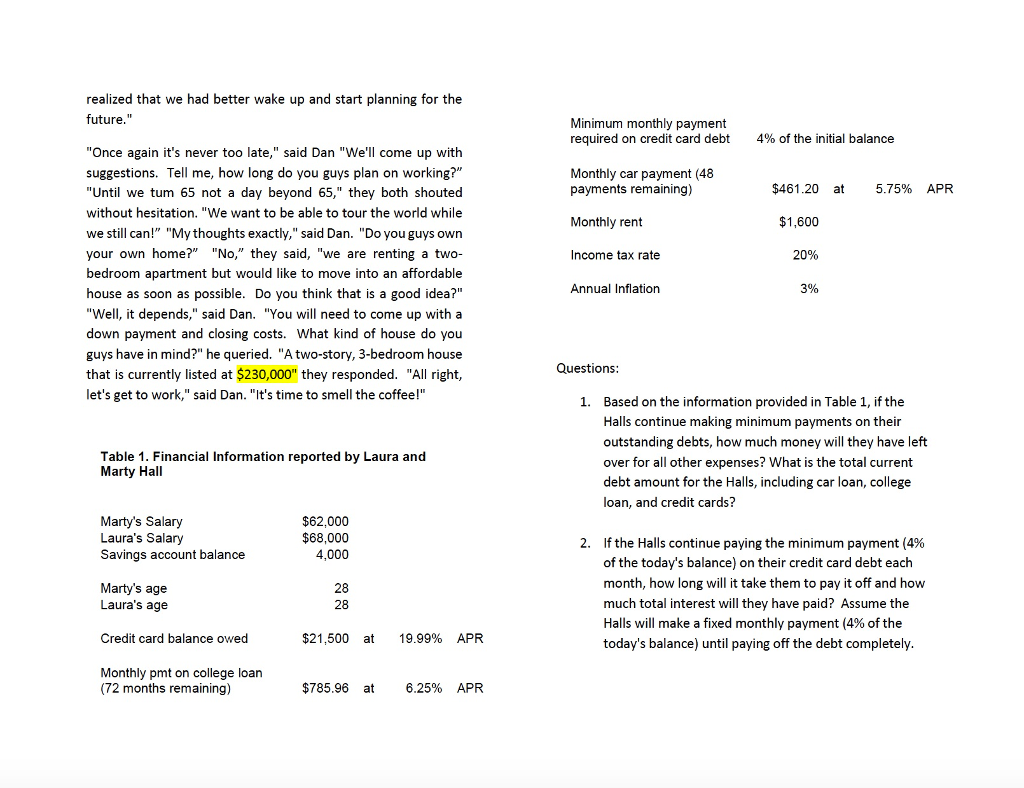

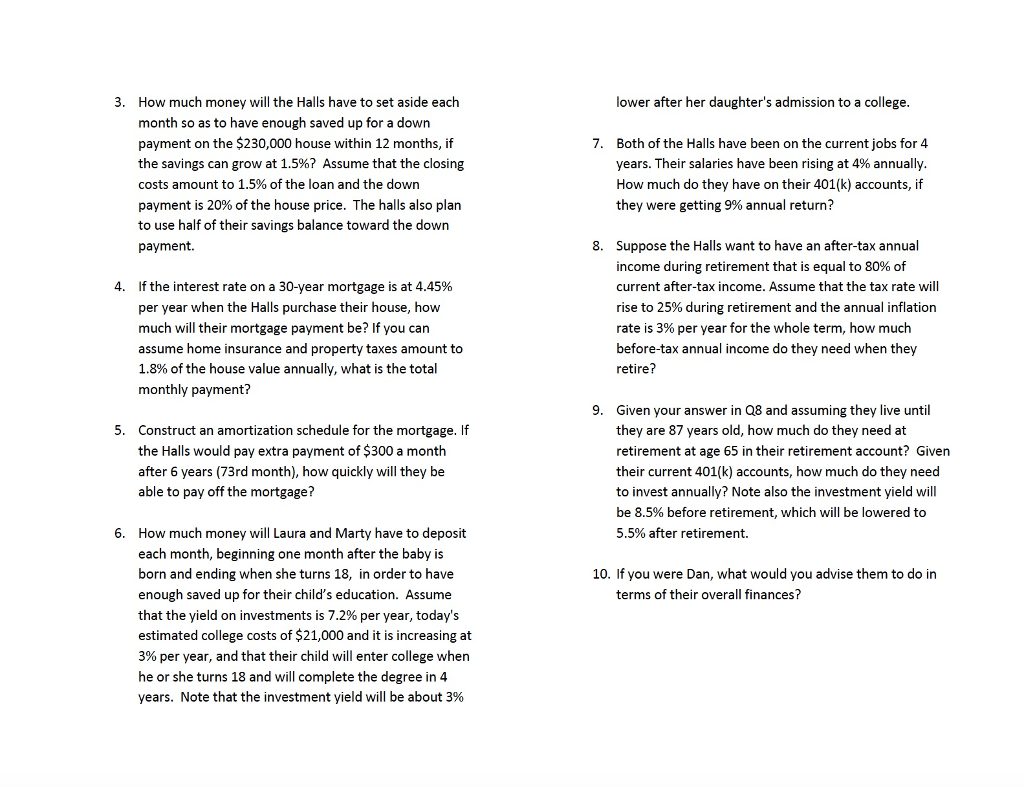

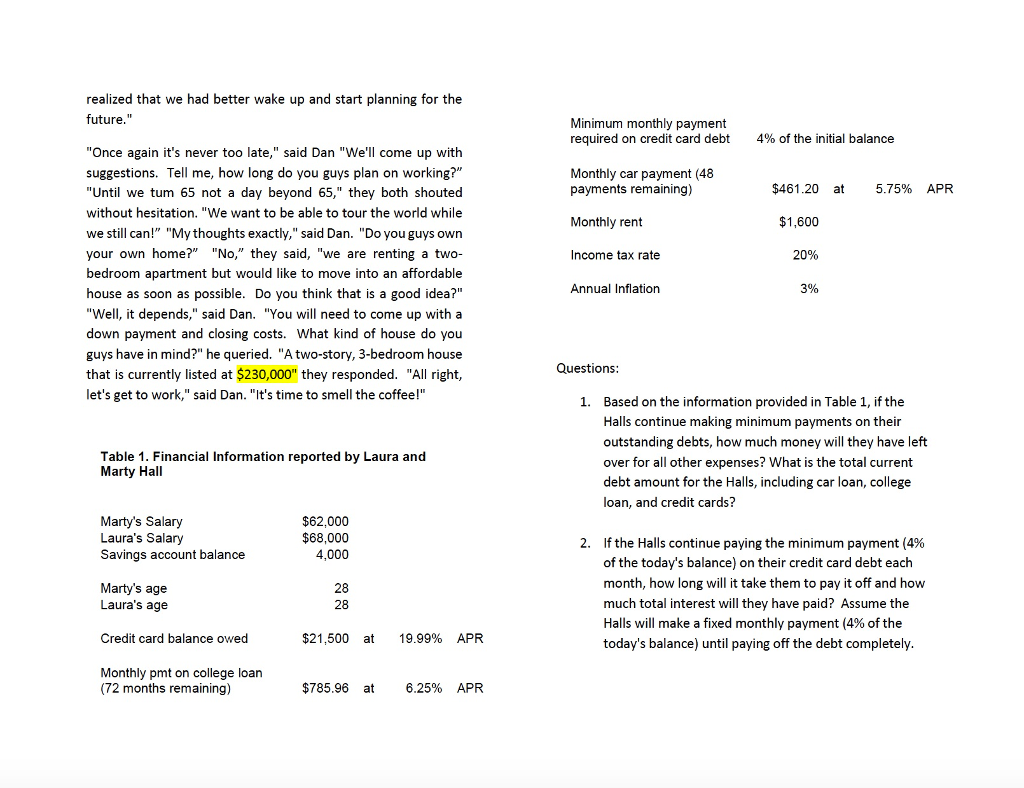

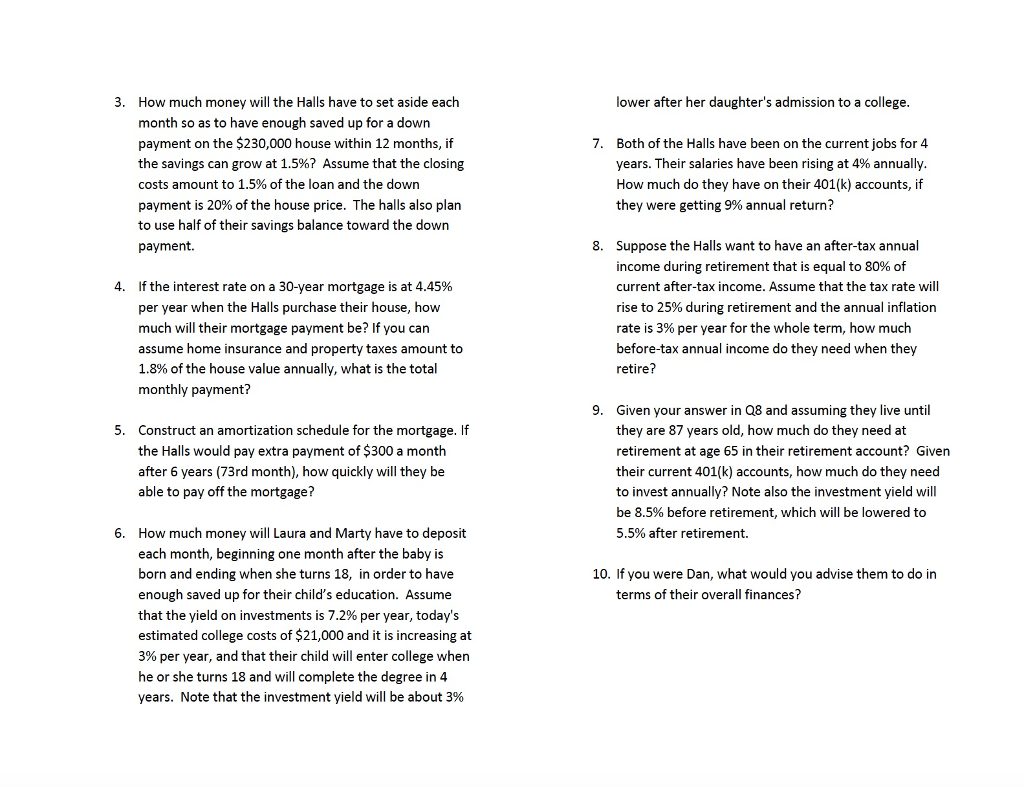

make the minimum contribution, which was 5% to be eligible for the company matching, as they needed the money to buy a fancy car, rent an expensive apartment, and consume most of their income. Both of them had racked up quite a bit of credit card debt and college loans over the years, but were making all the required monthly payments on time. They loved to take annual vacation trips and host parties so as to keep up with their social circle. And then the other day, Laura announced that she was pregnant with their first child. Their thoughts immediately turned to the future and it was only then that it hit them. With very little money saved up and no financial plan, they knew that they had better get some advice. So they took an appointment to see Dan and at the first meeting they were asked to present information about their ages, current earnings, savings, debts, expenses, and desired goals. Table 1 presents a summary of the information that the Halls reported Case Assignment -2018 Spring "Wake up and smell the coffeel" was the latest slogan that Dan Roth had used in his advertising campaign to make people aware of their need for financial planning, budgeting, and saving for retirement. Dan's financial consulting business had blossomed over the past few years because of such slogans and because Dan strongly believed in and preached the benefits of financial freedom. "A debtor is a slave to the lender," he always said when asked whether it made sense to borrow at low rates of interest. "The only way to financial independence is to be debt-free," he advised Marty & Laura Hall, who lived in the same town where Dan ran his consulting business, came across the advertisement in a local newspaper and it certainly caught their attention. The Halls had "tied the knot" about three years ago and were enjoying a fairly comfortable lifestyle Marty was a middle-level manager at an industrial chemical company, while Laura worked as an office manager at a local construction company. Both of their employers have a voluntary retirement savings program (401(k) plan) in place, whereby employees are allowed to contribute up to 10% of their gross annual salary (up to a maximum of $11,000 per year) and the company matches every dollar that the employee contributes Unfortunately, like many other young people who start out in their first "real" job, the Halls have not yet fully taken advantage of the retirement savings program. They both opted instead to When asked about their goals and objectives, Laura told Dan that they were expecting their first child by the end of the year and were interested in starting a savings plan for their child's college education. "Excellent idea," said Dan. "With college costs increasing every year and current annual costs of a college education averaging $21,000, it's never too early to start saving for your child's education. What about a retirement nest egg? Have either of you put any money aside in some kind of pension plan?" Marty and Laura looked sheepishly a ach other Unfortunately, we have been living it up and living off borrowed money," they said. "And thanks to your advertisement, we make the minimum contribution, which was 5% to be eligible for the company matching, as they needed the money to buy a fancy car, rent an expensive apartment, and consume most of their income. Both of them had racked up quite a bit of credit card debt and college loans over the years, but were making all the required monthly payments on time. They loved to take annual vacation trips and host parties so as to keep up with their social circle. And then the other day, Laura announced that she was pregnant with their first child. Their thoughts immediately turned to the future and it was only then that it hit them. With very little money saved up and no financial plan, they knew that they had better get some advice. So they took an appointment to see Dan and at the first meeting they were asked to present information about their ages, current earnings, savings, debts, expenses, and desired goals. Table 1 presents a summary of the information that the Halls reported Case Assignment -2018 Spring "Wake up and smell the coffeel" was the latest slogan that Dan Roth had used in his advertising campaign to make people aware of their need for financial planning, budgeting, and saving for retirement. Dan's financial consulting business had blossomed over the past few years because of such slogans and because Dan strongly believed in and preached the benefits of financial freedom. "A debtor is a slave to the lender," he always said when asked whether it made sense to borrow at low rates of interest. "The only way to financial independence is to be debt-free," he advised Marty & Laura Hall, who lived in the same town where Dan ran his consulting business, came across the advertisement in a local newspaper and it certainly caught their attention. The Halls had "tied the knot" about three years ago and were enjoying a fairly comfortable lifestyle Marty was a middle-level manager at an industrial chemical company, while Laura worked as an office manager at a local construction company. Both of their employers have a voluntary retirement savings program (401(k) plan) in place, whereby employees are allowed to contribute up to 10% of their gross annual salary (up to a maximum of $11,000 per year) and the company matches every dollar that the employee contributes Unfortunately, like many other young people who start out in their first "real" job, the Halls have not yet fully taken advantage of the retirement savings program. They both opted instead to When asked about their goals and objectives, Laura told Dan that they were expecting their first child by the end of the year and were interested in starting a savings plan for their child's college education. "Excellent idea," said Dan. "With college costs increasing every year and current annual costs of a college education averaging $21,000, it's never too early to start saving for your child's education. What about a retirement nest egg? Have either of you put any money aside in some kind of pension plan?" Marty and Laura looked sheepishly a ach other Unfortunately, we have been living it up and living off borrowed money," they said. "And thanks to your advertisement, we