Answered step by step

Verified Expert Solution

Question

1 Approved Answer

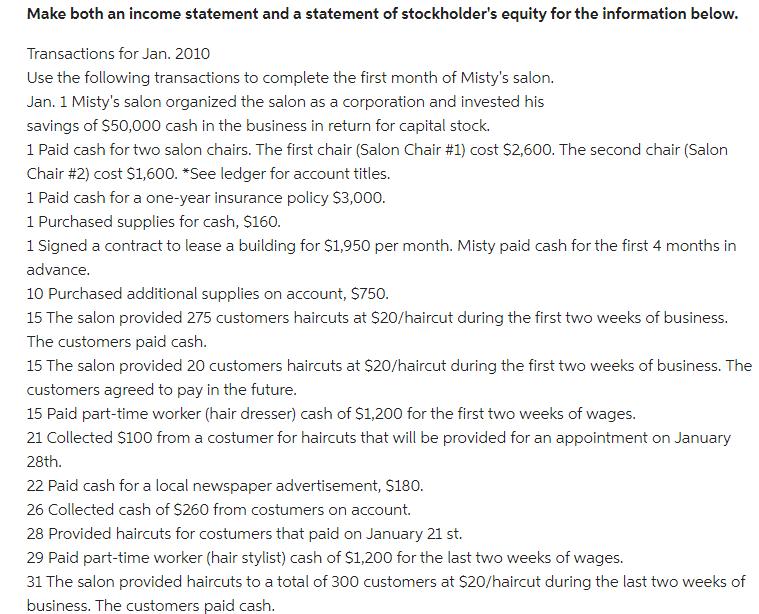

Make both an income statement and a statement of stockholder's equity for the information below. Transactions for Jan. 2010 Use the following transactions to

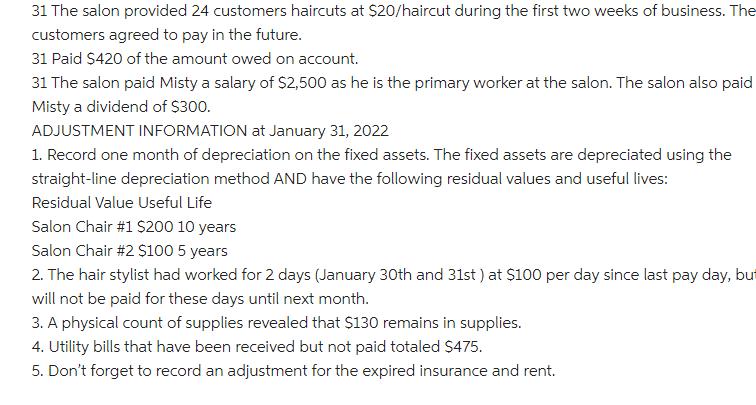

Make both an income statement and a statement of stockholder's equity for the information below. Transactions for Jan. 2010 Use the following transactions to complete the first month of Misty's salon. Jan. 1 Misty's salon organized the salon as a corporation and invested his savings of $50,000 cash in the business in return for capital stock. 1 Paid cash for two salon chairs. The first chair (Salon Chair #1) cost $2,600. The second chair (Salon Chair #2) cost $1,600. *See ledger for account titles. 1 Paid cash for a one-year insurance policy $3,000. 1 Purchased supplies for cash, $160. 1 Signed a contract to lease a building for $1,950 per month. Misty paid cash for the first 4 months in advance. 10 Purchased additional supplies on account, $750. 15 The salon provided 275 customers haircuts at $20/haircut during the first two weeks of business. The customers paid cash. 15 The salon provided 20 customers haircuts at $20/haircut during the first two weeks of business. The customers agreed to pay in the future. 15 Paid part-time worker (hair dresser) cash of $1,200 for the first two weeks of wages. 21 Collected $100 from a costumer for haircuts that will be provided for an appointment on January 28th. 22 Paid cash for a local newspaper advertisement, $180. 26 Collected cash of $260 from costumers on account. 28 Provided haircuts for costumers that paid on January 21 st. 29 Paid part-time worker (hair stylist) cash of $1,200 for the last two weeks of wages. 31 The salon provided haircuts to a total of 300 customers at $20/haircut during the last two weeks of business. The customers paid cash. 31 The salon provided 24 customers haircuts at $20/haircut during the first two weeks of business. The customers agreed to pay in the future. 31 Paid $420 of the amount owed on account. 31 The salon paid Misty a salary of $2,500 as he is the primary worker at the salon. The salon also paid Misty a dividend of $300. ADJUSTMENT INFORMATION at January 31, 2022 1. Record one month of depreciation on the fixed assets. The fixed assets are depreciated using the straight-line depreciation method AND have the following residual values and useful lives: Residual Value Useful Life Salon Chair #1 $200 10 years Salon Chair #2 $100 5 years 2. The hair stylist had worked for 2 days (January 30th and 31st) at $100 per day since last pay day, but will not be paid for these days until next month. 3. A physical count of supplies revealed that $130 remains in supplies. 4. Utility bills that have been received but not paid totaled $475. 5. Don't forget to record an adjustment for the expired insurance and rent.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started