Answered step by step

Verified Expert Solution

Question

1 Approved Answer

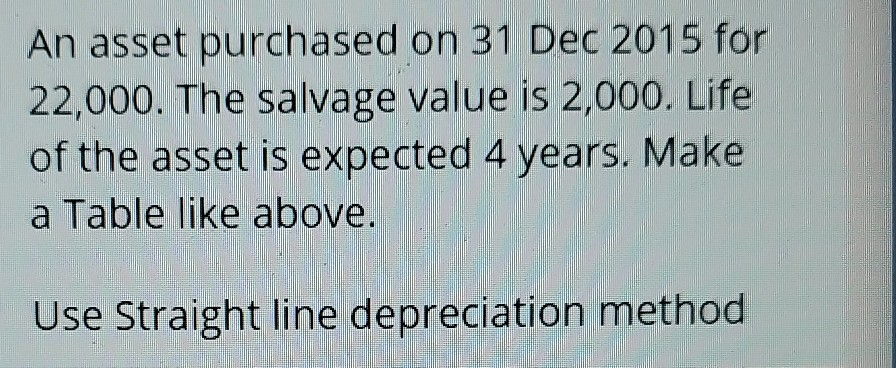

make it like this table An asset purchased on 31 Dec 2015 for 22,000. The salvage value is 2,000. Life of the asset is expected

make it like this table

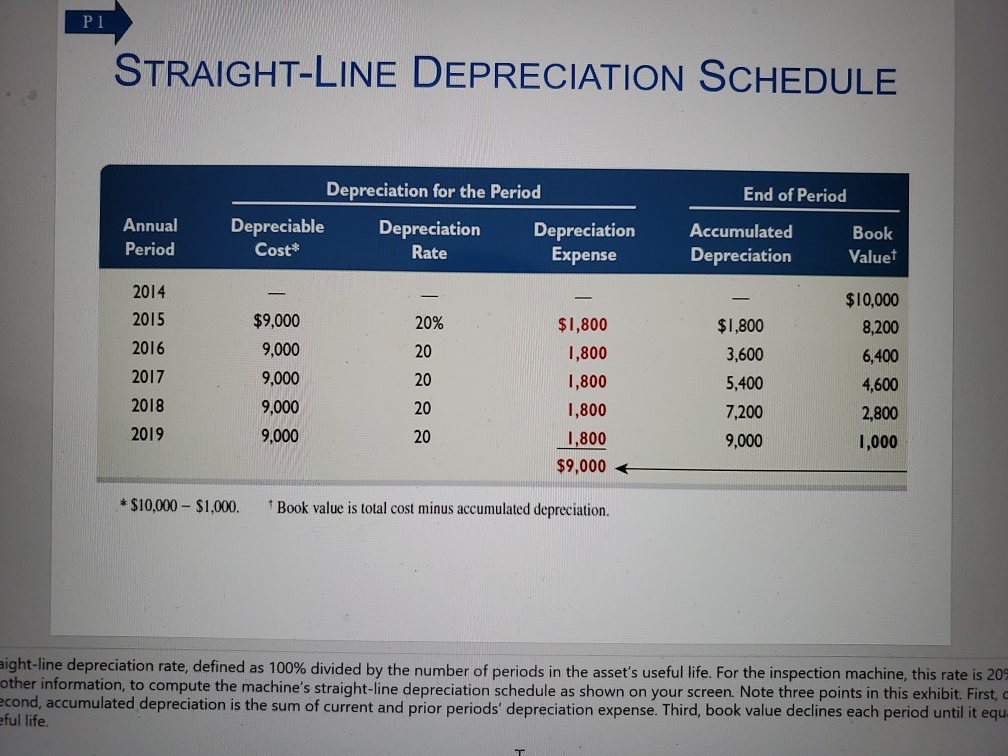

An asset purchased on 31 Dec 2015 for 22,000. The salvage value is 2,000. Life of the asset is expected 4 years. Make a Table like above. Use Straight line depreciation method PL STRAIGHT-LINE DEPRECIATION SCHEDULE Depreciation for the Period End of Period Annual Period Depreciable Cost* Depreciation Rate Depreciation Expense Accumulated Depreciation Book Valuet 20% $10,000 8,200 6,400 2014 2015 2016 2017 2018 2019 $9,000 9,000 9,000 9,000 9,000 $1,800 1,800 1,800 1,800 1,800 $9,000 $1,800 3,600 5,400 7,200 9,000 4,600 2,800 1,000 * $10,000 - $1,000 Book value is total cost minus accumulated depreciation. sight-line depreciation rate, defined as 100% divided by the number of periods in the asset's useful life. For the inspection machine, this rate is 20 other information, to compute the machine's straight-line depreciation schedule as shown on your screen. Note three points in this exhibit. First, cond, accumulated depreciation is the sum of current and prior periods' depreciation expense. Third, book value declines each period until it equ ful lifeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started