Answered step by step

Verified Expert Solution

Question

1 Approved Answer

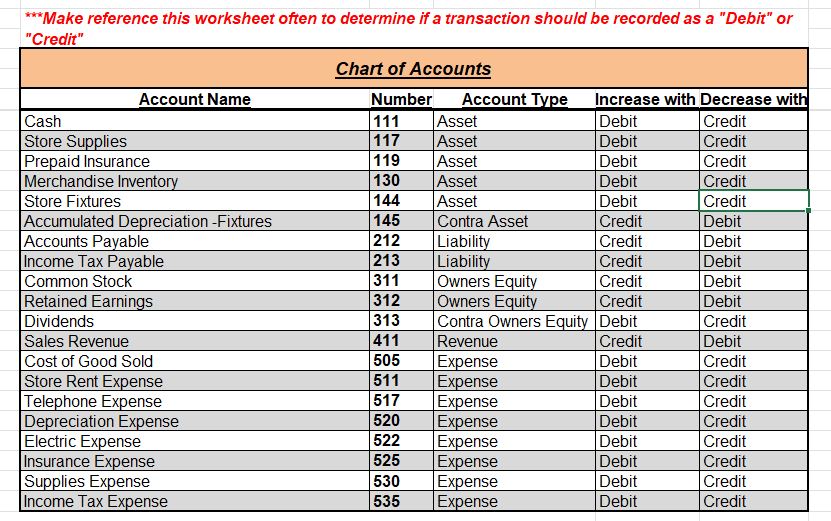

Make reference this worksheet often to determine if a transaction should be recorded as a Debit or Crrentit begin{tabular}{|c|lc} hline 1 & Prepare the Journal

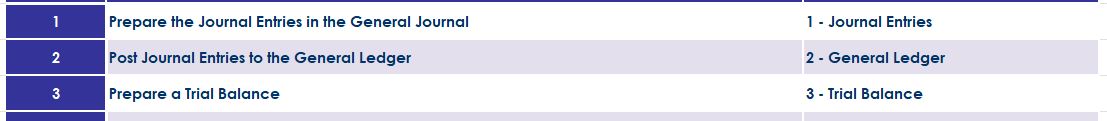

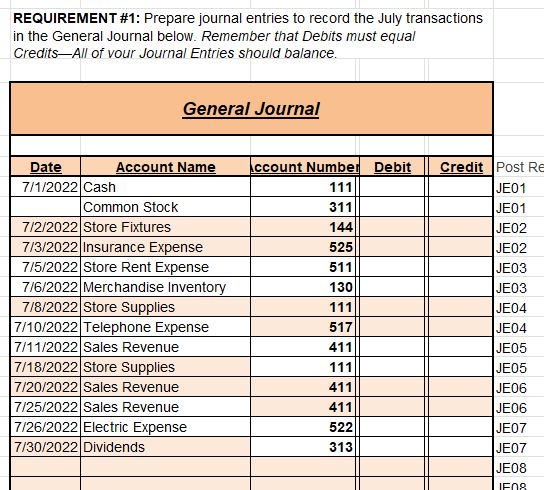

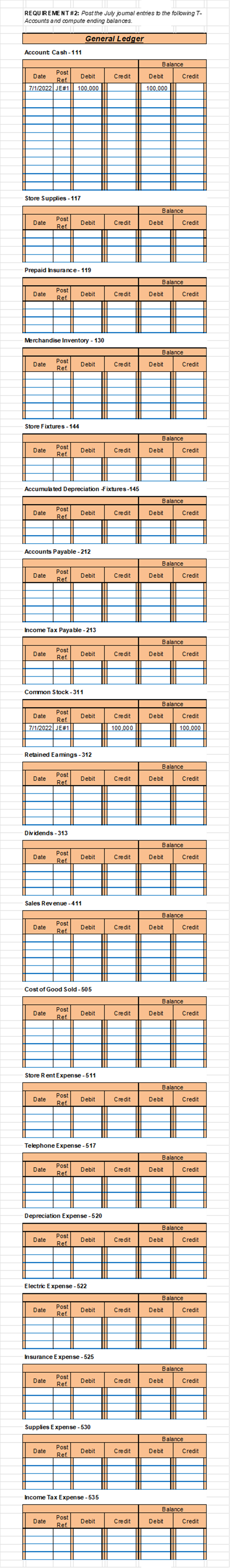

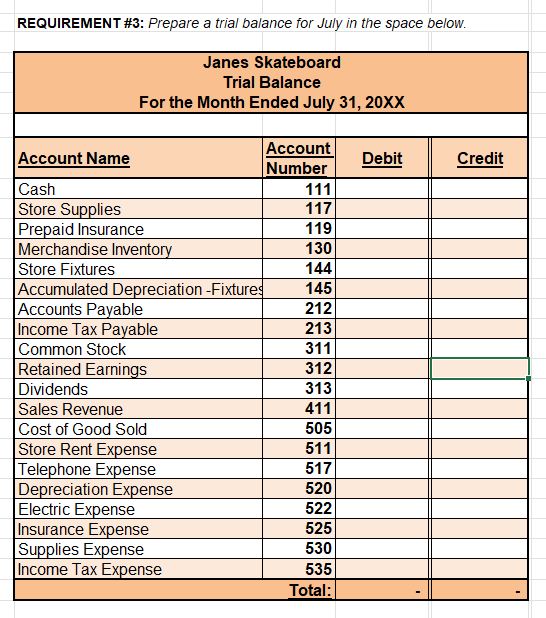

Make reference this worksheet often to determine if a transaction should be recorded as a "Debit" or "Crrentit" \begin{tabular}{|c|lc} \hline 1 & Prepare the Journal Entries in the General Journal & 1 - Journal Entries \\ \hline 2 & Post Journal Entries to the General Ledger & 2 - General Ledger \\ \hline 3 & Prepare a Trial Balance & 3 - Trial Balance \\ \hline \end{tabular} REQUIREMENT \#1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of vour Journal Entries should balance. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } & \\ \hline Date & Account Name & ccount Number & Debit & Credit & Post R \\ \hline \multirow[t]{2}{*}{7/1/2022} & Cash & 111 & & & JE01 \\ \hline & Common Stock & 311 & & & JE01 \\ \hline 7/2/2022 & Store Fixtures & 144 & & & JE02 \\ \hline 7/3/2022 & Insurance Expense & 525 & & & JE02 \\ \hline 7/5/2022 & Store Rent Expense & 511 & & & JE03 \\ \hline 7/6/2022 & Merchandise Inventory & 130 & & & JE03 \\ \hline 7/8/2022 & Store Supplies & 111 & & & JE04 \\ \hline 7/10/2022 & Telephone Expense & 517 & & & JE04 \\ \hline 7/11/2022 & Sales Revenue & 411 & & & JE05 \\ \hline \begin{tabular}{|l|} 7/18/2022 \\ \end{tabular} & Store Supplies & 111 & & & JE05 \\ \hline 7/20/2022 & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/25/2022 \\ \end{tabular} & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/26/2022 \\ \end{tabular} & Electric Expense & 522 & & & JE07 \\ \hline \begin{tabular}{l} 7/30/2022 \\ \end{tabular} & Dividends & 313 & & & JE07 \\ \hline & & & & & JE08 \\ \hline \end{tabular} REQUIREMENT \#3: Prepare a trial balance for July in the space below. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{c} Janes Skateboard \\ Trial Balance \\ For the Month Ended July 31, 20XX \end{tabular}} \\ \hline Account Name & \begin{tabular}{|l|} Account \\ Number \\ \end{tabular} & Debit & Credit \\ \hline Cash & 111 & & \\ \hline Store Supplies & 117 & & \\ \hline Prepaid Insurance & 119 & & \\ \hline Merchandise Inventory & 130 & & \\ \hline \begin{tabular}{|l|l|} Store Fixtures \\ \end{tabular} & 144 & & \\ \hline Accumulated Depreciation-Fixture & 145 & & \\ \hline Accounts Payable & 212 & & \\ \hline Income Tax Payable & 213 & & \\ \hline Common Stock & 311 & & \\ \hline Retained Earnings & 312 & & \\ \hline \begin{tabular}{|l|l|} Dividends \\ \end{tabular} & 313 & & \\ \hline Sales Revenue & 411 & & \\ \hline Cost of Good Sold & 505 & & \\ \hline \begin{tabular}{|l|l|} Store Rent Expense \\ \end{tabular} & 511 & & \\ \hline Telephone Expense & 517 & & \\ \hline Depreciation Expense & 520 & & \\ \hline Electric Expense & 522 & & \\ \hline Insurance Expense & 525 & & \\ \hline Supplies Expense & 530 & & \\ \hline Income Tax Expense & 535 & & \\ \hline & Total: & - & \\ \hline \end{tabular} Make reference this worksheet often to determine if a transaction should be recorded as a "Debit" or "Crrentit" \begin{tabular}{|c|lc} \hline 1 & Prepare the Journal Entries in the General Journal & 1 - Journal Entries \\ \hline 2 & Post Journal Entries to the General Ledger & 2 - General Ledger \\ \hline 3 & Prepare a Trial Balance & 3 - Trial Balance \\ \hline \end{tabular} REQUIREMENT \#1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of vour Journal Entries should balance. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } & \\ \hline Date & Account Name & ccount Number & Debit & Credit & Post R \\ \hline \multirow[t]{2}{*}{7/1/2022} & Cash & 111 & & & JE01 \\ \hline & Common Stock & 311 & & & JE01 \\ \hline 7/2/2022 & Store Fixtures & 144 & & & JE02 \\ \hline 7/3/2022 & Insurance Expense & 525 & & & JE02 \\ \hline 7/5/2022 & Store Rent Expense & 511 & & & JE03 \\ \hline 7/6/2022 & Merchandise Inventory & 130 & & & JE03 \\ \hline 7/8/2022 & Store Supplies & 111 & & & JE04 \\ \hline 7/10/2022 & Telephone Expense & 517 & & & JE04 \\ \hline 7/11/2022 & Sales Revenue & 411 & & & JE05 \\ \hline \begin{tabular}{|l|} 7/18/2022 \\ \end{tabular} & Store Supplies & 111 & & & JE05 \\ \hline 7/20/2022 & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/25/2022 \\ \end{tabular} & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/26/2022 \\ \end{tabular} & Electric Expense & 522 & & & JE07 \\ \hline \begin{tabular}{l} 7/30/2022 \\ \end{tabular} & Dividends & 313 & & & JE07 \\ \hline & & & & & JE08 \\ \hline \end{tabular} REQUIREMENT \#3: Prepare a trial balance for July in the space below. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{c} Janes Skateboard \\ Trial Balance \\ For the Month Ended July 31, 20XX \end{tabular}} \\ \hline Account Name & \begin{tabular}{|l|} Account \\ Number \\ \end{tabular} & Debit & Credit \\ \hline Cash & 111 & & \\ \hline Store Supplies & 117 & & \\ \hline Prepaid Insurance & 119 & & \\ \hline Merchandise Inventory & 130 & & \\ \hline \begin{tabular}{|l|l|} Store Fixtures \\ \end{tabular} & 144 & & \\ \hline Accumulated Depreciation-Fixture & 145 & & \\ \hline Accounts Payable & 212 & & \\ \hline Income Tax Payable & 213 & & \\ \hline Common Stock & 311 & & \\ \hline Retained Earnings & 312 & & \\ \hline \begin{tabular}{|l|l|} Dividends \\ \end{tabular} & 313 & & \\ \hline Sales Revenue & 411 & & \\ \hline Cost of Good Sold & 505 & & \\ \hline \begin{tabular}{|l|l|} Store Rent Expense \\ \end{tabular} & 511 & & \\ \hline Telephone Expense & 517 & & \\ \hline Depreciation Expense & 520 & & \\ \hline Electric Expense & 522 & & \\ \hline Insurance Expense & 525 & & \\ \hline Supplies Expense & 530 & & \\ \hline Income Tax Expense & 535 & & \\ \hline & Total: & - & \\ \hline \end{tabular}

Make reference this worksheet often to determine if a transaction should be recorded as a "Debit" or "Crrentit" \begin{tabular}{|c|lc} \hline 1 & Prepare the Journal Entries in the General Journal & 1 - Journal Entries \\ \hline 2 & Post Journal Entries to the General Ledger & 2 - General Ledger \\ \hline 3 & Prepare a Trial Balance & 3 - Trial Balance \\ \hline \end{tabular} REQUIREMENT \#1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of vour Journal Entries should balance. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } & \\ \hline Date & Account Name & ccount Number & Debit & Credit & Post R \\ \hline \multirow[t]{2}{*}{7/1/2022} & Cash & 111 & & & JE01 \\ \hline & Common Stock & 311 & & & JE01 \\ \hline 7/2/2022 & Store Fixtures & 144 & & & JE02 \\ \hline 7/3/2022 & Insurance Expense & 525 & & & JE02 \\ \hline 7/5/2022 & Store Rent Expense & 511 & & & JE03 \\ \hline 7/6/2022 & Merchandise Inventory & 130 & & & JE03 \\ \hline 7/8/2022 & Store Supplies & 111 & & & JE04 \\ \hline 7/10/2022 & Telephone Expense & 517 & & & JE04 \\ \hline 7/11/2022 & Sales Revenue & 411 & & & JE05 \\ \hline \begin{tabular}{|l|} 7/18/2022 \\ \end{tabular} & Store Supplies & 111 & & & JE05 \\ \hline 7/20/2022 & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/25/2022 \\ \end{tabular} & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/26/2022 \\ \end{tabular} & Electric Expense & 522 & & & JE07 \\ \hline \begin{tabular}{l} 7/30/2022 \\ \end{tabular} & Dividends & 313 & & & JE07 \\ \hline & & & & & JE08 \\ \hline \end{tabular} REQUIREMENT \#3: Prepare a trial balance for July in the space below. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{c} Janes Skateboard \\ Trial Balance \\ For the Month Ended July 31, 20XX \end{tabular}} \\ \hline Account Name & \begin{tabular}{|l|} Account \\ Number \\ \end{tabular} & Debit & Credit \\ \hline Cash & 111 & & \\ \hline Store Supplies & 117 & & \\ \hline Prepaid Insurance & 119 & & \\ \hline Merchandise Inventory & 130 & & \\ \hline \begin{tabular}{|l|l|} Store Fixtures \\ \end{tabular} & 144 & & \\ \hline Accumulated Depreciation-Fixture & 145 & & \\ \hline Accounts Payable & 212 & & \\ \hline Income Tax Payable & 213 & & \\ \hline Common Stock & 311 & & \\ \hline Retained Earnings & 312 & & \\ \hline \begin{tabular}{|l|l|} Dividends \\ \end{tabular} & 313 & & \\ \hline Sales Revenue & 411 & & \\ \hline Cost of Good Sold & 505 & & \\ \hline \begin{tabular}{|l|l|} Store Rent Expense \\ \end{tabular} & 511 & & \\ \hline Telephone Expense & 517 & & \\ \hline Depreciation Expense & 520 & & \\ \hline Electric Expense & 522 & & \\ \hline Insurance Expense & 525 & & \\ \hline Supplies Expense & 530 & & \\ \hline Income Tax Expense & 535 & & \\ \hline & Total: & - & \\ \hline \end{tabular} Make reference this worksheet often to determine if a transaction should be recorded as a "Debit" or "Crrentit" \begin{tabular}{|c|lc} \hline 1 & Prepare the Journal Entries in the General Journal & 1 - Journal Entries \\ \hline 2 & Post Journal Entries to the General Ledger & 2 - General Ledger \\ \hline 3 & Prepare a Trial Balance & 3 - Trial Balance \\ \hline \end{tabular} REQUIREMENT \#1: Prepare journal entries to record the July transactions in the General Journal below. Remember that Debits must equal Credits-All of vour Journal Entries should balance. \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ General Journal } & \\ \hline Date & Account Name & ccount Number & Debit & Credit & Post R \\ \hline \multirow[t]{2}{*}{7/1/2022} & Cash & 111 & & & JE01 \\ \hline & Common Stock & 311 & & & JE01 \\ \hline 7/2/2022 & Store Fixtures & 144 & & & JE02 \\ \hline 7/3/2022 & Insurance Expense & 525 & & & JE02 \\ \hline 7/5/2022 & Store Rent Expense & 511 & & & JE03 \\ \hline 7/6/2022 & Merchandise Inventory & 130 & & & JE03 \\ \hline 7/8/2022 & Store Supplies & 111 & & & JE04 \\ \hline 7/10/2022 & Telephone Expense & 517 & & & JE04 \\ \hline 7/11/2022 & Sales Revenue & 411 & & & JE05 \\ \hline \begin{tabular}{|l|} 7/18/2022 \\ \end{tabular} & Store Supplies & 111 & & & JE05 \\ \hline 7/20/2022 & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/25/2022 \\ \end{tabular} & Sales Revenue & 411 & & & JE06 \\ \hline \begin{tabular}{l} 7/26/2022 \\ \end{tabular} & Electric Expense & 522 & & & JE07 \\ \hline \begin{tabular}{l} 7/30/2022 \\ \end{tabular} & Dividends & 313 & & & JE07 \\ \hline & & & & & JE08 \\ \hline \end{tabular} REQUIREMENT \#3: Prepare a trial balance for July in the space below. \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{\begin{tabular}{c} Janes Skateboard \\ Trial Balance \\ For the Month Ended July 31, 20XX \end{tabular}} \\ \hline Account Name & \begin{tabular}{|l|} Account \\ Number \\ \end{tabular} & Debit & Credit \\ \hline Cash & 111 & & \\ \hline Store Supplies & 117 & & \\ \hline Prepaid Insurance & 119 & & \\ \hline Merchandise Inventory & 130 & & \\ \hline \begin{tabular}{|l|l|} Store Fixtures \\ \end{tabular} & 144 & & \\ \hline Accumulated Depreciation-Fixture & 145 & & \\ \hline Accounts Payable & 212 & & \\ \hline Income Tax Payable & 213 & & \\ \hline Common Stock & 311 & & \\ \hline Retained Earnings & 312 & & \\ \hline \begin{tabular}{|l|l|} Dividends \\ \end{tabular} & 313 & & \\ \hline Sales Revenue & 411 & & \\ \hline Cost of Good Sold & 505 & & \\ \hline \begin{tabular}{|l|l|} Store Rent Expense \\ \end{tabular} & 511 & & \\ \hline Telephone Expense & 517 & & \\ \hline Depreciation Expense & 520 & & \\ \hline Electric Expense & 522 & & \\ \hline Insurance Expense & 525 & & \\ \hline Supplies Expense & 530 & & \\ \hline Income Tax Expense & 535 & & \\ \hline & Total: & - & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started