Answered step by step

Verified Expert Solution

Question

1 Approved Answer

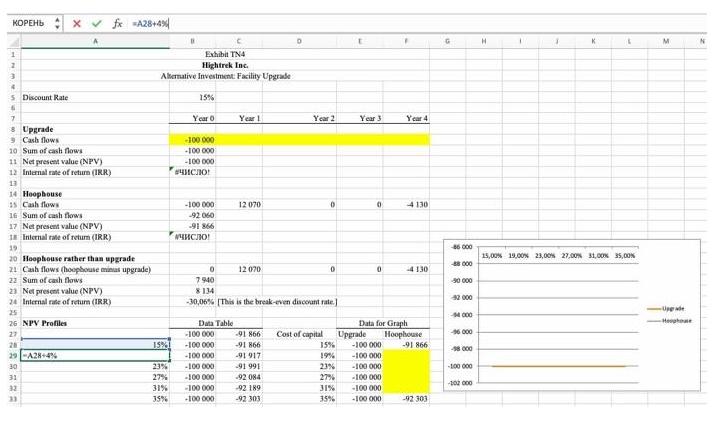

Make notes and and proceed with calculations in Exel (calculate missed numbers, highlighted in yellow) then construct NPV profiles for projects. x fx =A28+43% 1

Make notes and and proceed with calculations in Exel (calculate missed numbers, highlighted in yellow) then construct NPV profiles for projects.

x fx =A28+43% 1 2 5 Discount Rate 7 8 Upgrade 9 Cash flows 10 Sum of cash flows 11 Net present value (NPV) 12 Internal rate of return (IRR) 13 14 Hoophouse 15 Cash flows 16 Sum of cash flows 17 Net present value (NPV) 18 Internal rate of return (IRR) 19 A 20 Hoophouse rather than upgrade 21 Cash flows (hoophouse minus upgrade) 22 Sum of cash flows 23 Net present value (NPV) 24 Internal rate of return (IRR) 25 26 NPV Profiles 27 26 29-A28+4% 30 31 32 33 Exhibit TN4 Hightrek Inc. Alternative Investment Facility Upgrade 15%1 B 23% 27% 31% 35% 15% Year 0 -100 000 -100 000 -100 000 ! -100 000 -92060 -91 866 ! Data Table Year 1 -100 000 -100 000 -100 000 -100 000 -100 000 -100 000 -100 000 12070 12 070 0 7940 8134 -30,06% [This is the break-even discount rate.] -91.866 -91 866 -91 917 -91 991 -92 084 D -92 189 -92 303 Year 2 0 Cost of capital 0 15% 19% 23% 27% 31% 35% E Year 3 0 Upgrade 0 Data for Graph -100 000 -100 000 Year 4 -100 000 -100 000 -100 000 -100 000 4130 4130 Hoophouse -91 866 -92 303 G 86000 -88 000 90 000 42 000 -M4000 -96 000 -18 000 -100 000 -102 000 H 1 1 K L 15,00% 19,00% 23,00% 27,00% 31,00% 35,00% M Upgrade -Hophose

Step by Step Solution

★★★★★

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the calculations and notes you can make in Excel Calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started