Make one initial post to identify and explain (1) one similarity and (2) one difference in the classification of cash flow activities. (Hint: Look in the investing activities section or the financing activities section because the operating activities are prepared using the "indirect method" that you don't need to know. Don't waste time trying to understand the items that you are not familiar. Focus on those discussed in chapter 12. For example, for similarity: "Purchase of property, plant and equipment" is classified as an investing activity under GAAP and it is also classified as an investing activity under IFRS. This is because property, plant, and equipment are long-term assets. Do NOT use this example in your post. Also, do not search Internet, this is NOT a discussion on the differences between IFRS and GAAP in general.

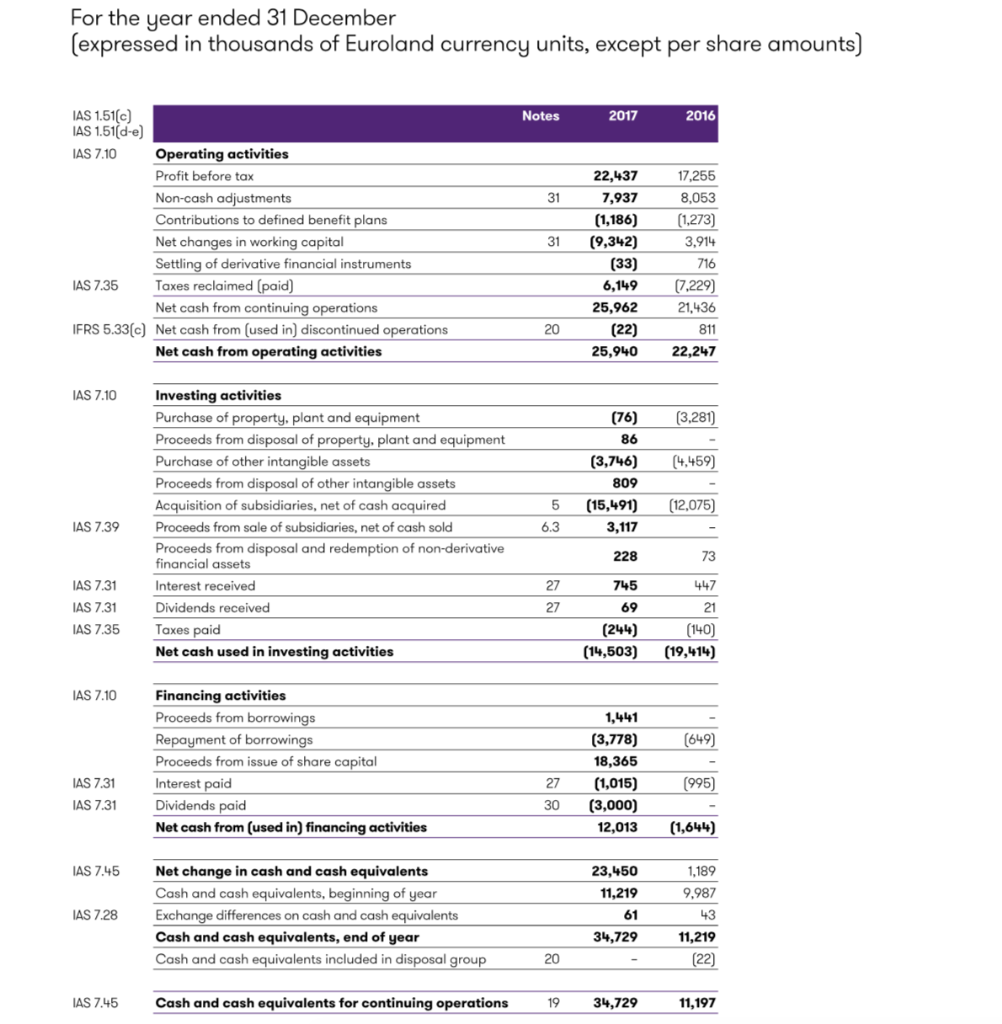

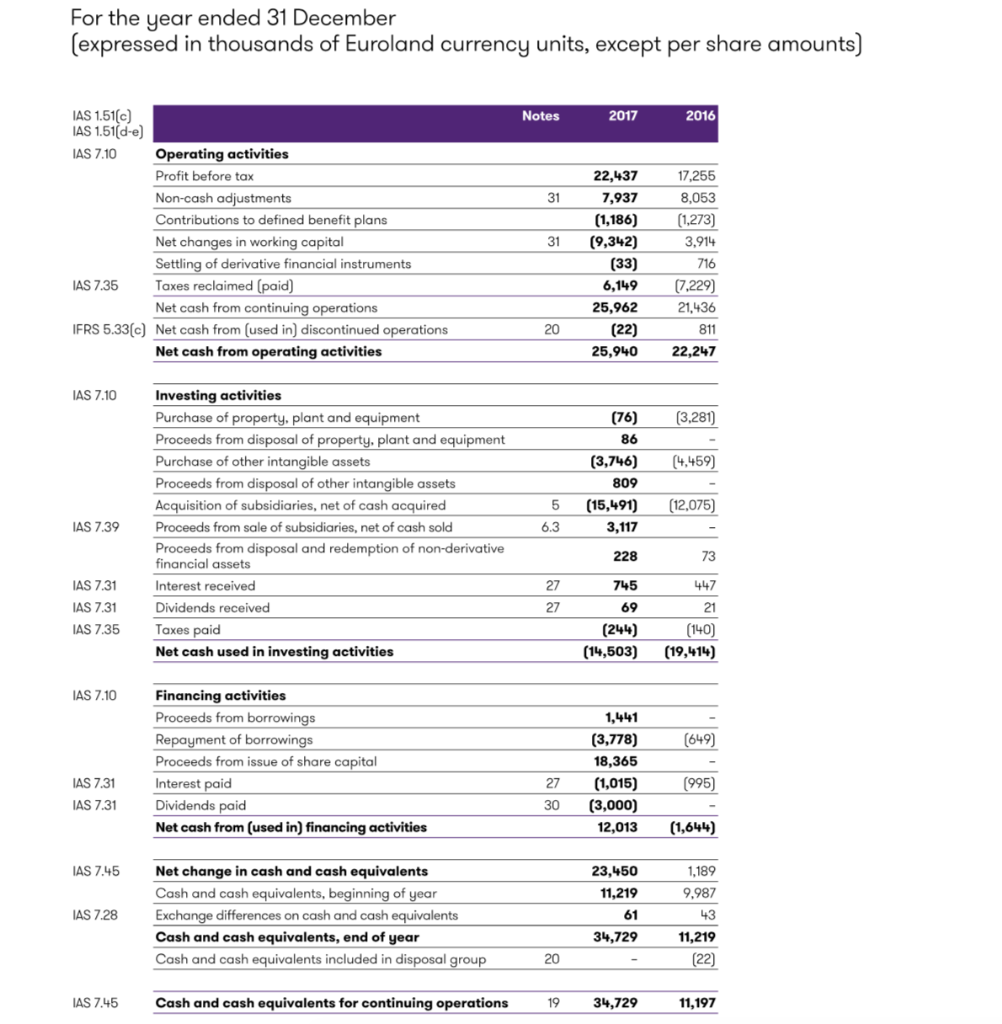

consolidated statement of cash flows:

For the year ended 31 December (expressed in thousands of Euroland currency units, except per share amounts) Notes 2017 2016 31 IAS 1.51C) IAS 1.51d-e) IAS 7.10 Operating activities Profit before tax Non-cash adjustments Contributions to defined benefit plans Net changes in working capital Settling of derivative financial instruments IAS 7.35 Taxes reclaimed (paid) Net cash from continuing operations IFRS 5.33(c) Net cash from (used in) discontinued operations Net cash from operating activities 31 22,437 7,937 (1,186) (9,342) (33) 6,149 25,962 (22) 25,940 17,255 8,053 (1,273) 3,914 716 (7,229) 21,436 811 22,247 20 IAS 7.10 (76) (3,281) 86 (4,459) (12,075) IAS 7.39 Investing activities Purchase of property, plant and equipment Proceeds from disposal of property, plant and equipment Purchase of other intangible assets Proceeds from disposal of other intangible assets Acquisition of subsidiaries, net of cash acquired Proceeds from sale of subsidiaries, net of cash sold Proceeds from disposal and redemption of non-derivative financial assets Interest received Dividends received Taxes paid Net cash used in investing activities (3,746) 809 5 (15,491) 6.3 3,117 228 27 745 2769 (244) (14,503) 73 IAS 7.31 IAS 7.31 IAS 7.35 447 21 (140) (19,414) IAS 7.10 (649) Financing activities Proceeds from borrowings Repayment of borrowings Proceeds from issue of share capital Interest paid Dividends paid Net cash from (used in) financing activities 1,441 (3,778) 18,365 (1,015) (3,000) 12,013 27 (995) IAS 7.31 IAS 7.31 (1,644) IAS 7.45 1,189 ,987 Net change in cash and cash equivalents Cash and cash equivalents, beginning of year Exchange differences on cash and cash equivalents Cash and cash equivalents, end of year Cash and cash equivalents included in disposal group 23,450 11,2199 61 34,729 IAS 7.28 43 11,219 (22) 20 IAS 7.45 Cash and cash equivalents for continuing operations 19 3 4,729 11,197 For the year ended 31 December (expressed in thousands of Euroland currency units, except per share amounts) Notes 2017 2016 31 IAS 1.51C) IAS 1.51d-e) IAS 7.10 Operating activities Profit before tax Non-cash adjustments Contributions to defined benefit plans Net changes in working capital Settling of derivative financial instruments IAS 7.35 Taxes reclaimed (paid) Net cash from continuing operations IFRS 5.33(c) Net cash from (used in) discontinued operations Net cash from operating activities 31 22,437 7,937 (1,186) (9,342) (33) 6,149 25,962 (22) 25,940 17,255 8,053 (1,273) 3,914 716 (7,229) 21,436 811 22,247 20 IAS 7.10 (76) (3,281) 86 (4,459) (12,075) IAS 7.39 Investing activities Purchase of property, plant and equipment Proceeds from disposal of property, plant and equipment Purchase of other intangible assets Proceeds from disposal of other intangible assets Acquisition of subsidiaries, net of cash acquired Proceeds from sale of subsidiaries, net of cash sold Proceeds from disposal and redemption of non-derivative financial assets Interest received Dividends received Taxes paid Net cash used in investing activities (3,746) 809 5 (15,491) 6.3 3,117 228 27 745 2769 (244) (14,503) 73 IAS 7.31 IAS 7.31 IAS 7.35 447 21 (140) (19,414) IAS 7.10 (649) Financing activities Proceeds from borrowings Repayment of borrowings Proceeds from issue of share capital Interest paid Dividends paid Net cash from (used in) financing activities 1,441 (3,778) 18,365 (1,015) (3,000) 12,013 27 (995) IAS 7.31 IAS 7.31 (1,644) IAS 7.45 1,189 ,987 Net change in cash and cash equivalents Cash and cash equivalents, beginning of year Exchange differences on cash and cash equivalents Cash and cash equivalents, end of year Cash and cash equivalents included in disposal group 23,450 11,2199 61 34,729 IAS 7.28 43 11,219 (22) 20 IAS 7.45 Cash and cash equivalents for continuing operations 19 3 4,729 11,197