Question

Make the appropriate journal entries, if any, to account for the changes in receivables (including any necessary changes to income tax expenses). Make any necessary

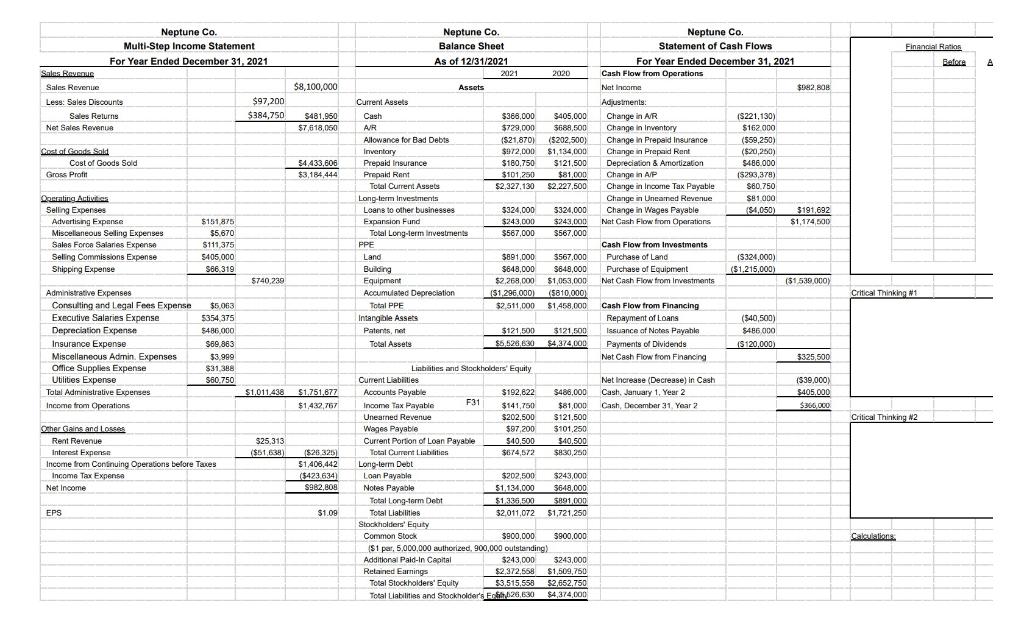

Make the appropriate journal entries, if any, to account for the changes in receivables (including any necessary changes to income tax expenses). Make any necessary changes to the financial statements. Calculate each of the required ratios using the original values (before any changes) and the updated values (after your changes)

Neptunes tax rate is 30%.

Under new GAAP (the Current Expected Credit Loss or 'CECL' rules), companies are required to estimate their Allowance for Bad Debt based not only on their historical loss rates but also on current market conditions and future predictions. The accounting process is the same (debit Bad Debt Expense and credit Allowance for Bad Debt), but the estimate is different. Based on the new rules, Neptune's management team has decided to adjust their historical rate based on a weighted average of their prediction of general economic risk in their area (weighted at 49.5%) and on the credit risk of their customers (weighted at 50.5%), as their loss rate. No adjusting entry has been made this year for bad debt.

At the beginning of the year, Neptune's collection team reported a historical loss rate of 4.5%. They believe the local economy will grow by .9% and that their average customer's credit risk has increased by 2.7%. They have also decided to round their calculations to three (3) decimal places for consistency

In addition, the team reported that on December 31, they received a $4,000 payment from SSG, Inc. Neptune closed SSG's account in July when they believed the company would not be able to pay any of their outstanding bill. No entries have been made for these transactions either

Neptunes management would like to know the effect of these adjustments on the following ratios:

Quick Ratio ([Cash + Cash Equivalents + net A/R*] / Current Liabilities) Accounts Receivable Turnover Ratio (Net Sales / Average net A/R) Current Ratio (Current Assets / Current Liabilities)

Hints: You'll need to adjust A/R and the Allowance for Bad Debt for the write off and unexpected repayment BEFORE you can make the adjusting entry for bad debt. Since they are changing, I recommend creating t-accounts for both accounts. Once you have the updated balances for each account (after the adjustments), then you can use those updated balances and your adjusted loss rate to calculate the adjusting entry for bad debt. To calculate the percentage needed to estimate the ending Allowance for Bad Debt, you'll need to first calculate the weighted average of the economic and risk adjustments. For example, if they believe that economic risk will decrease by 10%, but that their customer's risk has increased by 4%, then they would subtract 3.% from their historical loss rate. Remember to round to 3 decimal places! If we think the economy will GROW, then the economic risk will SHRINK, so we use a NEGATIVE number for our current estimate. Similiarly, if we think our customer risk will DECREASE, then our risk will SHRINK and we'll use a negative number for our current estimate. Make sure you check the wording for Neptune's assumptions so that you can use the correct sign!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started