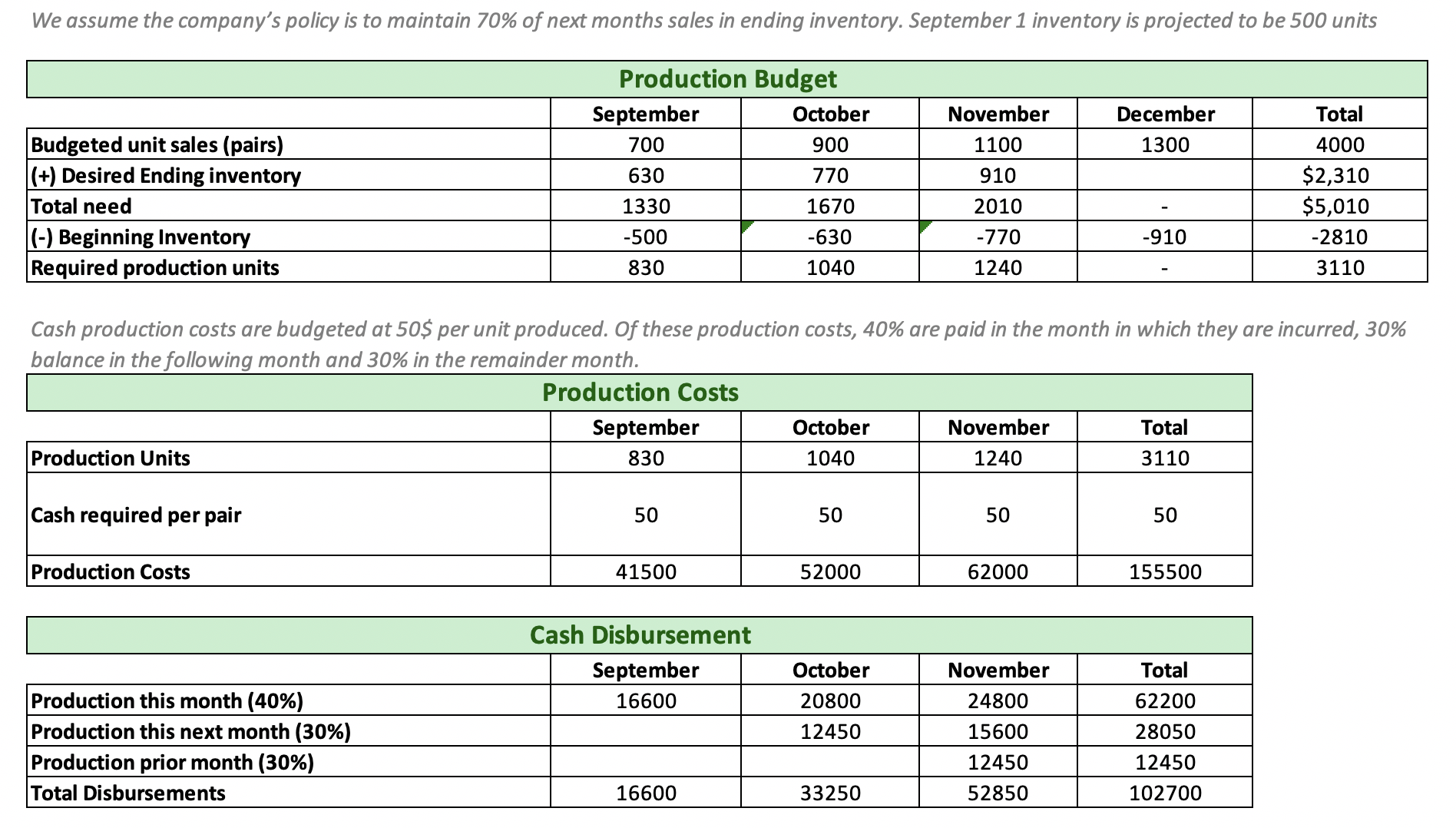

Make sure the master budgets are correct and all add up if not apply the correct answers. The information given above the tables are all hypothetical so can be changed or altered with. They are not all done correctly some numbers dont make sense in the tables.

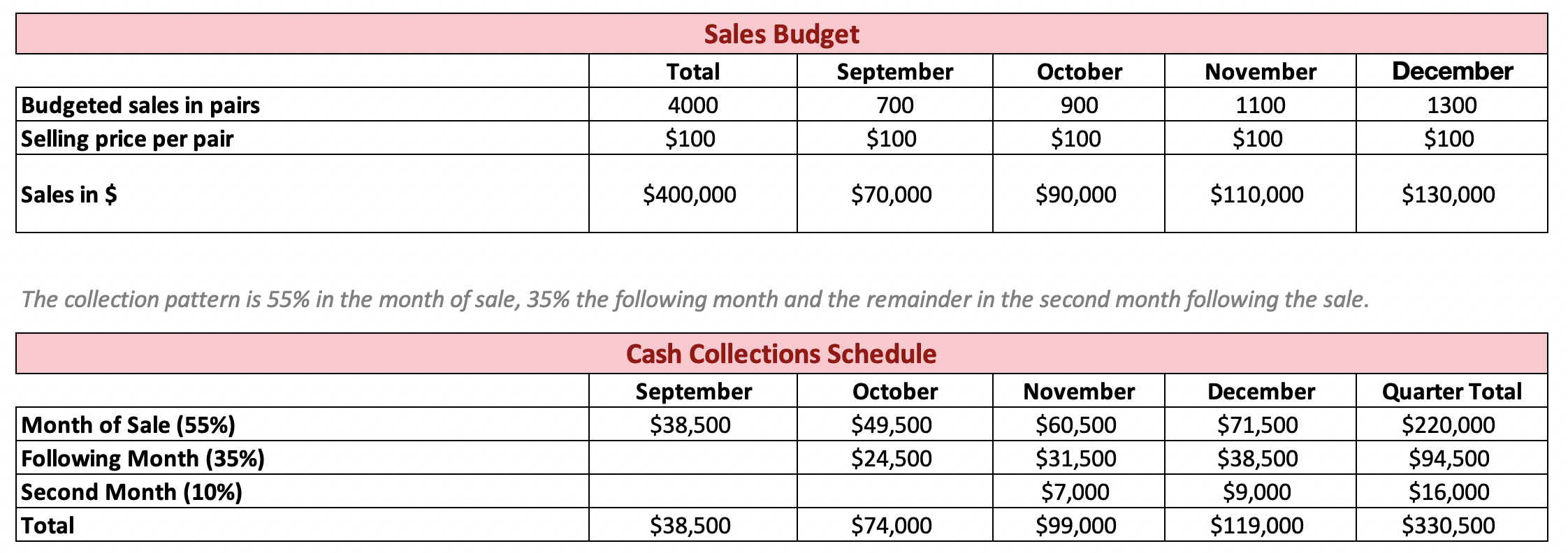

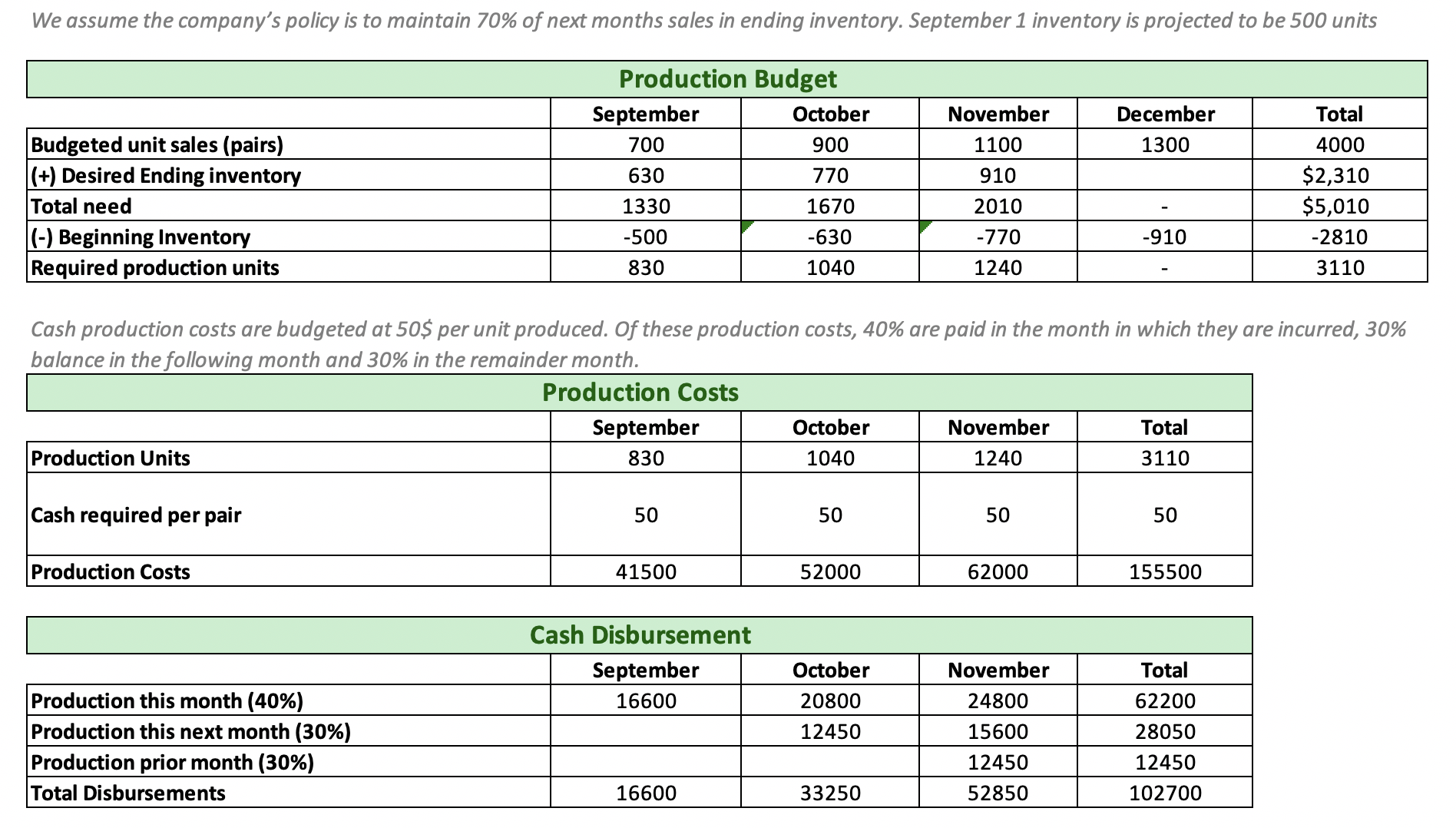

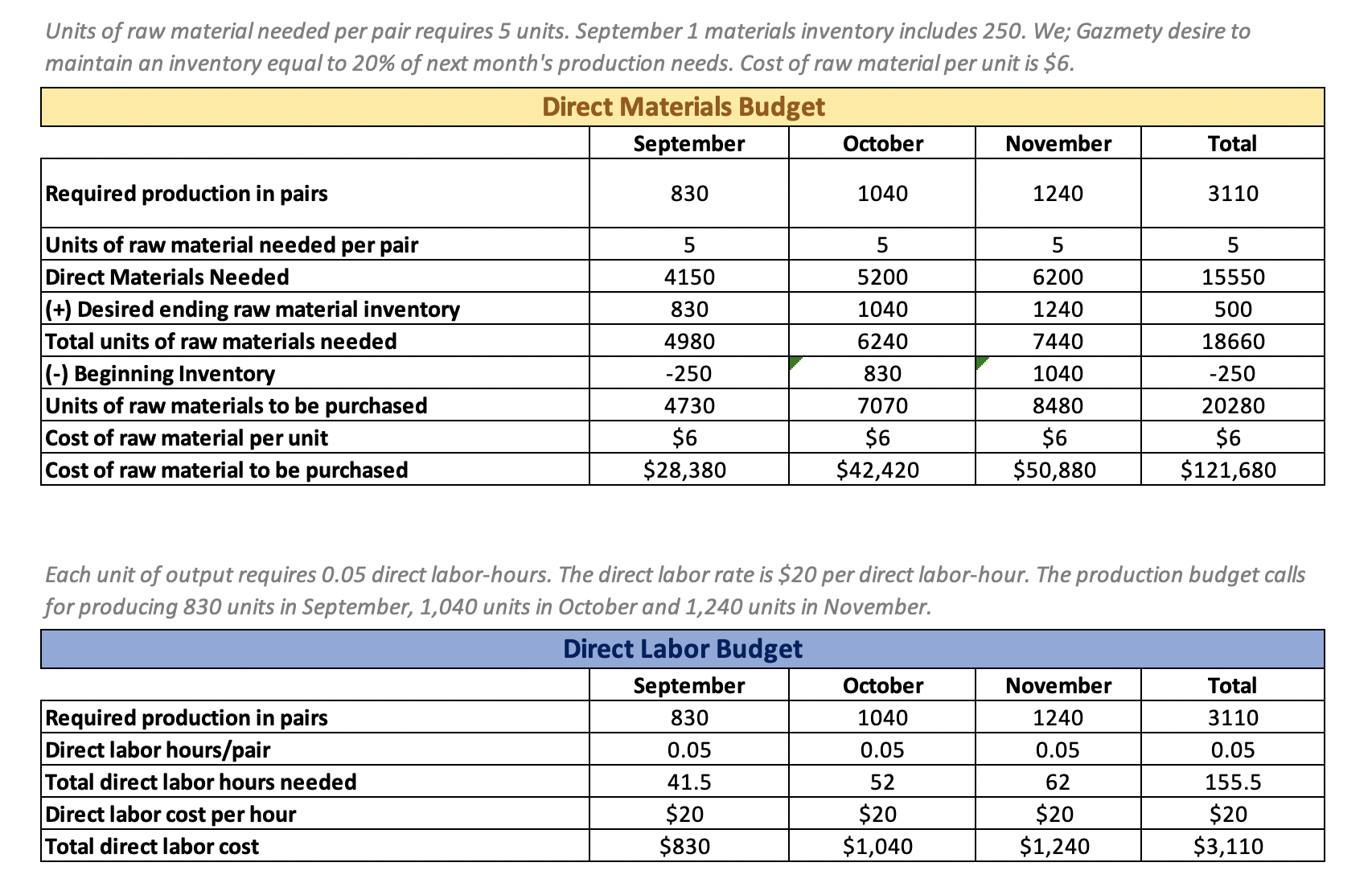

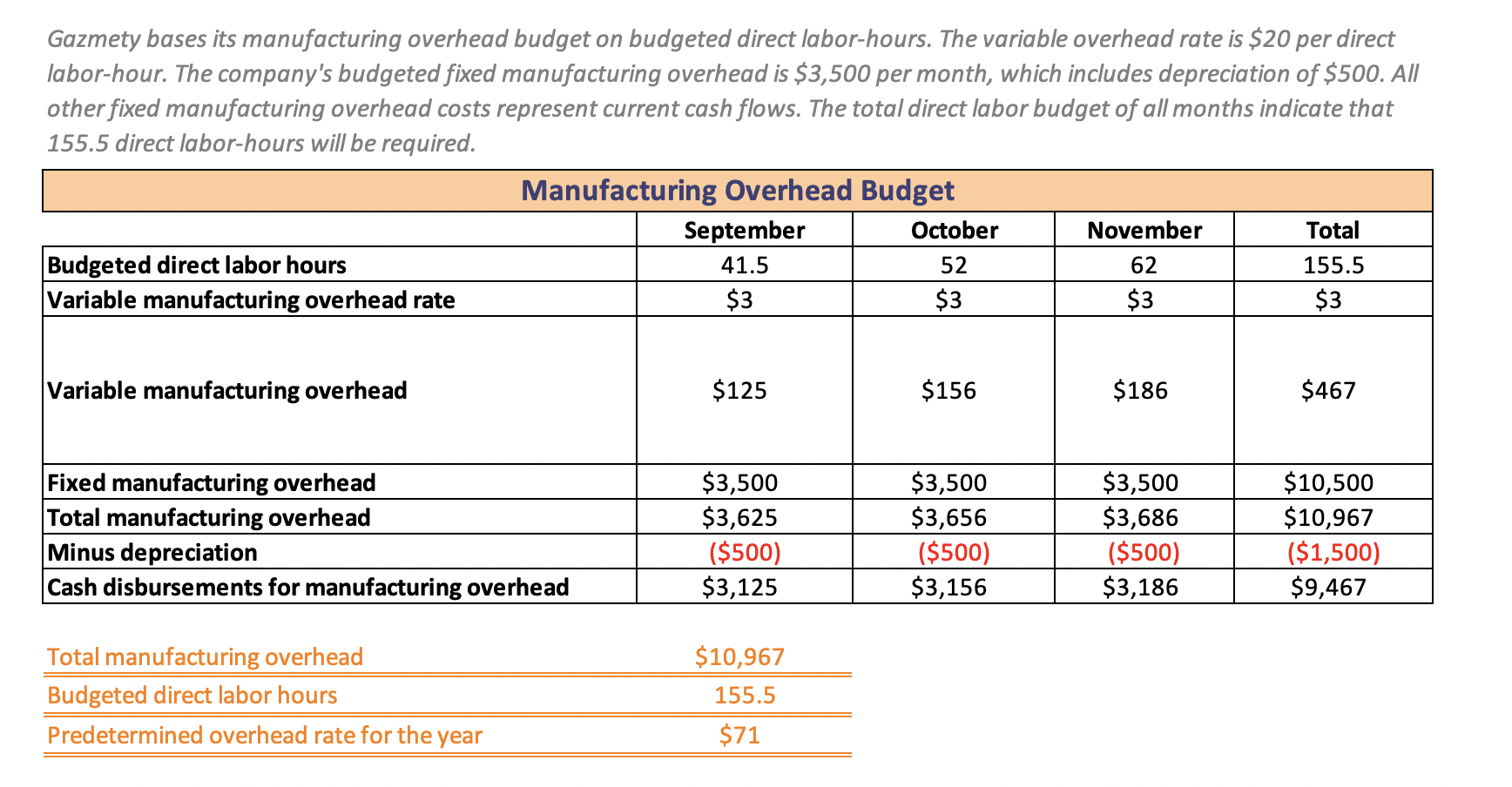

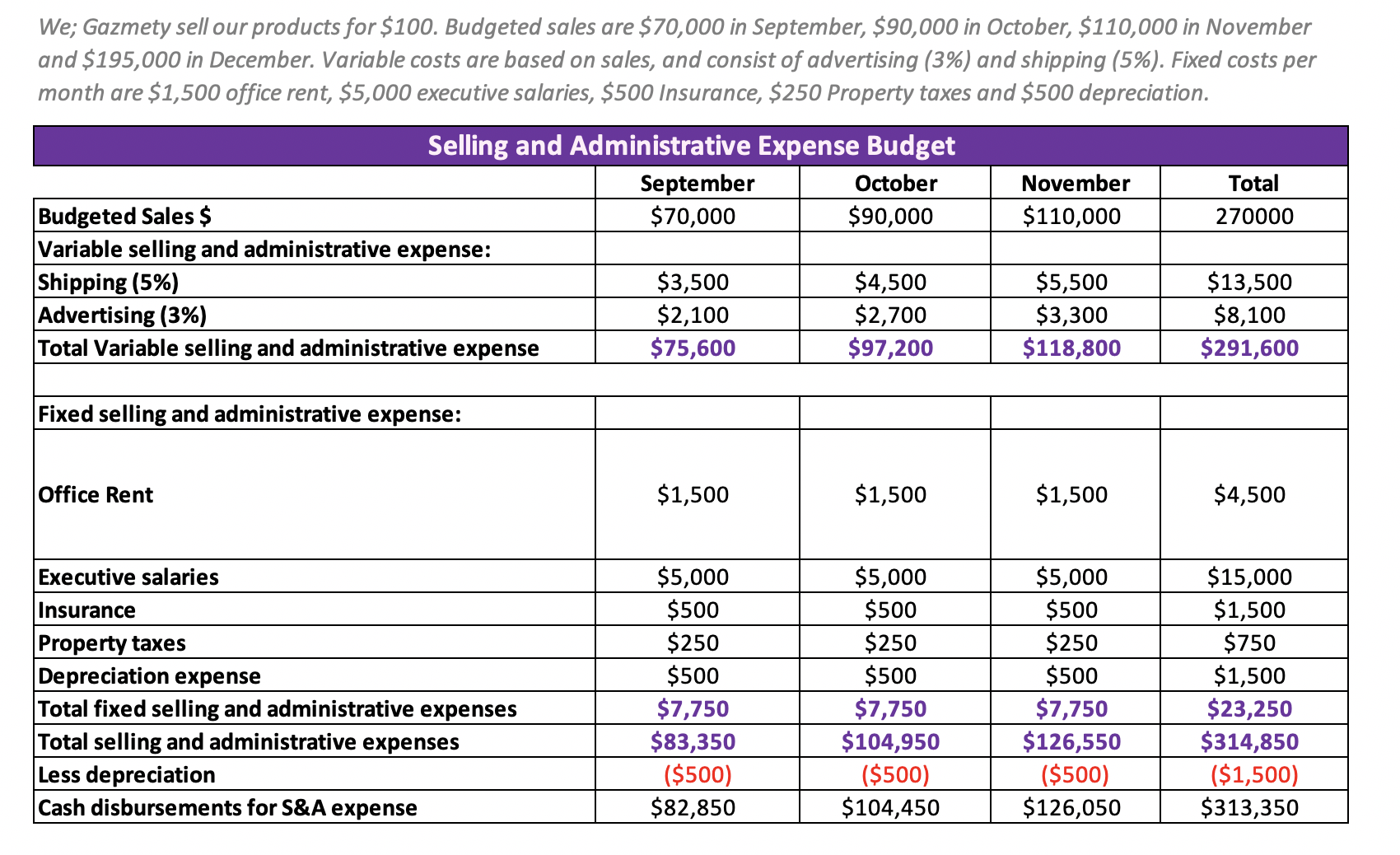

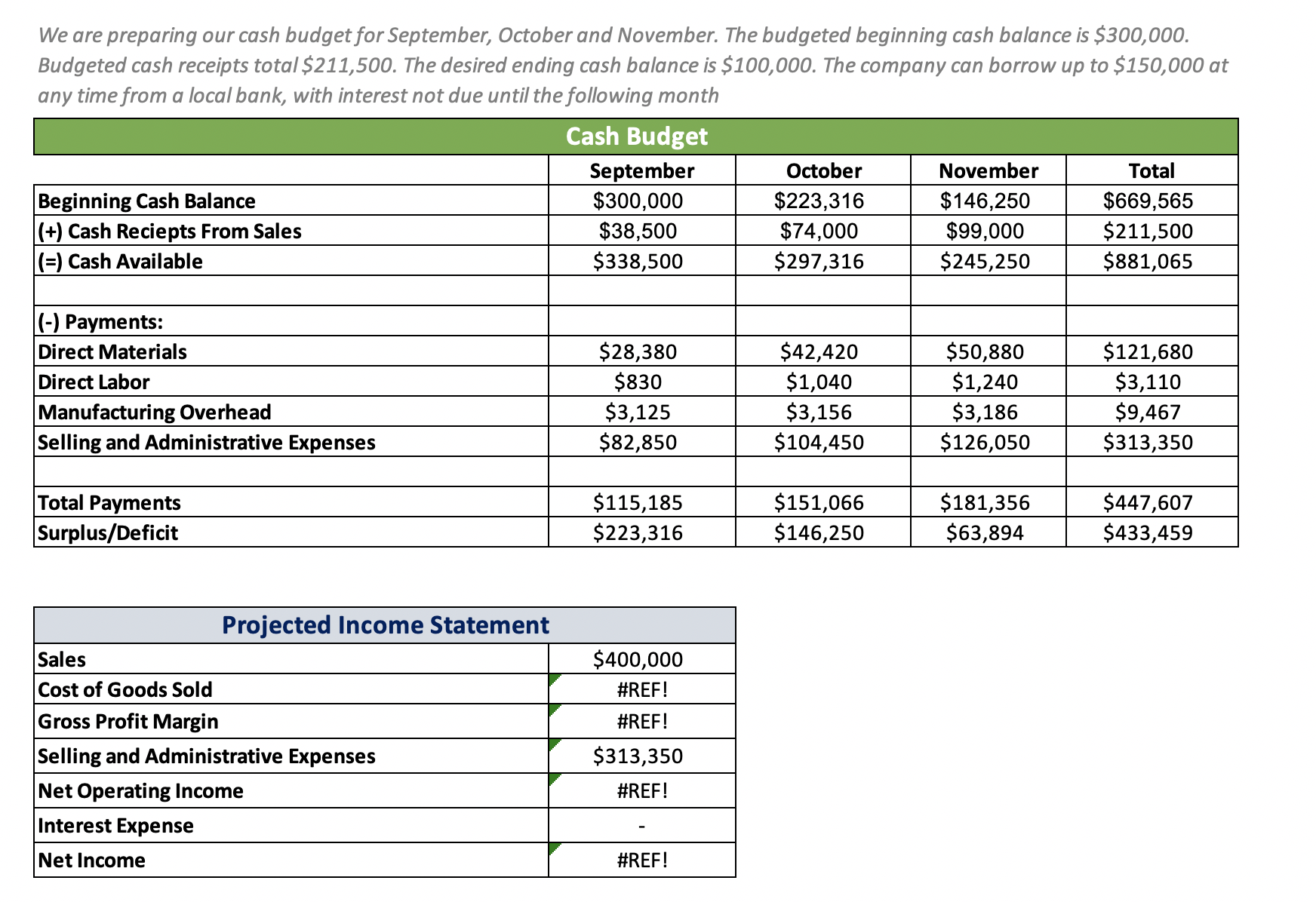

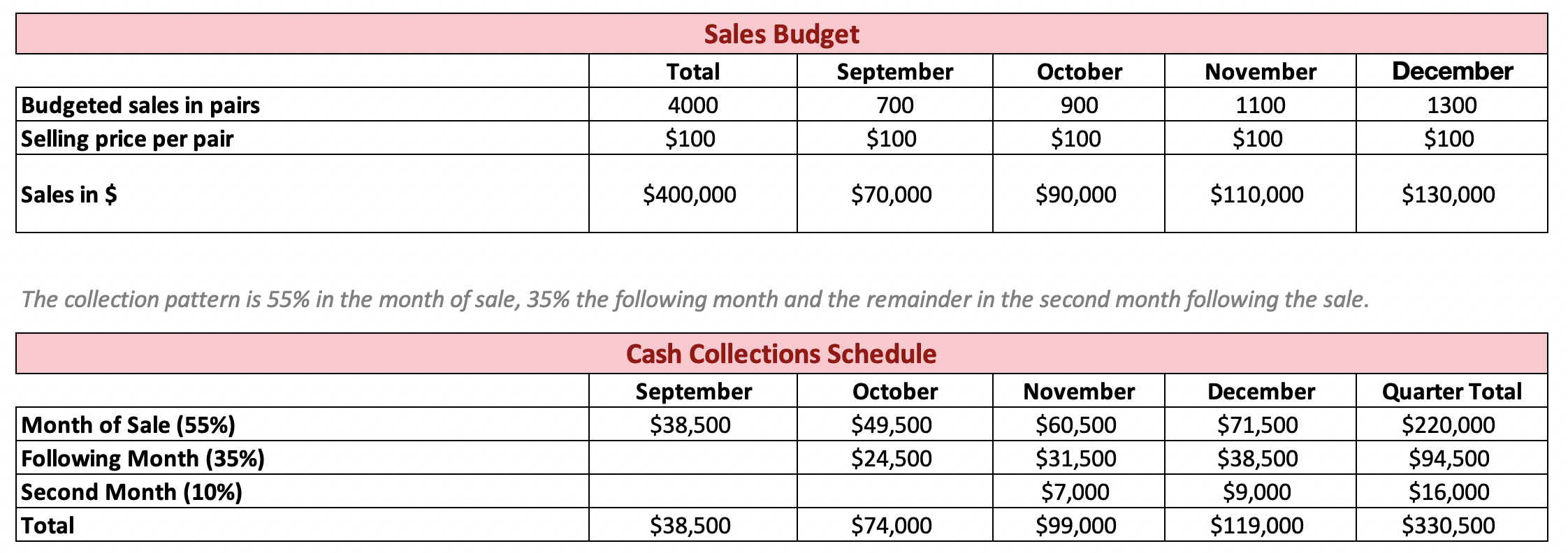

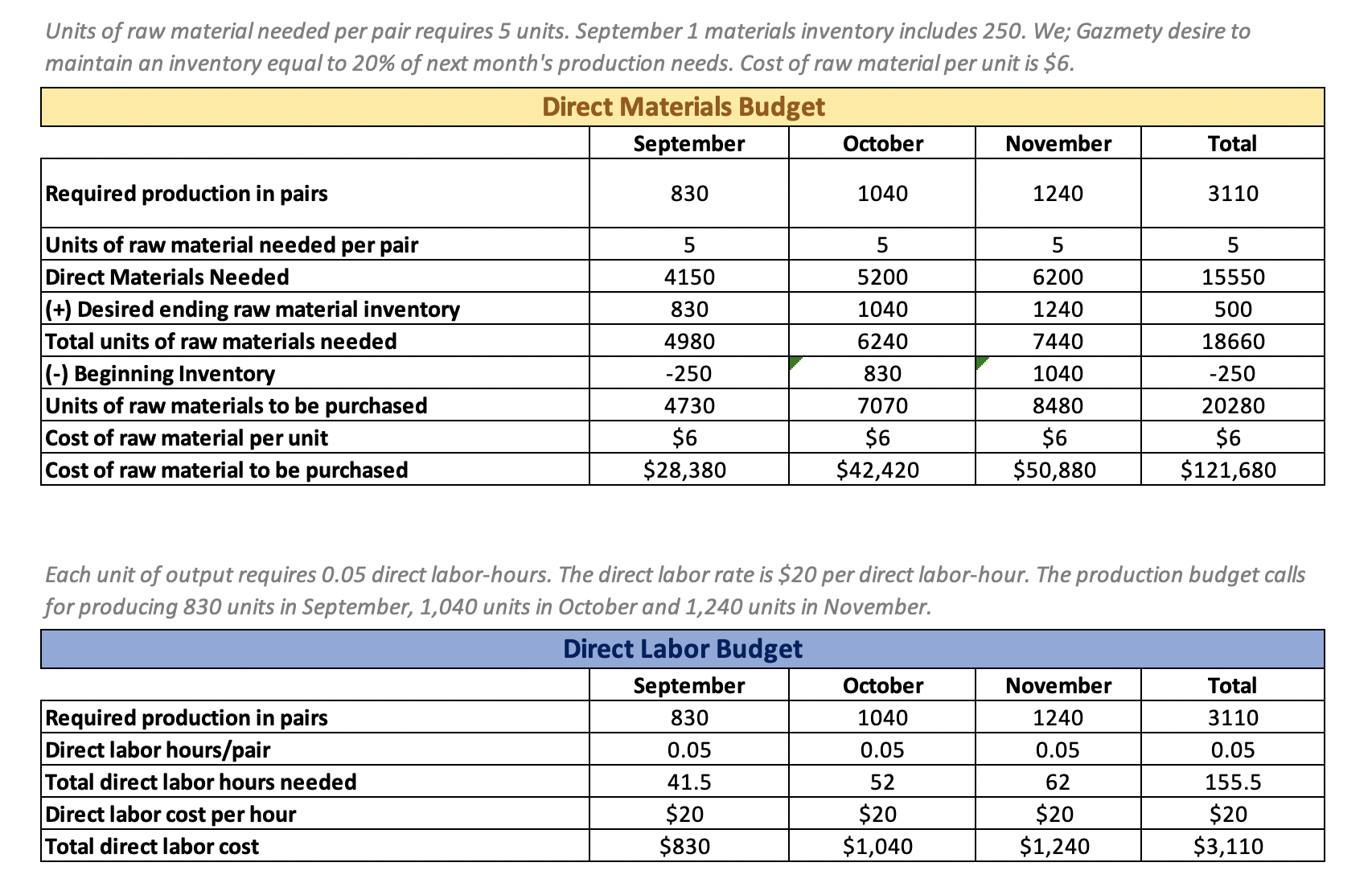

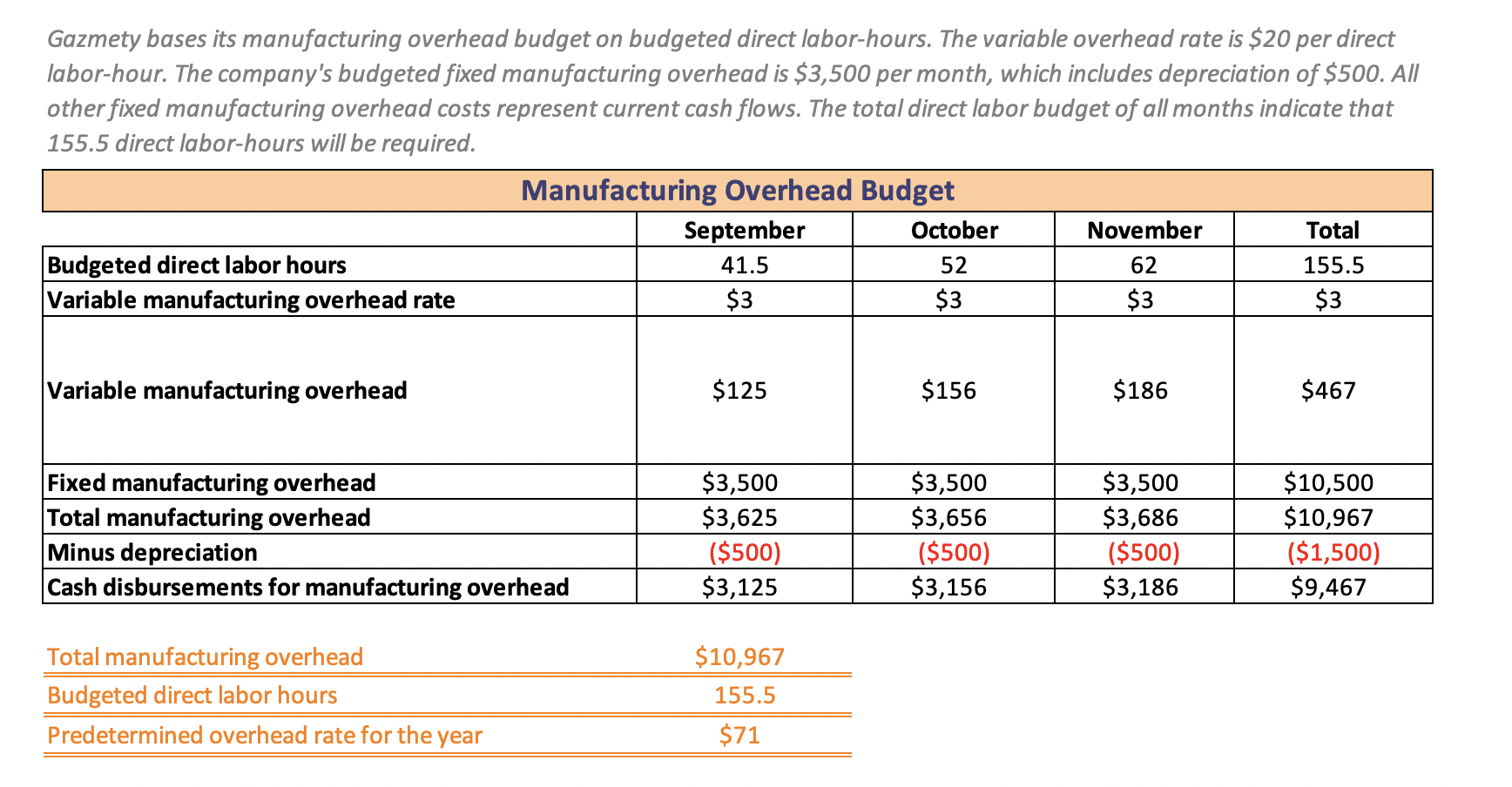

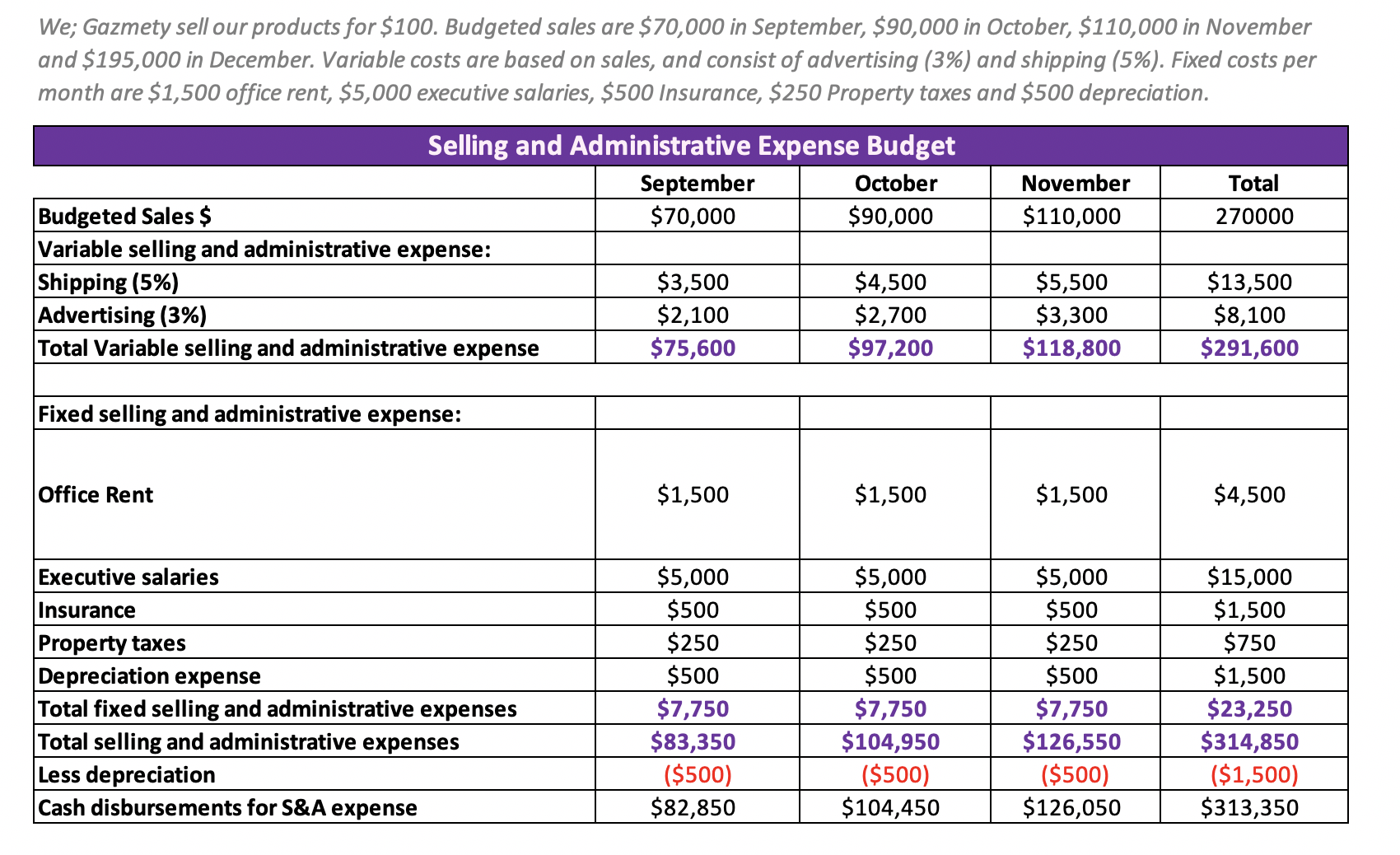

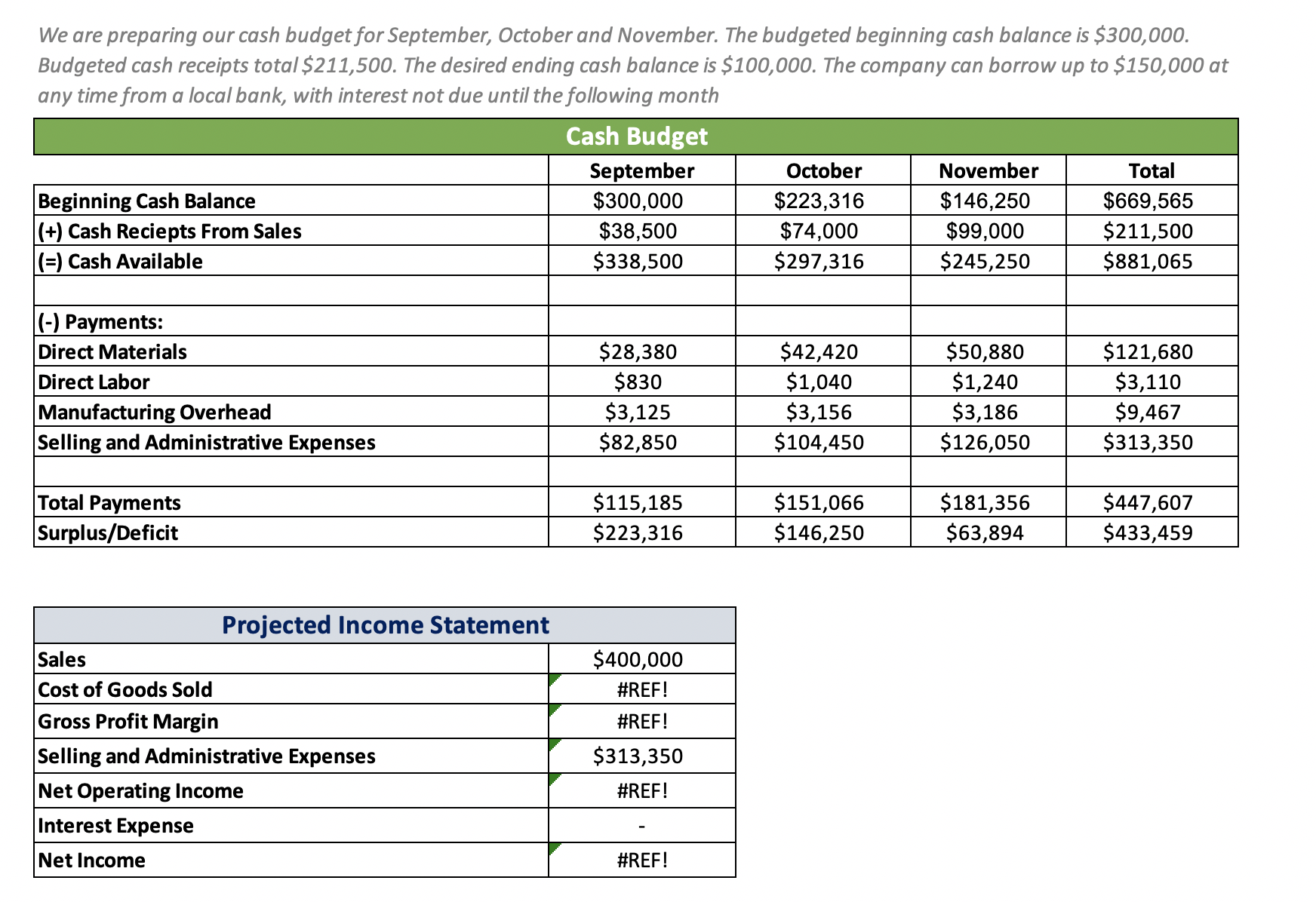

\begin{tabular}{|l|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Sales Budget } \\ \hline & Total & September & October & November & December \\ \hline Budgeted sales in pairs & 4000 & 700 & 900 & 1100 & 1300 \\ \hline Selling price per pair & $100 & $100 & $100 & $100 & $100 \\ \hline Sales in $ & $400,000 & $70,000 & $90,000 & $110,000 & $130,000 \\ \hline \end{tabular} The collection pattern is 55% in the month of sale, 35% the following month and the remainder in the second month following the sale. Cash production costs are budgeted at 50$ per unit produced. Of these production costs, 40% are paid in the month in which they are balance in the following month and 30% in the remainder month. Units of raw material needed per pair requires 5 units. September 1 materials inventory includes 250 . We; Gazmety desire to maintain an inventory equal to 20% of next month's production needs. Cost of raw material per unit is $6. Each unit of output requires 0.05 direct labor-hours. The direct labor rate is $20 per direct labor-hour. The production budget calls for producing 830 units in September, 1,040 units in October and 1,240 units in November. Gazmety bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $20 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $3,500 per month, which includes depreciation of $500. All other fixed manufacturing overhead costs represent current cash flows. The total direct labor budget of all months indicate that We; Gazmety sell our products for $100. Budgeted sales are $70,000 in September, $90,000 in October, $110,000 in November and \$195,000 in December. Variable costs are based on sales, and consist of advertising (3\%) and shipping (5\%). Fixed costs per We are preparing our cash budget for September, October and November. The budgeted beginning cash balance is $300,000. Budgeted cash receipts total $211,500. The desired ending cash balance is $100,000. The company can borrow up to $150,000 at any time from a local bank, with interest not due until the following month \begin{tabular}{|l|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Sales Budget } \\ \hline & Total & September & October & November & December \\ \hline Budgeted sales in pairs & 4000 & 700 & 900 & 1100 & 1300 \\ \hline Selling price per pair & $100 & $100 & $100 & $100 & $100 \\ \hline Sales in $ & $400,000 & $70,000 & $90,000 & $110,000 & $130,000 \\ \hline \end{tabular} The collection pattern is 55% in the month of sale, 35% the following month and the remainder in the second month following the sale. Cash production costs are budgeted at 50$ per unit produced. Of these production costs, 40% are paid in the month in which they are balance in the following month and 30% in the remainder month. Units of raw material needed per pair requires 5 units. September 1 materials inventory includes 250 . We; Gazmety desire to maintain an inventory equal to 20% of next month's production needs. Cost of raw material per unit is $6. Each unit of output requires 0.05 direct labor-hours. The direct labor rate is $20 per direct labor-hour. The production budget calls for producing 830 units in September, 1,040 units in October and 1,240 units in November. Gazmety bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $20 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $3,500 per month, which includes depreciation of $500. All other fixed manufacturing overhead costs represent current cash flows. The total direct labor budget of all months indicate that We; Gazmety sell our products for $100. Budgeted sales are $70,000 in September, $90,000 in October, $110,000 in November and \$195,000 in December. Variable costs are based on sales, and consist of advertising (3\%) and shipping (5\%). Fixed costs per We are preparing our cash budget for September, October and November. The budgeted beginning cash balance is $300,000. Budgeted cash receipts total $211,500. The desired ending cash balance is $100,000. The company can borrow up to $150,000 at any time from a local bank, with interest not due until the following month