Question

Make the following base-case assumptions to forecast 2020 to 2023 (please highlight answers in yellow): (a) Google will experience 30% year-over-year (YOY) revenue growth starting

Make the following base-case assumptions to forecast 2020 to 2023 (please highlight answers in yellow):

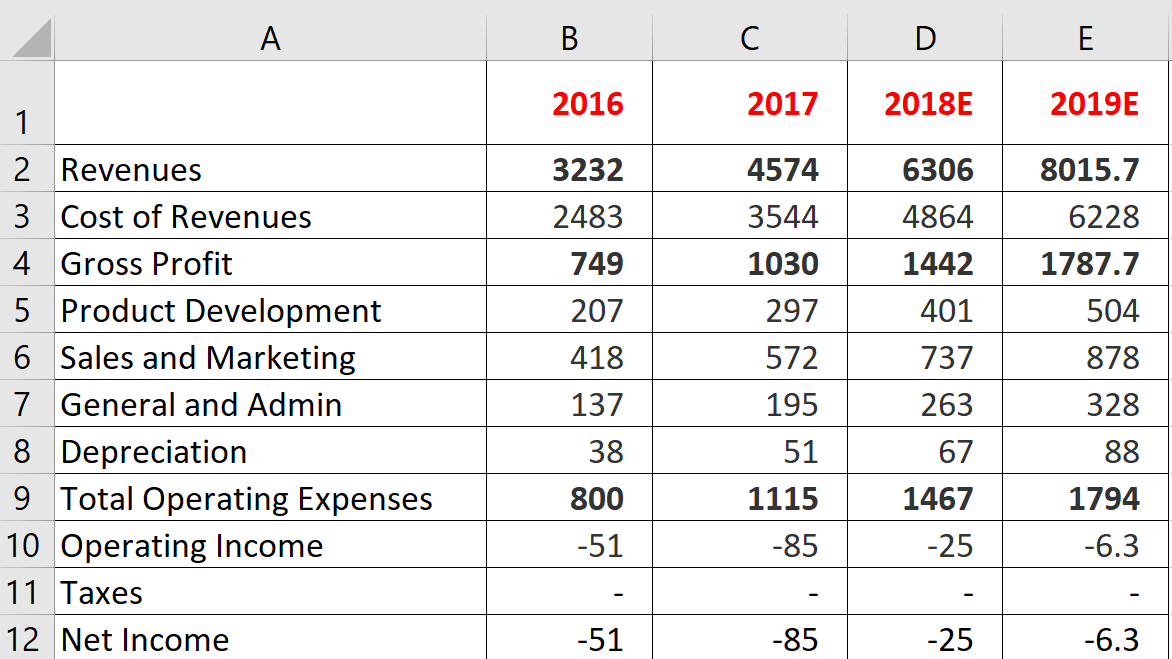

(a) Google will experience 30% year-over-year (YOY) revenue growth starting from2019 and continuing through 2023.

(b) Google gross margin (Gross Profit / Revenue, which is 1-(cost of sales/revenues))will stabilize at 23% from 2019 onward.

(c) Product development costs will be 6% of revenues in 2020 and 5% of revenues after that.

(d) Sales and Marketing Expenses will be 11% of revenues in 2020 and 10% of revenues after that.

(e) General and Administrative will be 4% of revenues in 2020, 3.5% in 2021, and then will stabilize at 3% of revenues.

(f) Depreciation will be 1.1% of revenues.

(g) Google is headquartered in Sweden, so assume a 26% tax rate and ignore any carryforwards.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started