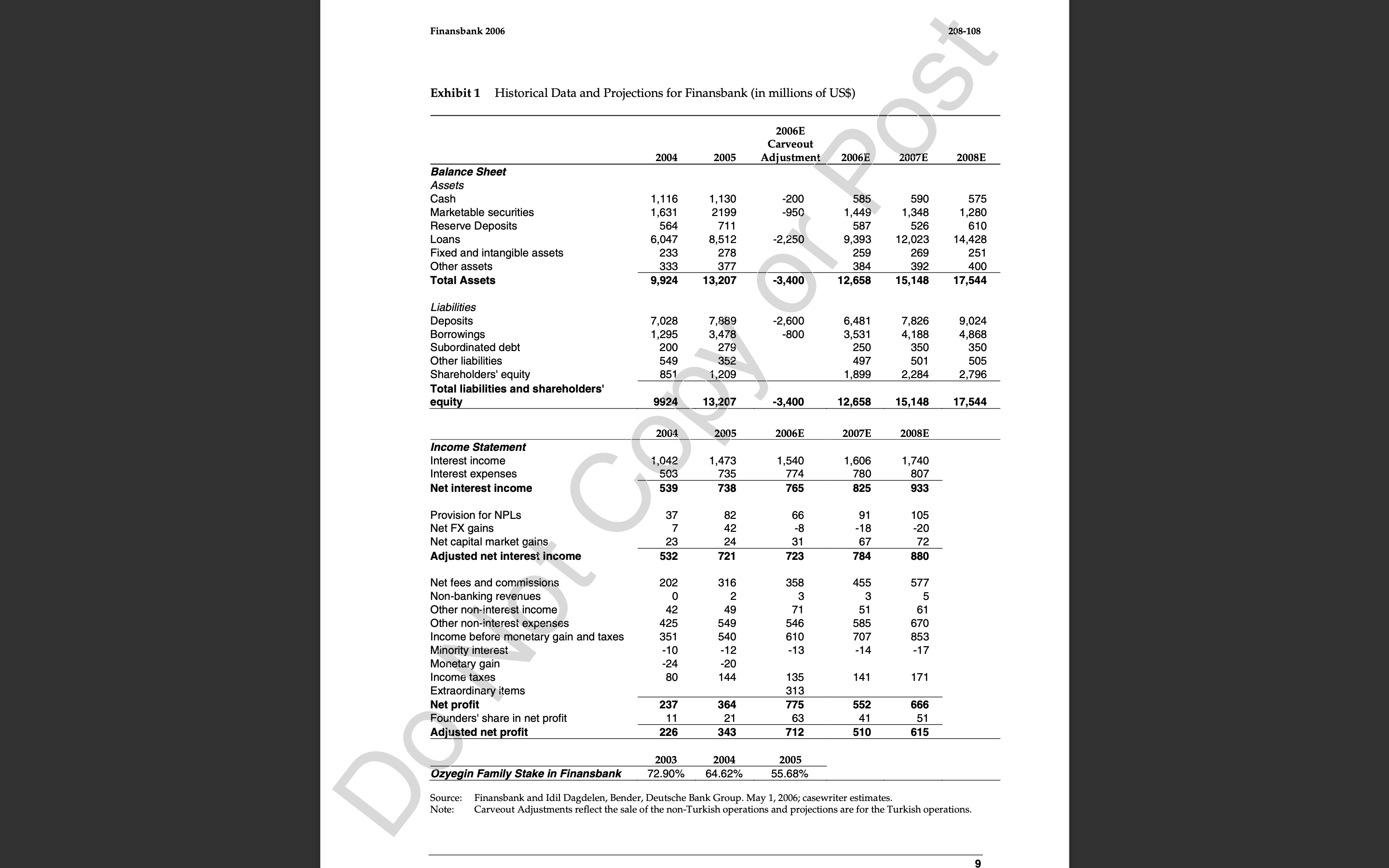

Finansbank 2006 Exhibit 1 Historical Data and Projections for Finansbank (in millions of US$) Balance Sheet Assets Cash Marketable securities Reserve Deposits Loans Fixed and intangible assets Other assets Total Assets Liabilities Deposits Borrowings Subordinated debt Other liabilities Shareholders' equity Total liabilities and shareholders' equity Income Statement Interest income Interest expenses Net interest income Provision for NPLs Net FX gains Net capital market gains Adjusted net interest income Net fees and commissions Non-banking revenues G Other non-interest income Other non-interest expenses Income before monetary gain and taxes Minority interest Monetary gain Income taxes Extraordinary items Net profit Founders' share in net profit Adjusted net profit a 2004 1,116 1,631 564 6,047 233 333 9,924 7,028 1,295 200 549 851 9924 2004 1,042 503 539 37 7 23 532 202 0 42 425 351 -10 -24 80 237 11 226 2006E Carveout 2005 Adjustment 1,130 2199 711 8,512 278 377 13,207 7,889 3,478 279 352 1,209 13,207 2005 1,473 735 738 82 42 24 721 316 2 49 549 540 -12 -20 144 364 21 343 2003 2004 72.90% 64.62% -200 -950 -2,250 -3,400 -2,600 -800 -3,400 2006E 1,540 774 765 66 -8 31 723 358 3 71 546 610 -13 135 313 775 63 712 2005 55.68% 2006E 585 1,449 587 9,393 259 384 12,658 6,481 3,531 250 497 1,899 2007E 1,606 780 825 91 -18 67 784 12,658 15,148 455 3 51 585 707 -14 141 Post 552 41 510 2007E 590 1,348 526 12,023 269 392 15,148 7,826 4,188 350 501 2,284 2008E 1,740 807 933 105 -20 72 880 577 5 61 670 853 -17 171 666 51 615 2008E 575 1,280 610 14,428 251 400 17,544 9,024 4,868 350 505 2,796 17,544 zyegin Family Stake in Finansbank Source: Finansbank and Idil Dagdelen, Bender, Deutsche Bank Group. May 1, 2006; casewriter estimates. Carveout Adjustments reflect the sale of the non-Turkish operations and projections are for the Turkish operations. Note: 9

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To conduct a valuation of Finansbank we will need to make several assumptions since the provided information is limited Here are some assumptio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started