Answered step by step

Verified Expert Solution

Question

1 Approved Answer

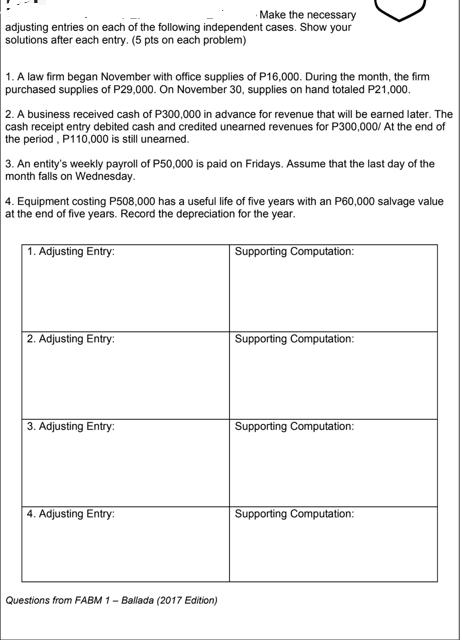

Make the necessary adjusting entries on each of the following independent cases. Show your solutions after each entry. (5 pts on each problem) 1.

Make the necessary adjusting entries on each of the following independent cases. Show your solutions after each entry. (5 pts on each problem) 1. A law firm began November with office supplies of P16,000. During the month, the firm purchased supplies of P29,000. On November 30, supplies on hand totaled P21,000. 2. A business received cash of P300,000 in advance for revenue that will be earned later. The cash receipt entry debited cash and credited unearned revenues for P300,000/ At the end of the period, P110,000 is still unearned. 3. An entity's weekly payroll of P50,000 is paid on Fridays. Assume that the last day of the month falls on Wednesday. 4. Equipment costing P508,000 has a useful life of five years with an P60,000 salvage value at the end of five years. Record the depreciation for the year. 1. Adjusting Entry: 2. Adjusting Entry: 3. Adjusting Entry: 4. Adjusting Entry: Questions from FABM 1- Ballada (2017 Edition) Supporting Computation: Supporting Computation: Supporting Computation: Supporting Computation:

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Adjusting Entry Office Supplies Expense 24000 Office Supplies 24000 Supporting Computation Supplie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started