Answered step by step

Verified Expert Solution

Question

1 Approved Answer

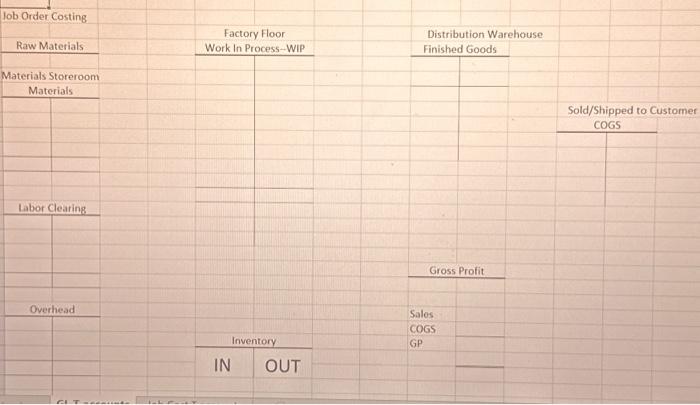

Make T accounts like the example and fill them for transactions Fotf and Balance your T accounts... Thanks Farm Equipment inc produces tractors and other

Make T accounts like the example and fill them for transactions Fotf and Balance your T accounts... Thanks

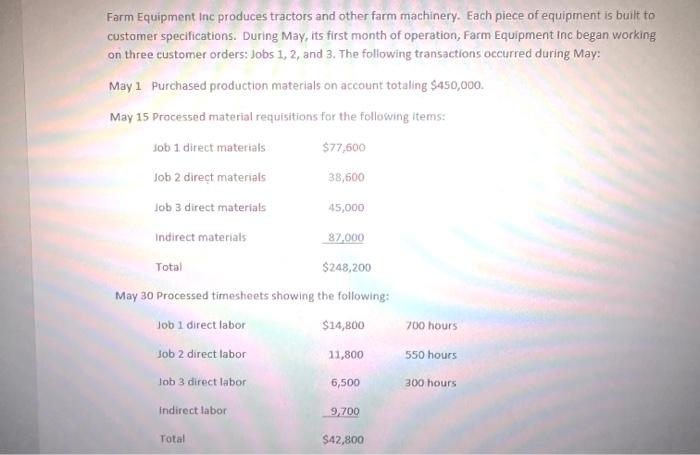

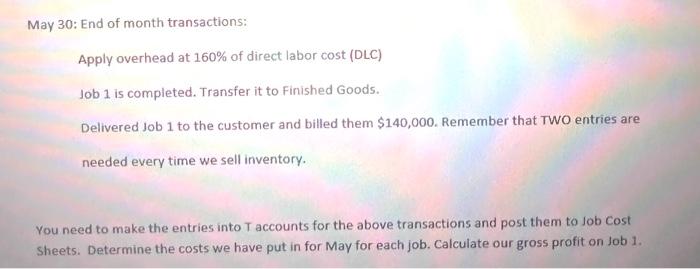

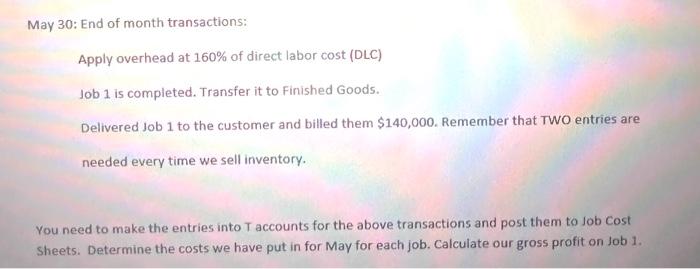

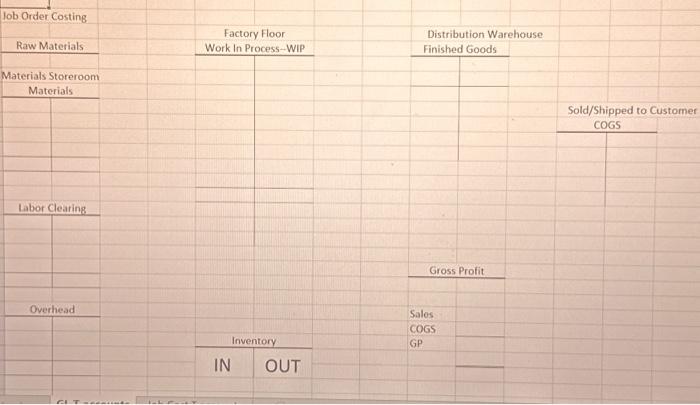

Farm Equipment inc produces tractors and other farm machinery. Each piece of equipment is built to customer specifications. During May, its first month of operation, Farm Equipment inc began working on three customer orders: Jobs 1, 2, and 3. The following transactions occurred during May: May 1 Purchased production materials on account totaling $450,000. May 15 Processed material requisitions for the following items: May 30 Processed timesheets showing the following: May 30: End of month transactions: Apply overhead at 160% of direct labor cost (DLC) Job 1 is completed. Transfer it to Finished Goods. Delivered Job 1 to the customer and billed them $140,000. Remember that TWO entries are needed every time we sell inventory. You need to make the entries into T accounts for the above transactions and post them to Job cost Sheets. Determine the costs we have put in for May for each job. Calculate our gross profit on Job 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started