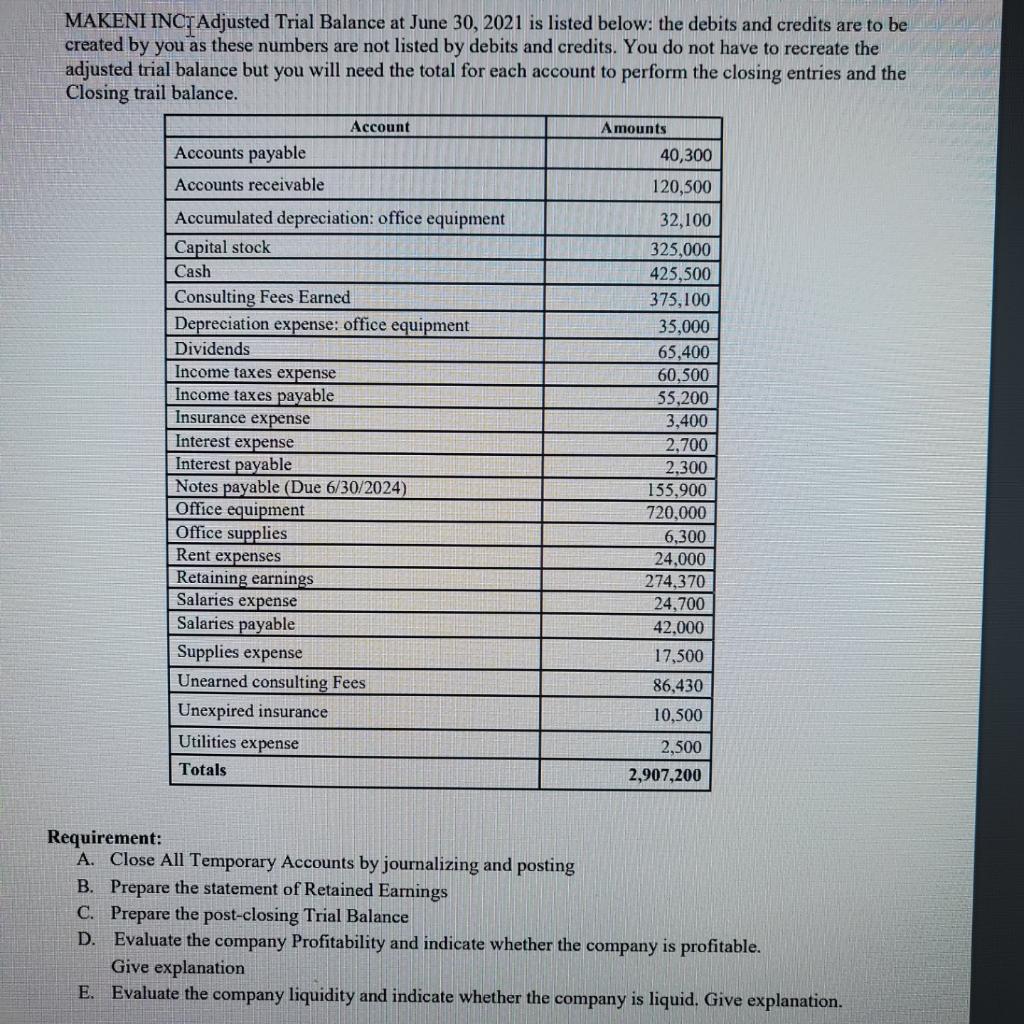

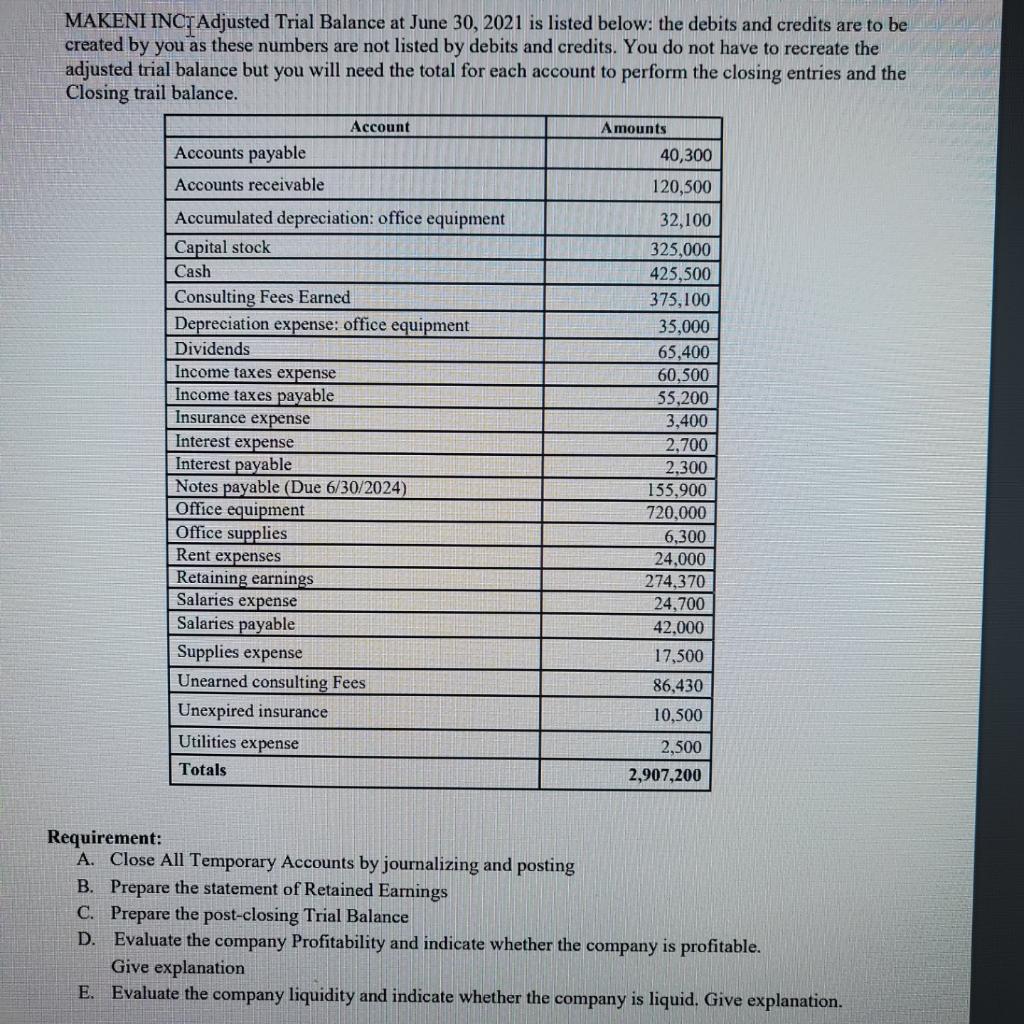

MAKENI INC. Adjusted Trial Balance at June 30, 2021 is listed below: the debits and credits are to be created by you as these numbers are not listed by debits and credits. You do not have to recreate the adjusted trial balance but you will need the total for each account to perform the closing entries and the Closing trail balance.

MAKENI INOT Adjusted Trial Balance at June 30, 2021 is listed below: the debits and credits are to be created by you as these numbers are not listed by debits and credits. You do not have to recreate the adjusted trial balance but you will need the total for each account to perform the closing entries and the Closing trail balance. Amounts 40,300 120,500 Account Accounts payable Accounts receivable Accumulated depreciation: office equipment Capital stock Cash Consulting Fees Earned Depreciation expense: office equipment Dividends Income taxes expense Income taxes payable Insurance expense Interest expense Interest payable Notes payable (Due 6/30/2024) Office equipment Office supplies Rent expenses Retaining earnings Salaries expense Salaries payable Supplies expense Unearned consulting Fees Unexpired insurance 32,100 325,000 425,500 375,100 35,000 65,400 60,500 55,200 3,400 2,700 2,300 155,900 720,000 6.300 24,000 274,370 24,700 42,000 17,500 86,430 10,500 Utilities expense 2,500 2,907,200 Totals Requirement: A. Close All Temporary Accounts by journalizing and posting B. Prepare the statement of Retained Earnings C. Prepare the post-closing Trial Balance D. Evaluate the company Profitability and indicate whether the company is profitable. Give explanation E. Evaluate the company liquidity and indicate whether the company is liquid. Give explanation. MAKENI INOT Adjusted Trial Balance at June 30, 2021 is listed below: the debits and credits are to be created by you as these numbers are not listed by debits and credits. You do not have to recreate the adjusted trial balance but you will need the total for each account to perform the closing entries and the Closing trail balance. Amounts 40,300 120,500 Account Accounts payable Accounts receivable Accumulated depreciation: office equipment Capital stock Cash Consulting Fees Earned Depreciation expense: office equipment Dividends Income taxes expense Income taxes payable Insurance expense Interest expense Interest payable Notes payable (Due 6/30/2024) Office equipment Office supplies Rent expenses Retaining earnings Salaries expense Salaries payable Supplies expense Unearned consulting Fees Unexpired insurance 32,100 325,000 425,500 375,100 35,000 65,400 60,500 55,200 3,400 2,700 2,300 155,900 720,000 6.300 24,000 274,370 24,700 42,000 17,500 86,430 10,500 Utilities expense 2,500 2,907,200 Totals Requirement: A. Close All Temporary Accounts by journalizing and posting B. Prepare the statement of Retained Earnings C. Prepare the post-closing Trial Balance D. Evaluate the company Profitability and indicate whether the company is profitable. Give explanation E. Evaluate the company liquidity and indicate whether the company is liquid. Give explanation